One of the hottest stocks in Canada earlier this year was none other than Facedrive (TSXV:FD), the sustainable ridesharing and technology company.

Facedrive stock saw an incredible rally to start 2021. With almost no sales, the stock reached a market cap of over $4 billion. However, investors quickly learned an important lesson — one that will likely repeat itself time and again.

Facedrive stock is a perfect lesson in why you don’t buy a stock just because of hype. It also shows why, at the end of the day, fundamentals matter.

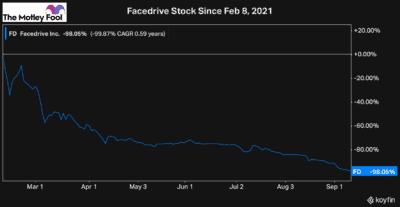

Facedrive stock is down a whopping 98% since its high in February and is now worth just over $100 million.

Why did Facedrive stock plummet over 95%?

Stocks can fly high for a long-time and often for an irrational amount of time. At the end of the day, though, with no fundamentals to fall back on, the rug can be pulled out from under investors, and selloffs like this can materialize.

And what makes it so difficult for investors, and why these stocks should always be avoided, is that you never know when a selloff like this can occur.

When we talk about risk versus reward, this is a great example. When you buy a stock that’s extremely overvalued, there is little reward to gain and almost all of your investment to be lost. This selloff is purely the result of speculation gone wrong.

How has the company performed over the last six months?

If you heard a stock was down 98% in just over half a year, you’d probably think a lot of it was the fault of a poor job by management.

However, in Facedrive’s case, I don’t think management’s performance, the company, or its operations had anything to do with the stock’s massive selloff.

If anything, over the last few months management, has done what it can to look for ways to grow the operations. The stock still has been consistently growing sales quarter over quarter.

However, when you consider the new environment we are living in, where there are fewer events and fewer people needing ride-sharing services, it was not only going to be difficult for the company to operate, but the market certainly shouldn’t have rewarded Facedrive stock with such a massive growth premium.

This is why I don’t think much, if any, blame can lie with management. Instead, the selloff has been a result of the fact that Facedrive stock has been nowhere close to earning the valuation that it’s traded at all year, whether that was $60 a share in February to even $4 a share a few weeks ago.

Is Facedrive stock worth a buy today?

At just over a $1oo million market cap and a price-to-sales ratio that’s finally below 10 times, Facedrive stock is finally starting to look like it has a reasonable valuation.

It’s no longer clearly overvalued, which means it could potentially be worth an investment soon. With that being said, though, the stock is quite volatile and has a tonne of downward momentum at the moment. So you may want to wait for it to bottom, rather than trying to catch a falling knife.

Going forward, if you are considering an investment, remember that the stock is still extremely early, with just over $10 million in sales during the last 12 months.

As a ridesharing business, Facedrive stock has nowhere near the scale of its two largest competitors of Uber and Lyft. So while it could remain cheap and offer some growth potential, it’s going to be a stock will a tonne of risk for a while.