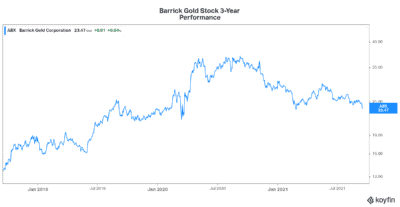

Barrick Gold (TSX:ABX)(NYSE:GOLD) and other gold stocks are the proverbial safe haven. They protect investors from inflation. They calm our fears as we flock to them when uncertainty rises. And most of all, they diversify our portfolios. This is because gold stocks are negatively correlated with most other stocks. In theory, they are the ones that rise when the rest of the market is falling.

Gold stocks: A shelter from uncertainty and inflation

Uncertainty is always present. Within the context of stock markets, though, it’s only recognized when enough people are saying it. These days, I do hear many market commentators saying that there’s a lot of uncertainty. But the market is unfazed. The commentators talk about the uncertainty as if it is somehow unique. The fact is that this is not unique. Uncertainty is always there. Therefore, gold stocks should always be a part of your portfolio.

Today, inflation is surging. The inflation rate in Canada hit 4.1% last month. This is a steady rise from the 3.7% the month prior. The last time inflation was this high was in 2003. What happened to gold prices and gold stocks in 2003? You guessed it – this is around the time when gold prices really began to spike. As for gold stocks, they were among the best performers in those years. Barrick Gold stock, for example, rose more than 120% in the following five years.

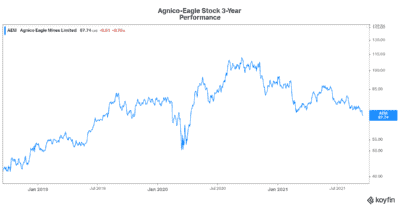

Agnico-Eagle Mines stock: Operational excellence

As a gold stock, Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) is top-notch. Its operational excellence has driven costs down to industry-leading levels. This, in turn, has boosted the company’s profit and cash flows. On top of this, gold prices have soared recently, resulting in the perfect storm. All of this has allowed the company to raise dividends significantly. In the last five years, Agnico’s dividend has increased by 230%. Its dividend yield is rising nicely and now stands at 2.6%.

So given the macro backdrop, combined with Agnico’s stellar performance, why is the stock trading at 52-week lows? Well, I don’t know for sure. All I know is that it doesn’t make sense. Yes, gold prices have been volatile. This is not surprising given that there’s talk that cryptocurrencies will replace gold as the inflation protection of choice. But I don’t believe this will happen. So we’re left with the facts. Inflation is rising dramatically. Gold is still the best inflation protection we’ve got.

Barrick Gold stock: Investors flock to this stock for gold exposure

Barrick Gold is one of the largest and most well-known gold stocks on the TSX and globally. It’s the go-to stock for gold exposure. At Barrick Gold, cash flows are also rising quickly. Yet Barrick Gold stock is also trading at 52-week lows. Clearly, investors are not believing the gold story or they’re just riding the momentum right now. But all of this means that we have the opportunity to buy these stocks at value levels.

Kirkland Lake Gold stock: A lesser-known stock with big torque

Kirkland Lake Gold (TSX:KL)(NYSE:KL) operates in Canada and Australia. This means that it has one of the safest political risk profiles in the gold sector and the mining sector in general. It is, in fact, a huge benefit. The Macassa mine is located in the town of Kirkland Lake, just north of Toronto. It accounts for approximately 30% of total production. This is one of the highest gold grade mines in the world. Kirkland’s mine in Australia is also high grade with strong exploration potential. Kirkland’s mines have well-established infrastructure and access. This has resulted in low costs and strong cash flows.

Additional dividend increases will support this stock as it continues to benefit from strong gold prices.

The bottom line

If I’m right, investors will start to flock to gold again as inflation heats up. Therefore, gold prices and gold stocks will rise. Consider buying Barrick Gold stock, Agnico-Eagle stock, and Kirkland Lake stock today while they’re relatively cheap and trading at 52-week lows.