Canada Goose Holdings (TSX:GOOS)(NYSE:GOOS) stock price declined by 13% after delivering market-beating earnings results on Wednesday last week. An opportunity to buy the dip on Canada Goose stock has arisen after the parka maker lost 18% of its equity value in three trading sessions since releasing the latest quarterly results. Should you take it and hope to book sizeable long-term profits?

GOOS shares fall after market-beating quarterly results

Despite posting a strong 115% year-over-year revenue growth and a lower net loss per share than previously projected by analysts, market players still clobbered Canada Goose stock last week.

GOOS reported quarterly revenues of $56.3 million for its fiscal first quarter (Q1 2022) on Wednesday last week. Analysts expected the company to book just $50.2 million during the period. Further, the premium apparel manufacturer printed a net loss of $56.7 million ($0.51 loss per share) for the quarter, this compared very well against market expectations for a loss of $62 million ($0.53 loss per share).

So, what triggered the sell-off in Canada Goose stock?

What went wrong in Canada Goose’s latest quarterly results?

I could confidently say that Canada Goose stock is priced like a growth play — and more so after the surprise record revenues reported in a most recent quarter (January-March 2021) boosted trader confidence in the company’s ability to ride the pandemic.

“Heading into this quarter, we were well-positioned after finishing fiscal 2021 with record revenue in our third and fourth quarters,” company CEO Dani Reiss said in an earnings conference call on Wednesday.

Unfortunately, Wednesday’s results were far from previous record levels due to usual seasonality. The company lost 40% of its trading days at nine of its Canadian stores during the quarter. Recurring COVID-19 inconveniences drained investors’ confidence as they witnessed quarterly sales come in far below the $71 million levels reached during a comparable quarter in 2019.

To make matters even worse, reported gross margins for the quarter were weaker than expected while operating expenses increased with further investments in the business.

Time to buy beaten-up Canada Goose stock?

“Our business has shifted from recovery to growth, and that has continued into this quarters,” said Dani Reiss during last week’s earnings conference call.

Although recently released results didn’t show the said top-line growth, continued sales expansion in all geographic regions, especially the triple-digit growth rates in Asia-Pacific and the EMEA e-commerce sales, show an encouraging growth picture.

Most noteworthy, all of the company’s stores are open now. The return of higher foot traffic could boost seasonal sales going forward. Further, high growth rates in high margin e-commerce sales could boost gross and net income margins during the remainder of the financial year.

Analysts expect Canada Goose Holdings to report record revenues again during its fiscal third and fourth quarters which end in December 2021 and March 2022. The market projects total revenue for the year at $1.1 billion, which should be a record year for GOOS. Analysts expect another record revenue for fiscal 2023. Fiscal 2023 sales projections read $1.3 billion, showing a potential 19% year-over-year growth.

There is some nice growth to be seen on GOOS financial results in the near future.

The company expects its high margin direct-to-customer (DTC) revenues to compose70% of revenue for this fiscal year. Total gross and earnings margins could expand further in 2022. Investors could associate higher margins with a higher valuation multiple on GOOS stock.

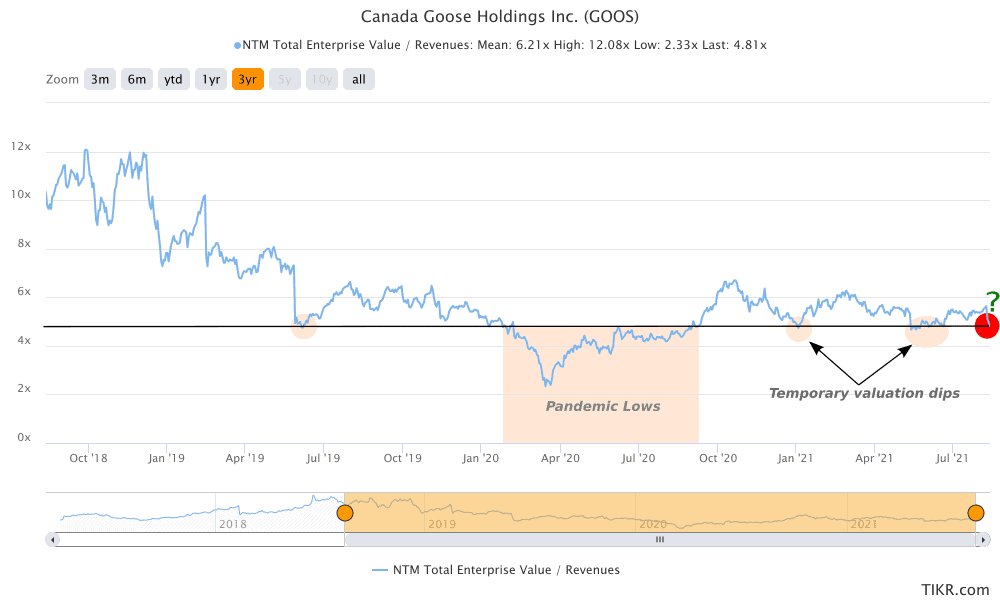

Canada Goose stock’s valuation has fallen by a significant margin after the recent drop. The current forward-looking enterprise value to revenue multiple stands at 4.8 times at writing. Shares are cheaper than their three-year average multiple of 6.2 times. The stock has historically recovered from such a cheap “temporary dip.” Long-term focused investors may consider loading up some undervalued shares at today’s lows.

Foolish bottom line

A persistent pandemic and emerging coronavirus problematic mutations like the current Delta variant pose significant sales recovery risks for a consumer cyclical company like Canada Goose. However, strong e-commerce growth rates promise to provide a layer of resiliency

Investors buying the beaten-up growth stock today could still profit handsomely if market projections come true over the next several quarters.