When I look back to a year ago, the Canadian stock indices (the TSX and TSX Venture) took a substantial dip between September and October. Hence, it is not surprising to see markets once again hit some volatility again. In September 2020, another wave of COVID-19 seemed imminent and the economy appeared shaky. As a result, stocks seemed expensive. Who would imagine that the S&P/TSX Composite Index would be up nearly 30% one year later?

The point is, for long-term investors, these dips are wonderful opportunities. Buying high-quality businesses that either boast strong economic moats or tailwinds for growth is a great way to set up for investing success. Given this, here are three high-quality Canadian stocks I would look to buy on any weakness in September or October.

Canadian Pacific Railway: A top value stock

If you are interested in value stocks to own for the long-term, you don’t get much better than Canadian Pacific Railway (TSX:CP)(NYSE:CP). With a market cap of $55 billion, it is one of the smallest class 1 railways in North America. While that may not sound too impressive, you might change your mind if you knew it was one of the most efficient railroad operators in the industry.

Likewise, its size differential is about to change. It is once again in the driver’s seat to acquire Kansas City Southern Railway. While it is paying a somewhat hefty price, CP is likely the only North American railroad capable of making this acquisition work.

The acquisition would not only broaden CP’s scale, but it would also render it the only rail network to touch Canada, the United States, and Mexico. At $83, this Canadian stock is down 5% year to date. It only trades with a price-to-earnings ratio of 18 times, giving it a substantial discount to its larger peer, Canadian National. You may need to be patient, but I think this stock will reward shareholders for many years to come.

Calian Group: A top GARP stock

In my opinion, Calian Group (TSX:CGY) stock has a little bit of everything for Canadian investors. It has a diverse business model, a cash-rich balance sheet, double-digit organic/acquisition growth, and a nice 1.80% dividend as the cherry on the cake.

Calian provides advanced solutions in healthcare, education, advanced technologies, and IT/cybersecurity. While it primarily caters to large institutions (the Canadian government, NATO, the European Space Agency, etc.), it has also been steadily expanding solutions for corporate partners as well.

Since 2018, this Canadian stock has been seeing growth accelerate. It has grown revenues by a compound annual growth rate of 19.5%. EBITDA has been growing even faster with a 27% growth rate. Calian only trades with an enterprise value-to-EBITDA ratio of 11 times. This stock has a market cap of just $700 million, so it still has a long runway ahead. It looks like a great growth-at-a-reasonable-price (GARP) stock to own now.

National Bank: A top Canadian income stock

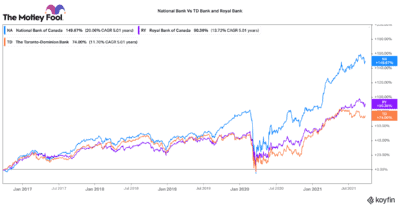

Income-orientated investors love Canadian bank stocks. Often TD Bank and Royal Bank are at the top of the list given their scale and attractive 3-4% dividend yield. However, when it comes to performance, none of them have beaten National Bank (TSX:NA). Over the past five years, its returns have beaten both by a wide +60% margin.

Sure, it is not the largest bank and it only pays a 2.95% dividend. Yet, it makes up for it through the exceptional management of its banking, wealth management, and capital markets businesses. It has only grown revenues at about two-to-three times inflation over the past five years (around 7.8% compounded annually). However, it has grown earnings per share by 22% when compounded annually.

By maintaining an efficient and strategic business model, it has outpaced its peers for years. Given its low payout ratio, chances are good its dividend will rise once regulatory restrictions are lifted. Its stock has pulled back by nearly 3% in the past month, so now may be a good time to start nibbling at this stock.