Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is one of the largest owners and operators of diversified infrastructure assets in the world. Its assets provide services we take for granted. We don’t realize how important these services are until they are gone. For example, if you lose power or natural gas in the middle of winter, you definitely know how much you miss it.

Well, those are privileges that Brookfield Infrastructure Partners provides. It owns everything from pipelines, electric transmission lines, and railroads to ports, data centres, and cell towers. What I love is that its assets are really essential to every part of our modern lives. As a result, around 95% of its assets are contracted or regulated.

Brookfield wins in almost any economic environment

While it was negatively affected by the pandemic (as were most businesses) last year, it still grew cash flows and raised its dividend. Similarly, it preserved a well-capitalized balance sheet.

In fact, recessions are often positive for this business over the longer term. It can employ its strong liquidity position to acquire assets at fire-sale prices. It did this during the 2008-2009 Great Recession. Likewise, during the March 2020 crash, it was able to acquire a number of cheap public equities that it was able to flip for a quick profit.

Set to acquire Inter Pipeline

One position it acquired was a near 20% stake (combining options and equity shares) in Inter Pipeline. Just a few weeks ago, it won a greasy takeover battle to capture control of its assets. Brookfield Infrastructure still needs to collect 55% shareholder approval. Yet, this deal is pretty much a sure thing. While it had to pay up 21% from its initial $16.50 offer, I still think this acquisition will be accretive over the long run.

Brookfield Infrastructure Partners has a large gas processing and midstream business across Canada and the U.S. Using its management expertise and a large pool of capital, it should be able to unlock new growth and value opportunities. Not to mention that it will now hold and operate the prized Heartland Petrochemical Complex. This should commence service and start yielding attractive returns next year.

A great combination of dividends and capital gains

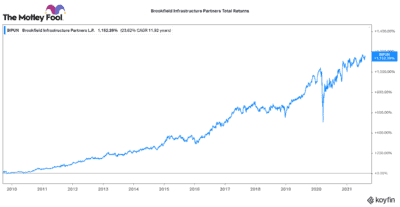

Overall, Brookfield is just very good at acquiring assets with good bones (and perhaps shaky financials) and turning them into cash-yielding machines. It has a great track record of delivering strong dividends and capital returns. Since its inception in 2009, it has delivered a 1,193% total return. Half of that return was actually from dividends!

Today, it pays an attractive 3.7% dividend. Yet, it has grown its dividend payout by a 10% compound annual growth rate since 2009. Consequently, I believe an investor’s yield on cost will continue to grow from here.

Strong fundamentals make this a great stock for a lifetime

Just last week, the company announced very strong second quarter results. Funds from operations per share increased 18% year over year.

As the world recovers from the pandemic, Brookfield benefits in two ways. First, 70% of its assets have inflation-linked contracts. When the economy is hot, it gets a contracted uptick in rate payments. Second, when there is strong demand for commodities, travel, or goods, it gets the benefit of higher volumes and rising margins.

Combine all these factors and Brookfield Infrastructure Partners’ business appears to be firing on all cylinders. Whether the economy is good or bad, this stock can deliver solid returns. As a result, this is one Canadian stock I believe investors can just buy, tuck away and own for a very, very long time.