The Evergrande fiasco has spooked investors. In a world where even the biggest companies can go bankrupt, everything feels more stressful. But what if said that you can rest easy? All you need to do is invest in one of the fastest-growing sectors today.

In this Motley Fool article, I would like to present three natural gas stocks that have been skyrocketing. This is supported by strengthening natural gas prices and skyrocketing cash flows. Let me introduce Peyto Exploration and Development (TSX:PEY), Birchcliff Energy (TSX:BIR), and Tourmaline Oil (TSX:TOU).

These are energy companies whose production is 80%+ natural gas. This means that they have strong exposure to the booming natural gas sector.

Evergrande anxiety? Check out natural gas stocks

The Evergrande situation does raise fears of a global contagion. Could this hinder economic growth in China? And will it spread to other areas of the world? Could it spark a financial sell-off? These are all good questions to ask. I think the answer is yes to all of them. Despite this, I think that it would only be a setback. I don’t think we can stop the rise in the natural gas sector. It’s a necessary fuel that’s replacing coal globally. It will fuel Asia’s economic development. And it will help us transition to clean energy.

After being in the dumps for years, natural gas is making a comeback. It’s supported by short and long-term trends. In the short term, prices are reacting to the combination of rising demand and falling inventories. Years of underinvestment in natural gas production are evident. As they say, the best cure for low prices is low prices. Natural gas prices were so low that companies cut production. Others went bankrupt.

Today, we’re emerging from this period with high hopes. The supply/demand picture is favourable. Strong demand coupled with low supply is propping up natural gas prices. Further, the natural gas investment case looks good. While the world is moving toward clean energy, natural gas is essential. For example, it’s much cleaner than coal. Furthermore, it’s inexpensive. It will be a key energy source for developing nations. And it will remain essential for developed nations as they make that shift to clean energy.

Natural gas stock prices and cash flows are skyrocketing

Evergrande is struggling to make its debt payments. The company is running out of cash. The real estate developer’s situation is reminiscent of the situation that many natural gas companies were in years ago. Falling commodity prices meant lower cash flows and higher debt levels. Many companies also felt this cash crunch as interest payments were coming due and cash flows were running dry.

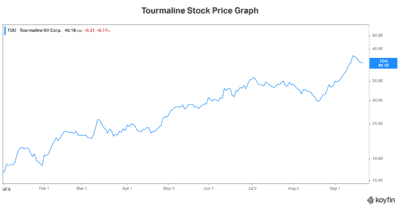

Today, natural gas companies are thankfully out of this dire situation. Those that have survived are seeing greener pastures. Tourmaline stock has rallied 120% so far this year.

Its cash flows are up big and are sitting at record levels. And this momentum is building. Tourmaline expects significant cash flows in the coming years. And you guessed it – the vast majority of it will be returned to shareholders. We can expect special dividends and dividend increases from this natural gas king.

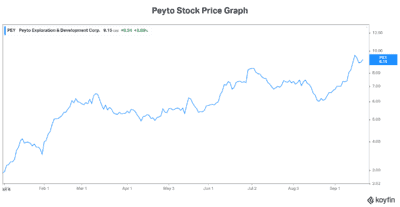

Peyto is another top natural gas stock to own for exposure to the strengthening natural gas sector. It’s Canada’s lowest-cost natural gas producer. Peyto’s cash flows are also soaring. Peyto’s stock price has risen 200% this year as its cash flow soars 150%+.

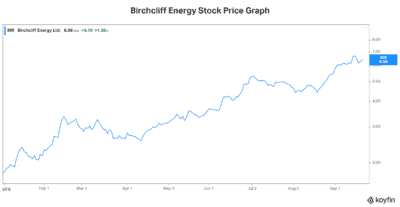

Finally, Birchcliff Energy is a smaller natural gas stock, but a very valuable one. This stock has risen 250% this year. Birchcliff is based in prolific basins in Western Canada. Importantly, it retains control over its assets, which isn’t a given for smaller companies. Cash flows are soaring and Birchcliff is well prepared for the booming times.

The bottom line

Hopefully, this Motley Fool article has given you hope that there are places to turn in these uncertain times. Evergrande might be on the brink of disaster. But natural gas stocks are both undervalued and high growth. Investors can win big by buying a portfolio of them. Consider Birchcliff, Peyto, and Tourmaline for their explosive upside.