If you’re a Motley Fool investor looking for safe stocks to invest in, you’re not alone. Fears related to the looming Evergrande crisis have taken front and centre stage again today. Also, Bitcoin continues to tumble. Markets are lower as investors focus on these risks. If you’re feeling nervous about the market, you’re also not alone. After all, we’re coming off an exceptionally strong period of performance. And the Evergrande situation has the potential to send shockwaves around the world.

Gold stocks are the ultimate safe haven. Also, many of them are trading at 52-week lows. This is a good combination for the times. This Motley Fool article discusses three gold stocks to buy for safety and even some good upside.

Gold stocks are still the safe haven of choice

There has been an emerging view that Bitcoin might replace gold as the safe haven of choice. Well, the Bitcoin price action of the last few weeks and days quickly dispels that notion. I mean, it’s fallen 20% in the last month alone. Also, today, China has declared cryptocurrency transactions illegal. So we can see a good reason to flock to gold.

Evergrande fears hit the market again

As a real estate developer, Evergrande was long known to be very heavily in debt. Many have stayed away from this company, as this strategy is often a time bomb. Today, Evergrande is running low on cash and struggling to make interest payments. It’s already been selling properties at discount prices in order to raise cash. This is causing shock waves in the real estate industry in China. It’s also causing shockwaves at financial institutions. Evergrande has borrowed almost $90 billion, with almost half of that due in less than a year.

Obviously, the market does not like this. It sends shivers down my spine to think about what this could set in motion. But the government is aware of the gravity of the situation. One would hope that it would step in to ensure the continued health of the Chinese economy. So stock markets around the world are lower again today, and investors are growing increasingly fearful of what’s to come.

3 gold stocks to buy for safety

Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) is one of the safest gold stocks out there. Its assets are located in politically safe, pro-mining jurisdictions. This means places like Canada, Europe, and Australia. Momentum at Agnico continues to build. For example, record production, cash flows, and dividend increases have become the norm. And to top it all off, Agnico-Eagle stock trades at 52-week lows. Investors have stuck their noses up at gold stocks in the last year, but this may be about to change!

Barrick Gold (TSX:ABX)(NYSE:GOLD) is the most well-known gold stock. It’s the one that investors flock to first when looking for gold exposure. That makes sense, as Barrick is the $41 billion gold behemoth. Also trading at 52-week lows, Barrick Gold stock is a top stock to buy for protection. It’s a safe stock because of its business and its valuation.

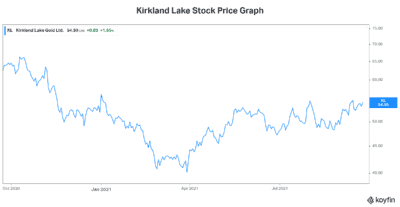

Kirkland Lake Gold (TSX:KL)(NYSE:KL) is a mid-tier gold stock with a market capitalization of just below $15 billion. Operating in Canada and Australia, Kirkland Lake Gold has one of the safest political risk profiles in the gold sector and the mining sector in general. This is a great characteristic to have, especially in a nervous market. Declining costs, soaring cash flows, and future dividend increases will support this stock as it continues to benefit from rising gold prices.

The bottom line

The Evergrande crisis continues to loom large. Bitcoin is losing its value. If you’re clamoring for safety, gold stocks are the way to go. Barrick Gold, Agnico-Eagle Mines, and Kirkland Lake can help shelter your portfolio as the risks to the market mount.