Canada’s main stock market index, the S&P/TSX Composite, lost 289.28 points to close at the 20,174.14 level on Tuesday — down more than 1.4% for the day.

Just 389 stocks advanced on the TSX stock market, 244 were unchanged, while 1,444 stocks declined during Tuesday’s trading session.

The picture was the same on the junior S&P/TSX Venture Composite Index, which lost 12.82 points, or 1.46%, to close at the 867.59 level, as 653 tickers were in the red, 351 stocks remained unchanged, while only 248 TSXV listed shares rose on Tuesday.

Major TSX market trading themes on Tuesday

A significant 1% drop in gold prices to US$1,733.49 per ounce can be blamed on a rising United States dollar.

Energy stocks tried to remain the star of the TSX after retaining early gains through mid-day. However, they eventually yielded to selling pressure when oil prices reversed course towards the end of Tuesday trading session. Energy stocks lost just 0.035% for the day. The sector had a strong show on Monday. Its 3.1% gain helped push the TSX higher, with support from healthcare, which gained 2.4% yesterday. Healthcare stocks lost 2% on Tuesday, and technology names were down 3.8%.

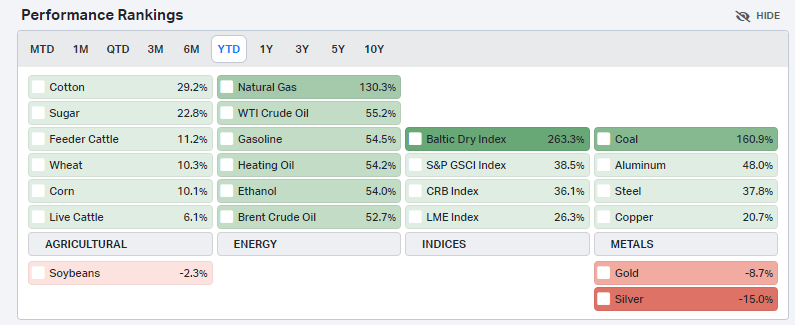

That said, oil prices remain firm enough to make energy investors smile. The Western Texas Intermediate (WTI) crude oil benchmark is up over 54% so far this year at US$74.77 per barrel. Natural gas prices continued to soar to new records as a crisis looms in Europe. The crisis may spread to more economies. Natural gas futures advanced 3% to US$5.88 on Tuesday. Baytex Energy (TSX:BTE)(NYSE:BTE) stock is hitting record highs this year, finally.

Technology stocks continue to bulk under the pressure of rising bond yields. The Canadian 10-year treasury bond yield increased by 9.6 basis points, or 6.8%, to 1.507%.

Inflation realities are hitting central bankers’ minds, and high inflation rates could linger for longer, prompting a revision to earlier expansionary policies. Interest rates could rise sooner rather than later, and investors are pricing all this information into market valuations. High-growth tech names and highly leveraged utilities take natural hits when these things happen.

Aurora Cannabis stock rises

On the brighter side for TSX cannabis stock investors, Aurora Cannabis (TSX:ACB)(NYSE:ACB) stock rebounded from an early 4% loss at market open to close nearly 6.9% higher at $8.64 per share. Pot investors’ early disappointment about the company’s revenue and earnings miss in Monday’s financial results could have weighed on ACB stock at market open, but an analyst upgrade from MKM Partners and positive and believable comments from ACB’s CEO about the outlook for a positive EBITDA by the first half of the fiscal year 2022 is music to bullish investors’ ears.

Agnico Eagle Mines to acquire Kirkland Lake Gold

Canadian gold miners Kirkland Lake Gold (TSX:KL)(NYSE:KL) and Agnico Eagle Mines (TSX: AEM)(NYSE: AEM) announced early on Tuesday a merger of equals. The combined company shall retain the “Agnico Eagle Mines Limited” name. Kirkland shareholders will receive 0.7935 of an Agnico Eagle common share in a deal that may close in December.

Executives at the two firms expect the merger to create “the gold industry’s highest-quality senior producer, with the lowest unit costs, highest margins, most favourable risk profile and industry-leading best practices in key areas of environmental, social and governance (ESG).” However, investors showed their disapproval, as Kirkland stock closed 7.8% lower, while Agnico Eagle stock lost 1.2% for the day. Fellow Fool contributor Jitendra Parashar believes the deal undervalues KL stock.