Investors often research far and wide when searching for new ideas on which stocks to buy. However, chances are high that we often unwittingly ignore some companies that we often interact with — and more so if there’s no hype attached to their stock prices at that moment. To my pleasant surprise, two such TSX dividend-paying stocks came up on my screener for companies with sustainably growing cash flows.

Generally, I like profitable businesses that persistently post growing revenues and expanding profit margins. However, I am even more excited when such businesses post growing cash flows. It can be said that cash flow is the lifeblood of any business. When free cash flows are adequately generated organically within a business, shareholder dilution is usually eliminated, dividends keep growing, and accretive share buy-backs can be sustained.

This is the situation at the two “every day” businesses I am going to cover today. They have both reported growing cash flows, even on a per-share basis over the past three years.

The North West Company

The North West Company (TSX:NWC) is a well-known retailer of food and everyday products serving rural communities and urban neighborhoods in Canada, Alaska, and the Caribbean markets.

NWC has reported consistently growing annual revenues over the past three years, and growth accelerated during last year’s lockdowns. The essential services supplier saw annual revenue growth rates expand from 1.4% in fiscal 2019 to over 12.6% in fiscal 2021 which ended in March this year.

Gross margins have been expanding during the past five consecutive years. What’s even better is that selling, general, and administrative (SG&A) expenses have been declining as a percentage of revenue, and the net result has been ever-expanding net profit margins, even before the pandemic’s boost.

Most noteworthy, cash flow from operations has been steadily rising in 2018 and 2019 before the 110% jump during the pandemic. Aided by controlled capital expenditures, the company has been generating beautifully growing free cash flows every year, and the trend is expected to persist post the pandemic.

However, investors haven’t been in favour of retailers generally, so we see NWC stock’s price-to-earnings ratio shrinking over the years, even as profits and returns on equity grew while leverage declined.

The company pays a quarterly dividend that’s yielding about 4% annually right now. The dividend has grown at an average rate of 2.8% over the past three years. Given the growth in cash flows, the company is aggressively buying back its shares. It could increase its rate of dividend raises too.

Stingray Group

The Stingray Group (TSX:RAY.A) is a music, media, and technology firm that delivers its services on television, through the web, and to mobile devices. The founder-led company operates television channels, dedicated music video channels and offers over 100 music channels to Canadians while providing advertising solutions.

Media businesses that relied on advertising spend had a tough year during the COVID-19 pandemic. However, there is an ongoing gradual return to normal commercial operations that are lifting Stingray’s business, and the company could return to pre-pandemic operating levels soon. Analysts expect the business to grow back to pre-pandemic levels by 2022.

Although revenues declined by 18.67% during the pandemic year, EBITDA margins continued to expand from 29% of revenue in 2018 to 38.3% of sales last year.

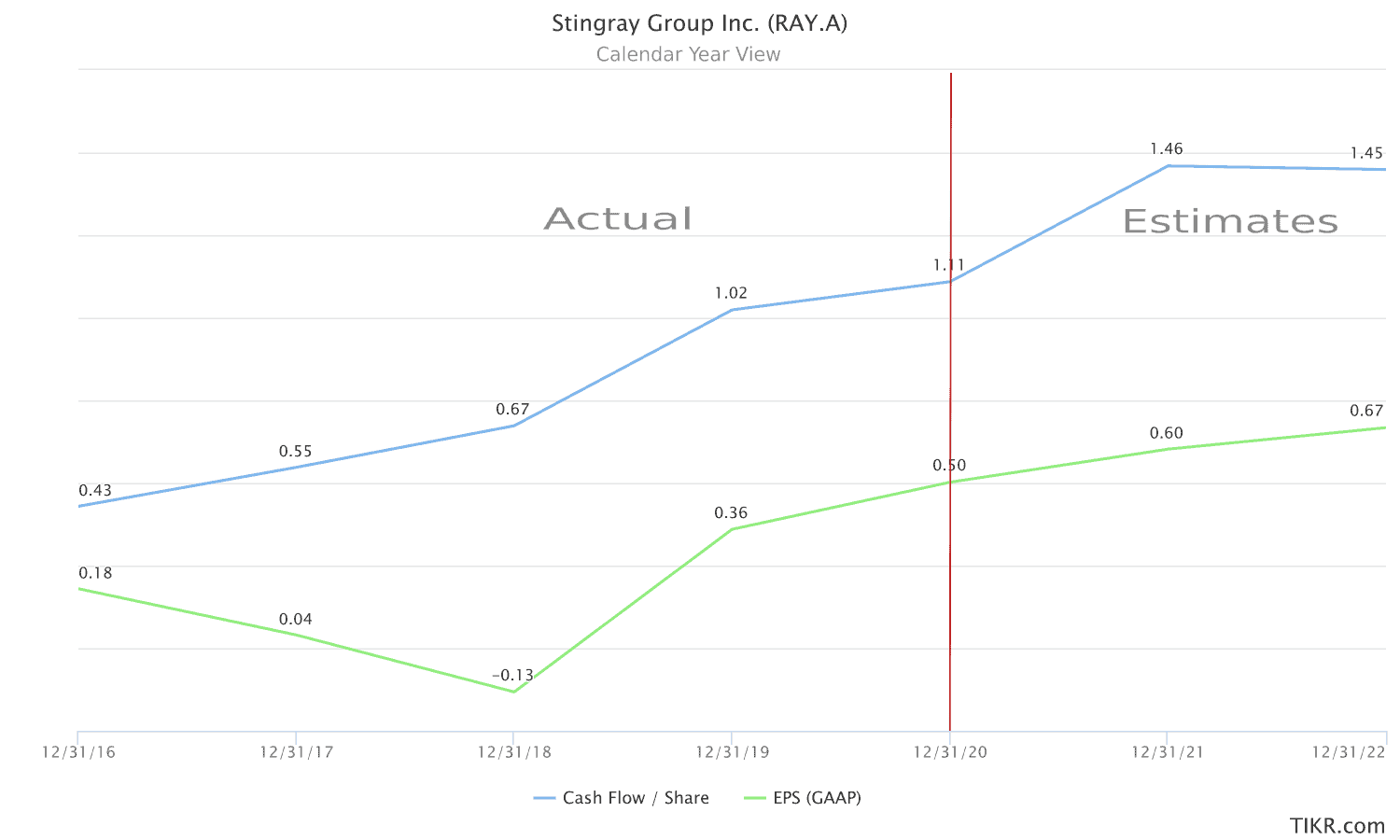

Most noteworthy, the company’s free cash flow generating capacity remained robust throughout the period. Of course, there was a helping hand from the government’s support programs. The Canada Emergency Wage Subsidy (CEWS) cushioned cash flows and earnings. But it should be reassuring to investors that after CEWS is gone, free cash flow for 2021 is expected to surpass pre-pandemic levels and print record levels this year and remain high in 2022.

What’s more, the business’s cash flow per share is consistently growing and could reach an all-time high of $1.46 during this calendar year. Earnings per share will be rising all this time.

I couldn’t stop thinking about what could happen to Stingray’s 3.96% yielding dividend in the near term. The company has increased its quarterly dividend by an average of 11.4% over the past three years. I would expect dividends to continue increasing as cash flows and profits rise.