Emerging Canadian retail technology and payments giant Lightspeed POS (TSX:LSPD)(NASDAQ:LSPD) saw its stock rise over 7% before mid-day on Thursday after the company’s fiscal first-quarter 2022 earnings report was released in the morning.

Lightspeed stock is printing new all-time highs and the company’s latest market-beating financial results could propel it even further over the next few weeks. If you are wondering whether to buy new LSPD stock now or to take some profit, here are some details to consider before you do so.

Lightspeed Q1 earnings surprised even the bullish

(All monetary figures are in USD)

During the quarter ended June 30, 2021, Lightspeed earned US$115.9 million in revenue, showing a 220% year-over-year growth from comparable results last year. Over 92% of quarterly sales are recurring in nature.

That wasn’t the best part in my view. Reported quarterly revenue exceeded the company’s previous guidance for $90-94 million issued late in May by over 23%. Analysts projected quarterly sales of $92.4 million, the company did better by a wide 25% margin. Lightspeed beat both analysts’ and its own expectations.

Consistently growing customer base

The company boasts of an increased revenue base of “over 150,000” customer locations. The number is up 7% sequentially from “over 140,000” locations reported in May. A 7% sequential growth in just three months is just wonderful and compounds the company’s rate of business expansion.

More customer locations exponentially expand LSPD’s business volumes. We can see Lightspeed’s accelerating growth rate in its reported first-quarter 2022 gross transactional volume (GTV) growth of 203% year over year.

Actually, I think it’s somehow unfair to compute year-over-year growth rates for a company that has been growing through acquisitions. However, will the picture change much if I told you that Lightspeed grew its quarterly GTV by 51% in three months?

The company’s payments volumes (GTV) increased from $10.8 billion reported for the first three months of this year to $16.3 billion by the end of June.

As a result, transaction-based revenue was up 453% year over year to $56.5 million.

The best number from the latest earnings report

From my angle, the best number in LSPD’s latest earnings was its average revenue per customer.

The average revenue per user (ARPU) stood at $215 by March this year. The latest ARPU figure of $230 represents a 44% annual increase and a strong 7% sequential quarter-on-quarter expansion. The company’s customer base is increasing, and its existing customers are generating more revenue.

Increasing payments volumes have been behind the recent ARPU boom. The company expanded the availability of its payments solution to customers in Europe. Payment volumes and associated revenue numbers could be more interesting over the next six months.

The company is still unprofitable though. It reported a net loss of $49.3 million for the quarter, which was bigger than a $20.1 million loss reported for the same period last year. However, its adjusted net loss of $6.9 million was a narrower 6% loss on revenue. Last year’s comparable adjusted loss was 7.5% of revenue.

Raised outlook for the fiscal year 2022

The company has raised its previous guidance for the new financial year. Management at LSPD sees annual revenue range rising from a previous $430-450 million range to a higher $510-530 revenue range. The company’s expected annual adjusted EBITDA loss has been increased from $30 million to $35 million, representing a 7% loss on revenue.

Watch the valuation

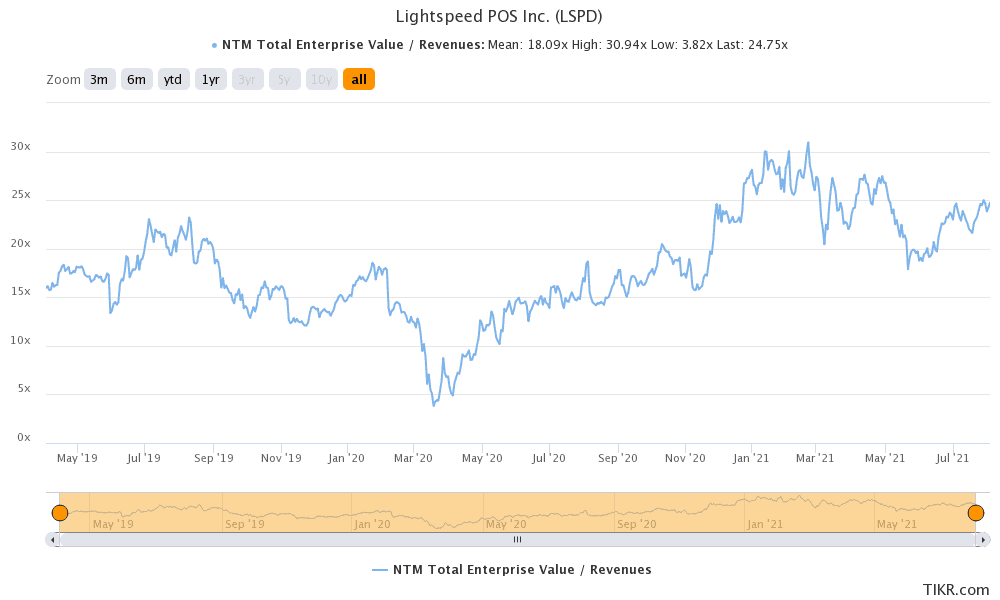

Lightspeed stock was expensive before today and it’s even more expensive after Thursday’s rally. However, it’s much cheaper than a profitable Shopify.

The company is valued at 25 times its future annual revenue. However, compared to e-commerce solutions giant Shopify stock’s 35 times its multiple today, Lightspeed is cheaper. Perhaps the reason lies in the latter’s consistently unprofitable operations to date.

Foolish bottom line

There is evidently so much to like on Lightspeed stock, more so after its latest quarterly earnings. However, valuation remains an important metric to always check before you chase the stock at its all-time highs. Growth stocks are always expensive though. Buying on pullbacks could be a more profitable strategy.