Cineplex (TSX:CGX) is Canada’s leading entertainment destination. Cineplex stock, however, is Canada’s leading headache. It’s a world of two extremes, where lockdowns and restrictions have paralyzed an otherwise solid business.

So, Cineplex stock has definitely tested our patience. It has gotten killed during the pandemic. It’s also failed to stage a meaningful recovery as of yet. I mean, lockdowns and restrictions have persisted for pretty much the last year and a half. Therefore, this stock hasn’t really had a chance.

But where are we now in Cineplex stock’s journey? Well, I’m here to say that it’s finally time to buy this stock. In fact, in my mind, it’s become a top stock to buy. Please read on as I walk you through the reasons for my belief.

Cineplex stock itching to move higher

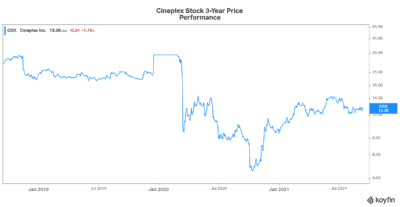

Cineplex’s stock price has stalled after rising almost 200% from its 2020 lows. Now, one might say that after this phenomenal return, we should not be expecting more. But may I remind you that just before the pandemic hit, Cineplex stock was trading above $33. And in 2017, it was trading above $50. This does not guarantee that the stock will get back up there. But it does illustrate the upside that exists if the company plays its cards right.

And I believe that’s exactly what Cineplex will do. In fact, this is what Cineplex has done all along. Its quality management team and strategic focus has allowed Cineplex to survive this unprecedented downturn. Despite all of the obstacles that this pandemic has presented, Cineplex has managed well by cutting costs and reducing its cash burn. Today, there is finally light at the end of the tunnel.

Attendance recovers, as Cineplex looks forward to a strong ending to 2021

In the second quarter of 2021, Cineplex continued to reopen its theatres and entertainment venues. As of July 13, all venues were open from coast to coast. As a result, Cineplex is now set up to thrive. In fact, the first fully open weekend in July was the busiest since March 2020. As of this summer, Cineplex was running at over 50% versus 2019 attendance. This will be built upon as more people are vaccinated, providing comfort for a return to theatres and gaming venues. As we approach the end of the year, Cineplex management expects attendance to rise to 80% of 2019 levels.

Looking ahead to the second half of 2021, this backdrop sets Cineplex up nicely. Because in the second half of this year, the movie lineup looks good. Blockbuster movies such as The Eternals and The Matrix reboot will surely attract movie watchers to the theatre. It is, after all, an immersive shared entertainment experience that you can’t get at home. And let’s face it — at this point, aren’t we all itching for this?

Motley Fool: The bottom line

In my view, Cineplex stock’s time has come, making it a top stock to buy today. In 2020, the stock sank, as investors weren’t sure that this company would even survive. But today, Cineplex is showing that it not only will survive, but it might even thrive again. The pandemic restrictions are lifting, and vaccines are making a huge difference. Cineplex has a lot to look forward to this year and next. Soaring cash flows are just a heartbeat away. A soaring Cineplex stock price is not far behind.