Energy stocks are finally having their day. Recent sharp increases in demand have come after a time of declining production and inventories. This has culminated in a sharp rise in oil and natural gas prices. Simply put, cash flows in the energy sector are booming. Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ), Cenovus Energy (TSX:CVE)(NYSE:CVE), and Peyto Exploration and Development (TSX:PEY) are examples. Their soaring cash flows are foreshadowing explosive stock price returns.

The outlook is bright

Oil and natural gas prices are booming. The mix of increasing demand and lower production over the last few years has triggered the perfect storm. In the last year, oil prices are up almost 80%. Natural gas prices have soared almost 85%. This, in turn, is causing cash flows to skyrocket at energy companies. So far, most companies have used this cash to pay down debt. Debt was increased in the last few years, as energy companies struggled. But today, companies have made a lot of progress on their debt reduction. Soon, the focus will turn to shareholder returns. In short, expect rising shareholder returns from energy stocks.

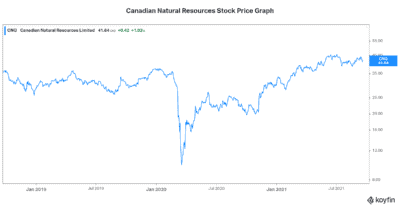

Energy stocks like Canadian Natural Resources are gearing up for increased shareholder returns

Canadian Natural Resources is Canada’s largest oil and gas exploration companies. Its assets are unmatched in their quality and operational efficiency. CNQ generated over $3 billion in cash flow in its latest quarter. In fact, things are going so well that the company has raised its cash flow guidance. Also, its balance sheet is being deleveraged. The next step likely will include some type of increase in shareholder returns.

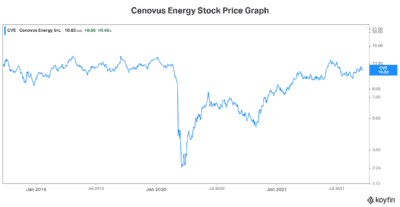

Cenovus Energy is an integrated Canadian energy company that is top tier. You may know it well from its recent very well-timed acquisition of Husky Energy. Today, Cenovus is already talking share buybacks. The company is awash in cash and well on its way in its deleveraging plan. Once this is done, management will consider share repurchases. They believe, as I do, that Cenovus Energy’s stock price is severely undervalued. Therefore, they see share repurchases as the best way to return capital to shareholders. Dividend increases are likely next.

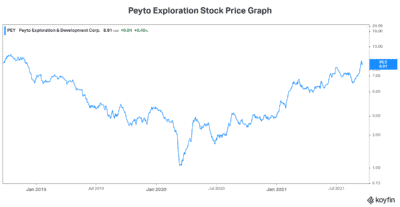

Peyto Exploration is Canada’s lowest-cost natural gas producer. It has a strong history of financial excellence and environmental stewardship. Peyto stock has soared in the last year. And this is just the beginning. In its latest quarter, funds from operations increased 150%. Peyto’s management thinks that the second half of this year and the year 2022 will be significantly better. And I agree. The up cycle in natural gas prices was a long time coming. It’s finally here. As Peyto’s CEO put it, we are “getting back to the old days” of booming cash flows and natural gas prices.

Energy stocks have risen fast … AND there’s more to come

Up cycles in commodities don’t last forever. But they do last. At this point, I believe we are at the beginning stages of an upward energy cycle. This means that all of these energy stocks that have soared recently are not done yet. In short, you still have time to buy. Energy stocks are still relatively undervalued.

There are some major themes coming from energy companies. The first relates to strengthening natural gas fundamentals. The next relates to rising demand in general. The last one relates to Asia-Pacific. There’s ample opportunity to participate in this geographic market. Some Canadian companies have assets there. Others can participate through liquified natural gas (LNG) exports. Essentially, Canadian energy plays an important role in Asian energy supply.

For example, Cenovus Energy has assets in China that are proving to be very valuable indeed. Also, natural gas companies such as Peyto have a big opportunity. Canada is well positioned to supply Asia with natural gas energy via LNG exports.

Motley Fool: The bottom line

Energy stocks are rallying hard. After years of struggle, oil and gas prices are rising. This is turning the fortunes of energy stocks. Canadian Natural Resources, Cenovus Energy, and Peyto Exploration are all booming. Right now, they’re using cash flow to shore up balance sheets. Ultimately, this cash will be used to increase shareholder returns. It’s not too late today to buy into this booming sector.