The market price for gold has recovered to above US$1,800 this week. This could be an important price point for the world’s second-largest bullion producer, Barrick Gold (TSX:ABX)(NYSE:GOLD) whose stock price has declined by 12% so far this year.

In its latest quarterly earnings release on August 9, Barrick acknowledged that a significant contribution from its copper assets is setting it apart from industry peers. The detail supports a buy-the-dip call on the miner’s stock today. However, the most important reason I’d buy Barrick Gold stock today is its strong cash flow generation capacity whenever bullion remains above US$1,800 per ounce.

Barrick Gold to make more money at today’s metal prices

The company stands to make more cash than it budgeted for in 2021 if bullion prices hold above US$1,700 per ounce this year.

The company maintained its 2021 production guidance and outlook earlier this month. It expects to produce between 4,400,000 and 4,700,000 ounces of gold this year at all-in sustaining costs (AISC) between US$970 and US$1,020 per ounce. ABX will remain very profitable if gold prices remain high this year.

Most noteworthy, management’s guidance was made using an average price of bullion of US$1,700 for this year.

The company revealed that a US$100 surge in market prices for the yellow metal could add about US$620 million to Barrick’s earnings before interest, taxes, depreciation, and amortization expenses (EBITDA) for the year.

However, the company realized much better prices during the first half of the year, and it continues to pile on some huge amounts of free cash flow when commodity prices remain as firm as they are today.

Watch the growing cash flow

Stronger precious metal prices have had a tremendous impact on Barrick’s financial strength and cash flow generating capacity over the past five years to the extent that even Warren Buffett’s Berkshire Hathaway made a play on ABX stock in 2020.

Just five short years ago, Barrick was sitting at a US$5.5 billion net debt position exit 2016. Fast forward to December 2020 and the company was sitting on a positive net cash position of US$33 million. It had over US$5.2 billion in cash and cash equivalents on its balance sheet.

The cash growth trend should continue in the near term. Analysts project a US$2.9 billion net cash position for ABX by the end of 2022.

What to expect if you buy shares in August

If you buy Barrick Gold’s stock today, you can expect to earn a US$0.09 per share quarterly dividend in September, a US$0.14 per share return of capital again in September, another US$0.09 regular dividend during the fourth quarter, and the final $0.14 return of capital before year-end.

The company is disbursing some US$750 million in an ongoing return-of-capital program. The company will determine a record date for the final tranche in November.

If one buys shares before the August 31 record date, they can be eligible for these “dividends” before yearend. Investors could receive a total of US$0.46 in cash per share to yield a 2.3% return over four short months.

Analysts expect the company to pay out about US$0.44 in dividends in 2022. At today’s prices, next year’s dividends payouts could yield another 2.2% for the year.

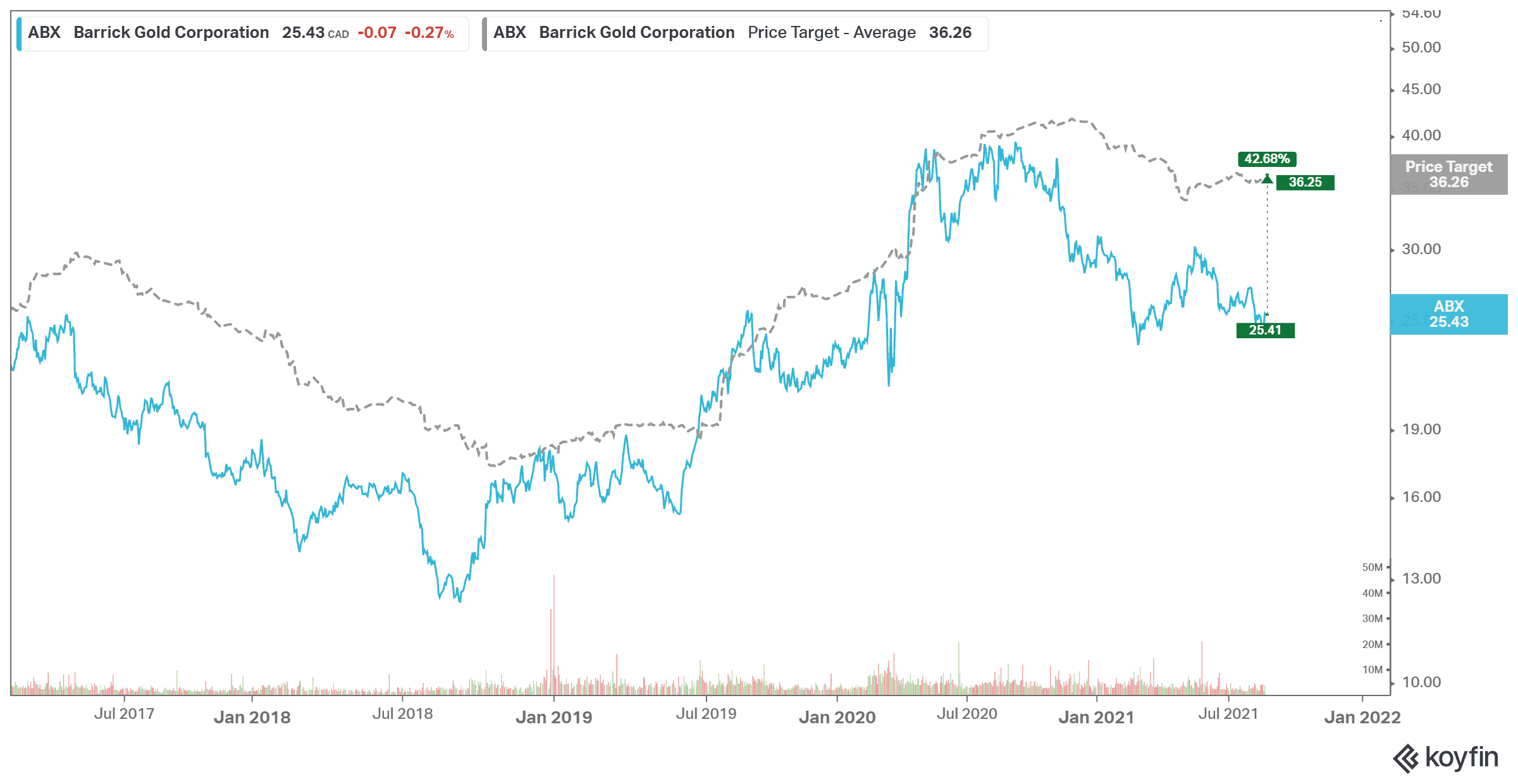

That said, I think the bulk of potential returns from holding the miner’s shares could be in the form of capital gains due to price appreciation. The consensus analyst price target on ABX stands at C$36.24, indicating a potential 43% upside over the next 12 months.

Foolish bottom line

A recovery in gold prices could trigger another rally in Barrick’s stock. The company is already in a very good earnings and cash flow position at today’s market prices. Add this to its improved copper economics and sustained development expenditures and a buy-the-dip play on ABX seems a profitable long-term trade to make today. Shares have recovered to match analyst targets in the recent past. They may do so again if sentiment returns to industry stocks again.