If you want to earn passive income through dividend stocks, I suggest two Canadian dividend stocks that are good long-term buys.

Sun Life

Sun Life Financial (TSX:SLF)(NYSE:SLF) is a Toronto-based insurance company providing asset management and wealth management services to clients around the world.

Its second-quarter 2021 earnings report showed that net income increased to $900 million, up 73% from $519 million in the same quarter last year. Insurance sales increased 35% and wealth sales increased 64%. Asia Group’s net income was $143 million, up 13% from the same period last year. The expansion of Sun Life’s business in Asia combined with the improvement of its business in North America contributed to strengthening its performance.

Return on equity was strong at 16.3%. The company has a strong balance sheet with $3.2 billion in cash and liquid assets as of June 30, 2021.

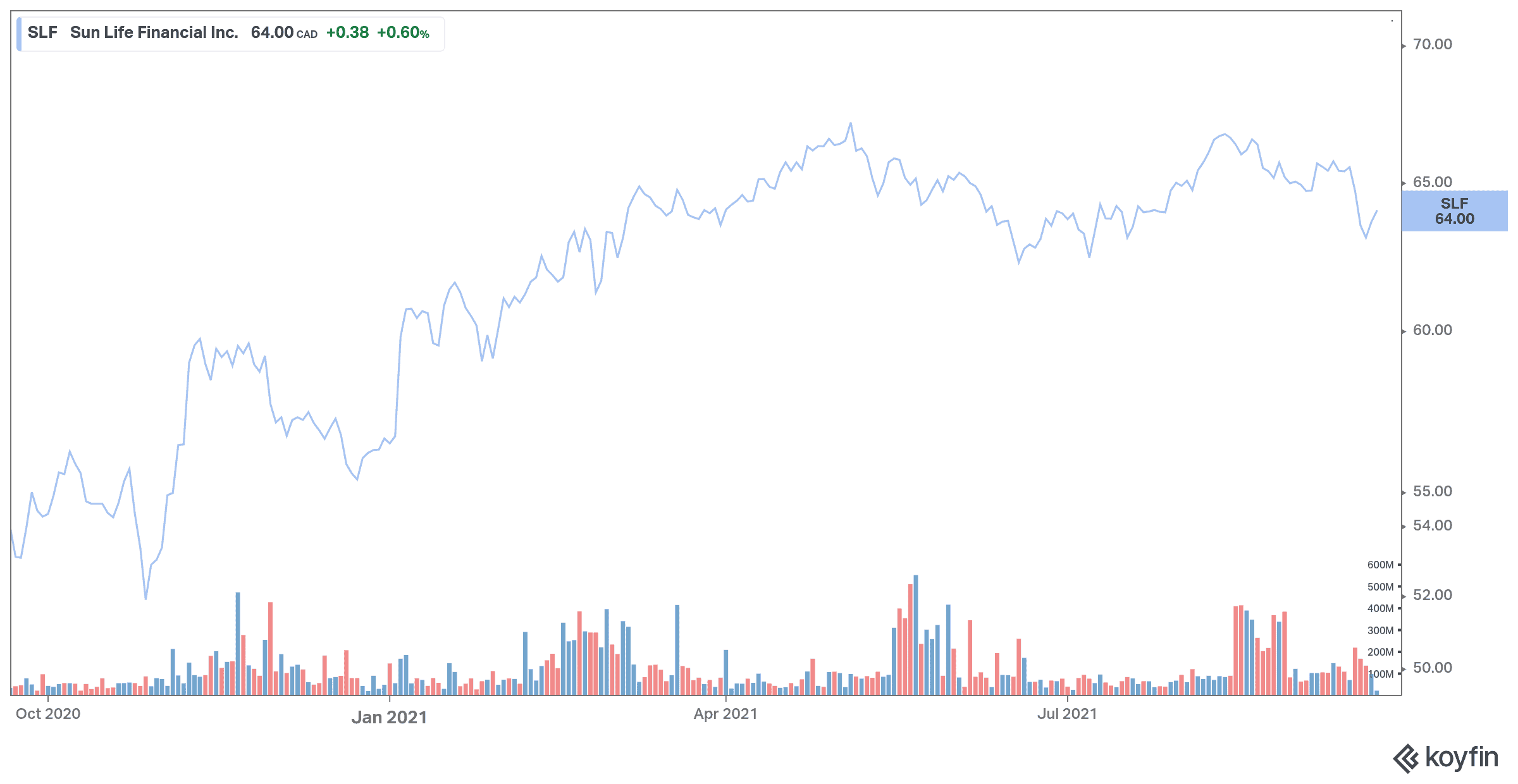

Sun Life pays a quarterly dividend of $0.55 per share. The second-quarter payout ratio was 37%, so there is ample room for increases. At the time of writing, the stock is trading at almost $65 per share and offers a dividend yield of 3.4%.

Looking ahead, interest rates are expected to rise in the second half of 2022 and continue to rise in the years to come. Higher interest rates tend to be a net benefit to Sun Life, as they increase the return the company can earn on funds held to cover potential insurance claims.

The company’s potential to generate growth, reliable income, and strong overall fundamentals make it one of the most attractive dividend stocks to buy now.

Telus

Telus (TSX:T)(NYSE:TU) is a leader in the Canadian communications industry with wired and wireless network infrastructure providing customers with television, internet, and mobile services.

Telus does not have a media division, but that has not held back the growth of the company.

Instead, Telus has invested in a healthcare division, which has seen an increase in the use of its services over the past year. Telus Healthcare provides digital solutions to doctors, hospitals, and insurance companies and offers apps and other tools to help healthcare professionals connect with patients in a secure digital environment. The trend towards more e-health services is expected to continue, and Telus is already a leader in this field in Canada.

Telus recently spent nearly $2 billion to buy new spectrum that will support the expansion of the company’s 5G network in the years to come.

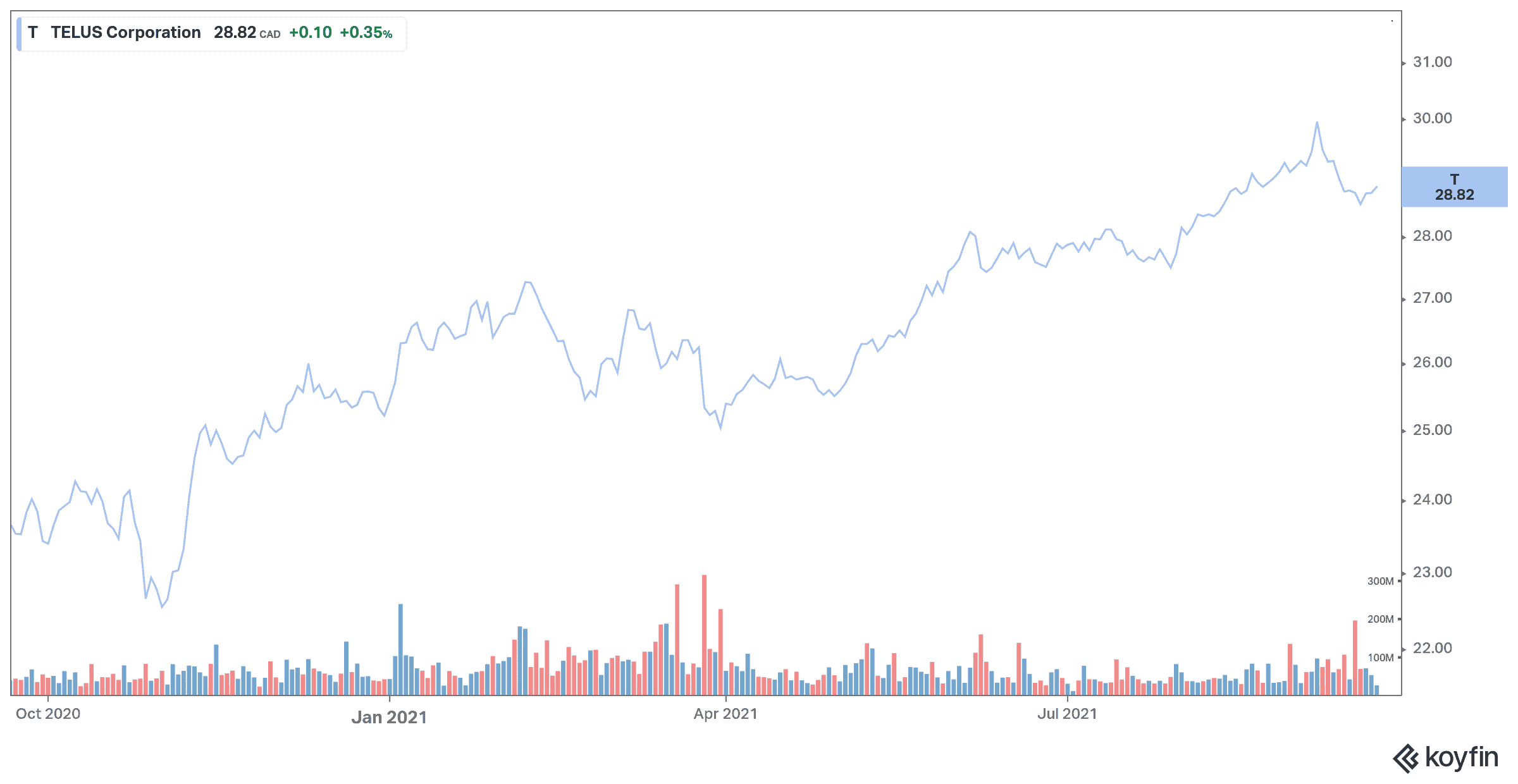

Telus is also doing well in terms of its ability to attract and retain customers for its main telecommunications company. For the second quarter of 2021, the company reported 223,000 new net customer additions, better than Rogers and BCE. Telus added 89,000 new mobile phone customers, 84,000 for connected devices, 30,000 for Internet, 19,000 for security and 11,000 new TV client connections.

For the quarter, Telus’s operating revenue increased 10.3% year over year to $4.111 billion and adjusted EBITDA increased 9.5% to $1.490 billion.

Telus stock has a long history of strong dividend growth and attractive total returns, making it one of the best Canadian dividend stocks. While Telus is investing heavily in fibre optic lines and 5G networks, investors should still see the company generating sufficient cash flow to continue increasing distributions. Telus stock is trading near $30 and currently offers a 4.4% dividend yield. The stock tends to hold up well when the broader market falls, as mobile phones and internet are considered essential services nowadays.

2-for1 Sale

2-for1 Sale