Canadian investors love their dividend stocks. Dividend stocks are especially important for retirees, especially considering it is a key supplement to retirement income.

In today’s low-interest rate environment, government bonds, GICs, and savings accounts are yielding a negative return after inflation. Hence, dividend-yielding stocks are more important to a retiree’s investment portfolio than ever. Here are four solid Canadian dividend stocks retirees can buy, hold, and rely on for stable income.

Enbridge: A top Canadian infrastructure stock

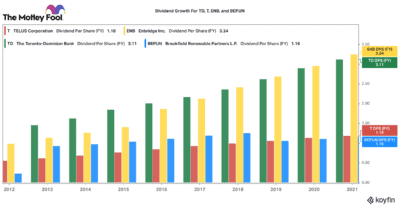

One of the best high-yielding Canadian stocks you can find today is Enbridge (TSX:ENB)(NYSE:ENB). Despite a solid 25% return year to date, Enbridge still pays an attractive 6.6% dividend! Today, it is trading just below a 52-week high. Recent strength in global energy markets has certainly helped buoy this stock up.

While that is a short-term catalyst, there is a lot to like about Enbridge for the longer term. First, it has highly contracted, toll-like assets (pipelines, storage containers, export terminals) that capture very predictable streams of cash.

Second, the company is using excess cash to diversify into renewables and green technologies. While this Canadian stock can benefit from strength in oil pricing today, it will also have the assets to stay a relevant green energy business for years to come.

Brookfield Renewables: A top green stock

Speaking of renewables, Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP) is perhaps the safest way to enjoy that rising trend. It only pays a 3.1% dividend. However, with a market cap of $13 billion, it is one of the largest, most experienced, and best capitalized renewable power developers and operators in the world.

While its dividend might be on the lower side, it has consistently grown its payout by a compound annual rate of 6% for years. The great news is that this company is primed for even faster growth. Many governments and corporations are looking to transition to clean energy.

Brookfield is perfectly positioned to be a key green energy solutions partner. This business has the balance sheet, expertise, and global scale to grow significantly. As a result, this Canadian stock’s dividend is likely to keep growing for many years to come.

TELUS: A top Canadian telecom stock

Another great Canadian infrastructure stock to own is TELUS (TSX:T)(NYSE:TU). It pays a nice 4.4% dividend. In 2021, it has actually raised its dividend rate by 8.6%! In fact, over the past five years, it has raised its dividend annually by around 7%.

Since the pandemic, TELUS has performed admirably, leading the industry in net customer additions across its telecom service segments. Likewise, it has accelerated its broadband and 5G spend, which should result in elevated free cash flow growth early next year. Not to forget, TELUS is also incubating a number of very interesting growth verticals inside its business.

One of these verticals, TELUS International, was IPO’d early this year. It became one of Canada’s largest tech public offerings ever. Combine a stable cash-yielding telecom business and tons of optionality from the global digital revolution and TELUS is one Canadian dividend stock to buy and hold for the long run.

TD Bank: A top financial stock

I would be remiss to discuss dividend stocks without mentioning a top Canadian bank. Toronto-Dominion Bank (TSX:TD)(NYSE:TD) recently pulled back 7% from 52-week highs. As a result, it looks fairly attractive here. With a market cap of $122 billion, investors get a large, well-managed, highly-capitalized financial institution. It has a great retail presence in both Canada and the United States.

There are two catalysts that should benefit investors over the long term. First, interest rates have likely bottomed here and there is room for them to rise. That means higher interest margins and solid earnings growth could be just around the corner. Second, as the pandemic abates, financial regulators will eventually release Canadian bank stocks from capital deployment restrictions.

With excess capital to utilize, dividend increases, share buybacks, and even acquisitions could all be on the menu for TD. This Canadian stock pays a nice 3.8% dividend right now. It is a solid way to capture stable retirement income and modest capital gains over time.