Many Canadian stocks have had a strong recovery over the last year as the market has been on a major rally. But after consistently setting new all-time highs for months, there is now some volatility creeping back into markets.

This is only natural given some of the headwinds we are facing, such as rising bond yields and a devastating surge of the Delta variant around the world.

Despite these headwinds, there are still several Canadian stocks that offer investors high-quality opportunities to grow their money. In fact, if you’re looking for a Canadian stock to buy today, here are two picks that could potentially double soon.

A top tech stock trading cheap

One of the first Canadian stocks you’ll want to consider buying today is AcuityAds Holdings (TSX:AT)(NASDAQ:ATY).

AcuityAds is a high-potential Canadian growth stock in the AdTech industry. The company has significant long-term growth potential because its industry has been gaining tonnes of popularity recently, especially with big data and the power of computers today. However, AcuityAds also has an exciting proprietary platform for customers that many analysts and investors are bullish on long-term.

Despite all this optimism surrouding AcuityAds in the long run, the stock has been out of favour recently. And with tech stocks selling off last month, the Canadian stock has only continued to decline, now becoming ultra-cheap.

This is creating an extremely promising opportunity as AcuityAds could reward investors who see the big picture and have the patience to wait it out. Because when AcuityAds gains momentum, the stock certainly has the potential to double — and quite possibly even a lot more.

The stock’s current average target price from analysts is upwards of $19, a more than 130% premium today’s trading price. So if you’re looking for a high-potential stock that could double soon, AcuityAds is one of the best companies to consider.

A top Canadian gold stock

Many gold stocks are cheap these days and have the ability to recover substantially. However, Equinox Gold (TSX:EQX) is one that offers some of the most growth potential and could certainly double when gold stocks come back into favour.

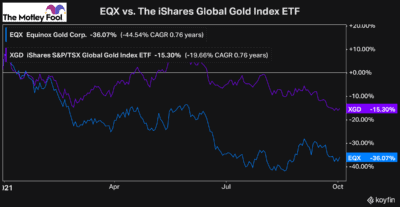

Not only does the Canadian gold stock have long-term growth potential, but because it’s a growth stock that trades with a premium during rallies, it’s sold off more than its peers.

From 2019 to 2021, Equinox earned investors a total return of 187%, compared to the iShares Global Gold Index ETF, which earned investors just 84%. However, because Equinox is one of the top growth stocks in the industry and therefore has sold off more than its peers, it offers a significant opportunity today.

As you can see by the chart, Equinox is even cheaper than the rest of the undervalued stocks in the gold industry.

And with the company rapidly growing its production and expected to produce close to 600,000 ounces of gold this year and scale that up to one million annually by 2024, it’s an excellent time to make an investment.

In the last two years, Equinox’s revenue has grown by 843%, thanks in large part to the massive increase in gold production. So as the stock continues to grow its operations and gold eventually comes back into favour, the Canadian stock has the potential to double and possibly even more.

Currently, Equinox is trading more than 50% off its 52-week high. That means if Equinox just rallied back to its all-time high, it would already more than double investors’ money if they bought the stock today.

And with so much opportunity for growth in the long-term, the potential is even greater than that. So if you’re looking for a top Canadian stock to buy today, Equinox is an excellent choice.