Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD), formerly known as Lightspeed POS, is a software development tech company that offers omnichannel point of sale platform solutions. Its focus is on the restaurant and retail industry, which is severely lacking in its e-commerce channel. The company has seen rapid growth as it has benefitted from the boom in e-commerce during the pandemic. When I first planned to write a Motley Fool article on Lightspeed stock, it was to consider whether it was too late to buy it.

Today, just a short week later, my angle has changed. I mean, the stock has dropped 25% in the last week or so. Therefore, the question that we have to ask ourselves now is a different one. So, should Motley Fool investors buy Lightspeed stock on weakness?

Lightspeed pos stock gets killed

The issues dragging Lightspeed stock down run deep. When short-sellers go after a stock, things get rough. The accusations are bold – inaccuracies and mischaracterizations. The bottom line is that according to a short-seller’s report, the revenue growth at Lightspeed is not what it seems. They’ve gotten their hooks into Lightspeed. Management, of course, denies this.

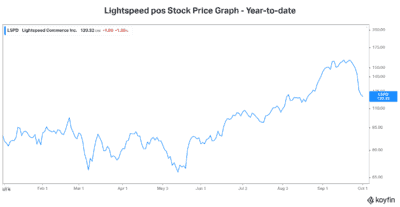

Lightspeed’s stock price has had its big rally. In fact, it’s up 40% in 2021. Given the volatility, it’s time to question our position in Lightspeed (or lack thereof). For those who are already invested, I would consider taking profits. If not all, then at least some profits. For those considering entering the stock on this weakness, beware. Attempting to catch a falling knife is dangerous. Remember, doing nothing is an active decision. You can make a decision to wait for the dust to settle. Today, the stock trades at a lofty 50 times price to sales multiple. It’s not like it’s cheap. Indeed, it remains very richly valued. And that’s after the stock got hit.

Certainly, there will be a time to buy, but that time is not now. Lightspeed is falling from incredible heights and it’s very difficult to call the bottom.

Why was Lightspeed targeted?

As far as stocks go, Lightspeed was the perfect target for short-sellers. It’s been trading at mega-high valuations. Also, it has made expensive acquisitions. And, the company is losing money every quarter resulting in a dwindling cash balance. I mean, the stock could have been hit on valuation alone. See the following chart that highlights Lightspeed’s stock price action in 2021.

We’re also seeing a rotation away from tech stocks in recent days/weeks. This makes sense, as many of these stocks have enjoyed out-of-this-world returns. And they’re now trading at really lofty valuations. At a certain point, a company can’t live up to lofty expectations, no matter how amazing its business is. When expectations that are priced into a stock get too optimistic, bad things happen.

Is there truth to the allegations?

This is a more difficult question to answer. It’s very possible that the accuser is just trying to set it up so that their short position works. Or they could simply be wrong. As investors, it’s difficult to gauge the situation. But what we can do is remove ourselves from this high-risk affair. I mean, other sectors/stocks are attractively valued. There are others, like energy stocks, that are seeing big buying activity amidst rising oil and gas prices. There comes a time to shift gears. This might very well be the time to lighten up on Lightspeed and tech stocks in general.

The bottom line

Lightspeed stock is really coming crashing down. It’s a dramatic, yet not entirely unexpected situation. We knew that tech stocks like Lightspeed were trading at lofty valuations. We also knew that most stocks can’t go up in a straight line forever. There often comes a time to tweak your holdings – and take some profits.