High-yield dividend stocks are a great source of income. Chosen correctly, they can really give your portfolio a significant boost. The trick is finding the right stocks. Because as we know, sometimes stocks are high-yielding because there are real issues that place the dividend itself in question.

So without further ado, here are three high yield dividend stocks to buy now. These stocks are in a good position to continue to pay their respective dividends. They are even in a position to grow said dividends.

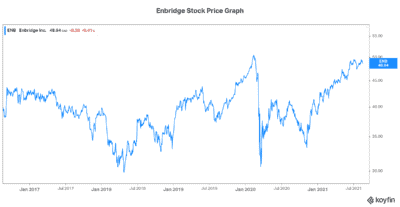

Enbridge stock: A high-yield stock that you should buy for its strong cash flows and sustainability

Enbridge (TSX:ENB)(NYSE:ENB) is a top energy infrastructure stock that has received a lot of bad press lately. This has driven its stock price down. Consequently, this has driven its dividend yield higher. Today, Enbridge stock is undervalued and yielding 6.84%. It’s a high-yield dividend stock that’s backed by lots of good stuff.

For example, the fact is that this company will continue to be an essential part of North America’s energy grid for years to come. Also, Enbridge has a history of stable and growing earnings and cash flows. It also has a history of dividend growth that is not matched by many.

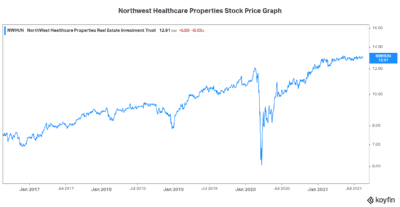

NorthWest Healthcare REIT: A high-yield dividend stock to buy for its exposure to long-term trends

NorthWest Healthcare Properties REIT (TSX:NWH.UN) is an owner/operator of a diversified portfolio of healthcare assets in Canada as well as globally. These assets have a defensive stream of revenue. This means that in the good times and the bad times, these revenues are safe.

The population is aging in many parts of the world. This is an underlying growth driver for any healthcare-related companies. NorthWest’s healthcare real estate assets are benefitting from this trend. The demand is strong.

NorthWest Healthcare is currently yielding a very generous 6.16%. It’s good to know that this yield is backed by NorthWest’s defensive business and its exposure to the aging population trend. Looking at NorthWest Healthcare’s most recent quarter, we can see all of this in action. While revenue was stable, funds from operations increased 8%. Occupancy was high, reflecting the strong demand that continues to exist. And the REIT continues to expand globally.

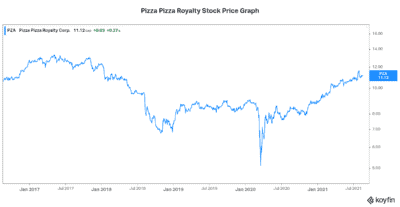

Pizza Pizza Royalty: A high-yield stock collecting low-risk royalties

Pizza Pizza Royalty (TSX:PZA) is a high-yield dividend stock. It’s characterized by its low debt and steady cash flows throughout the years. In fact, these cash flows have been so steady that Pizza Pizza has just raised its dividend. The latest raise was just this last quarter when it was increased 9%.

The fact that this is a royalty stock is a key fact. The Pizza Pizza restaurants are franchises. This means that the franchisee operates as an independent business. In turn, Pizza Pizza Royalty simply collects royalty income without incurring operating expenses. Pizza Pizza dominates the pizza quick-service restaurant segment in Ontario. It also has locations across Canada. It has been a staple in its segment for many years now.

So Pizza Pizza Royalty stock is a high-yield dividend stock that’s currently yielding a generous 6.5%.

The bottom line

High-yield dividend stocks are essential as part of an income-producing portfolio. They provide the extra torque for your income. And chosen correctly, they provide stability in times of market weakness, as their dividends can be expected to continue unscathed. Consider Enbridge stock, NorthWest Healthcare Properties REIT, and Pizza Pizza Royalty to help you generate extra income and stability.