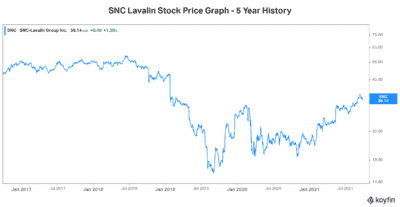

Value stocks are hard to come by these days – but today, I have found another one. SNC-Lavalin Group (TSX:SNC) is an engineering services company that’s seen its share of controversy and scandal. From high-level bribes to widespread corruption, this has been a disaster. But what if this same company is actually now a very compelling buy opportunity? I mean, its troubles were the very thing that made it a value stock. Bear with me as I take you through the reasons that SNC stock is up 70% in 2021, yet it’s still a value stock. And here are the reasons why this stock is set up for success.

A value stock with a strong long-term growth runway

There are many growth trends that SNC is set up to capitalize on. First, let’s recall the business that this company is in. SNC provides engineering services, its biggest segment. In this segment, SNC brings projects to life in many different industries. For example, the transportation industry is a big contributor. In terms of future growth, water infrastructure and power/renewables infrastructure represent rapidly growing areas.

So within this, there are some megatrends that are driving current growth and future expected growth. For instance, infrastructure is aging. Most of the infrastructure in the United States was built between 1930 and 1950. In Canada, it’s pretty much the same story. What this means is that significant spending is coming for infrastructure modernization and replacement. SNC stock certainly does not reflect this huge opportunity. This makes it a value stock.

Net-zero targets and de-carbonization spurs rapid future growth prospects

The environment has taken centre stage in recent years. Governments worldwide are increasingly establishing net zero emissions targets. These goals will obviously require big capital investments. SNC is readying itself for the estimated $120+ trillion that will be spent in the next three decades. The clean energy transition will certainly be very expensive. From the design of de-carbonization infrastructure to the implementation, SNC has all areas of this value chain covered. The value that SNC will capture here is huge, but I don’t believe it’s reflected in its stock price.

There’s also good news in the more immediate future. In the U.S. and Canada, both President Biden and Prime Minister Trudeau have passed legislation to upgrade infrastructure. This translates to a more than $30 billion prospect pipeline for SNC in the next three years. It’s pretty significant stuff.

Leaving its shady businesses — and depressed valuation — behind

SNC hosted its investor day this week. To me, the company’s presentation spoke volumes. There was a big focus on integrity, ethics, and oversight. Clearly, the company knows it has some work to do. It’s difficult to get past the shady deals the company has been part of. Because of this, SNC stock is trading at depressed valuations. Here’s the good news.

In fact, SNC stock trades at a price to earnings multiple of fewer than 20 times. For a company that’s swinging from net losses to net earnings with a rapidly growing backlog, this is low. Also, investors can look forward to lower debt and rising cash flows as SNC de-risks and focuses its business.

Without the corruption overhang, there’s no telling what SNC stock can do. Because the fundamentals are strong – both in the short and the long term.

Motley Fool: the bottom line

In summary, SNC stock’s performance in 2021 has been exceptional. It’s been a long time coming but the company is finally focusing and improving its business practices. But it’s still a value stock worth buying. Long-term drivers should continue to drive the stock higher. The world is rapidly changing and improving. SNC is part of this change.