The best Canadian stocks to buy have a few things in common. For example, they are stocks that benefit from the underlying companies’ competitive advantages. These are leaders in their respective industries. Also, they are all companies with very successful operational and financial business models. In short, revenue and/or cash flows are soaring and balance sheets are pristine.

Join me as I walk through the three best Canadian stocks to buy this summer.

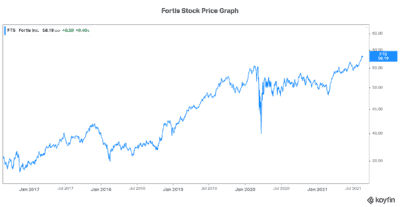

Fortis stock: Stability and predictability

We all need a little stability and predictability in our lives. Our investing lives are no different. Fortis (TSX:FTS)(NYSE:FTS) is the best provider of this. What the remainder of 2021 will bring is highly uncertain. I mean, the TSX is trading near all-time highs. It has had a blowout year that I think blew past most of our expectations.

In my view, this leaves the market vulnerable. Record stimulus has been injected into the economy. Also, we’re still feeling the effects of the pandemic. This may be the perfect storm for inflation to rear its ugly head.

Fortis is a leader in the regulated gas and electric utility industry in North America. This is a highly defensive business with predictable and resilient cash flows. In a scenario where the market and economy struggle, Fortis is a key holding. In fact, in any scenario, Fortis stock is a key holding. The predictable dividend income stream from Fortis is a key selling point.

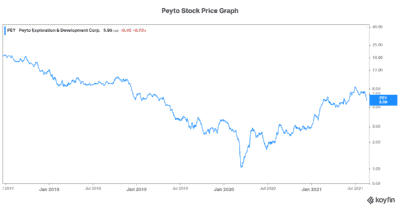

Best Canadian stock to buy: A natural gas leader to take us into the winter

As we head into the fall, we can start thinking colder temperatures. It’s not a pleasant thought for most of us. But Peyto Exploration and Development (TSX:PEY) surely looks forward to it. This is because there’s no better time of the year for energy demand than winter. This year, this seasonal driver will be accompanied by the secular drivers for natural gas.

Natural gas is a relatively low-carbon, low-emitting fuel. It is the easiest replacement for high-carbon fuels such as coal. It will certainly be a key transition fuel as we fight to reduce our carbon footprint. According to some estimates, natural gas demand will increase by as much as 45% by 2040. Asian economies will drive this as they make the switch from coal to natural gas. Also, their economies will continue to grow and demand more energy.

Peyto is one of Canada’s lowest-cost natural gas producers. It operates in a very prolific resource basin that’s characterized by predictable production profiles, low-risk exploration, and long reserve life. The company’s cash flows are currently soaring as natural gas prices soar. I think the supply/demand fundamentals for natural gas will continue to strengthen. Peyto is perfectly positioned for this.

Well Health stock: The future of healthcare from one of the best Canadian stocks to buy

Well Health Technologies (TSX:WELL) is an omnichannel digital health company. Well stock has been soaring as the future of healthcare has been reimagined. In fact, it’s up more than 335% in the last two years. Not surprisingly, the pandemic has accelerated the digitization of the healthcare industry, pushing it forward into a new digital age.

The company has continued to acquire in order to cement its leading position. Revenue is currently soaring as Well Health continues to rise in this emerging business. The digitization of the healthcare industry has been a long time coming. Because of the realities of the pandemic, it’s finally here, bringing with it greater efficiencies, greater patient and doctor satisfaction, and a better standard of care. And this is ultimately what makes Well Health stock so attractive.

The bottom line

There’s no magic formula to help us decide on the best Canadian stocks to buy this summer. It all comes down to looking for companies with a leading position in their industry. It also boils down to uncovering those companies that boast an unmatched operational performance. And finally, we need to look for those companies with a bright future.