The tax-free savings account, or TFSA, is an important tool for investors. In fact, it’s an invaluable tool. Today, the TFSA contribution limit is $75,500. This means that you can safely store away all of this money, tax-free. So take a moment to ensure that you have the best TSX stocks within this savings vehicle – that is, stocks that have high dividend growth/yields and high expected capital appreciation.

This tax shelter will save you a significant amount of savings over many years. In short, you will maximize your returns. So before you make one more investment, please make sure that you’re maxing out on your TFSA contributions. Here are three of the best TSX stocks to buy for explosive dividend growth.

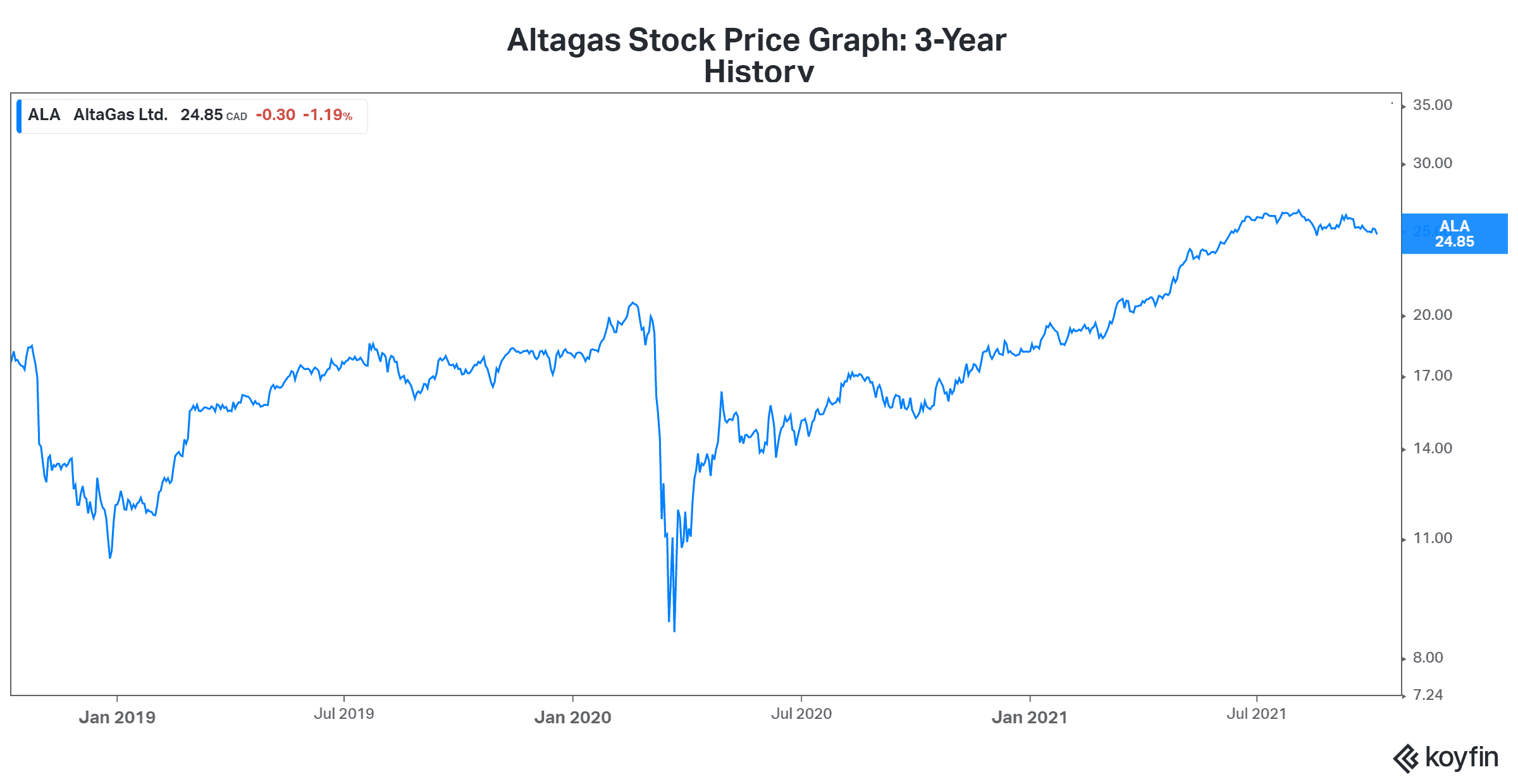

Altagas stock: one of the best stocks for your TFSA

Altagas (TSX:ALA) is a diversified energy infrastructure company. Indeed, 60% of the company’s EBITDA is derived from its highly defensive utility business. And the rest of it is from its midstream business. The company’s two segments provide it with a stable and secure revenue stream mixed with growth. The defensive utility segment provides Altagas with steady and defensive utility earnings. The midstream segment provides Altagas with huge growth.

So what does this mean for investors? Well, it means that you can attain stable dividend income with Altagas, while also benefitting from a growth business. Altagas’ midstream natural gas assets are where the growth is coming from. These assets are located in some of the fastest-growing markets in North America, including the Montney and Marcellus/Utica basins. The strongest growth is coming from Altagas’ propane export facility. It’s currently posting 20%+ growth in volumes as Asian propane demand is soaring.

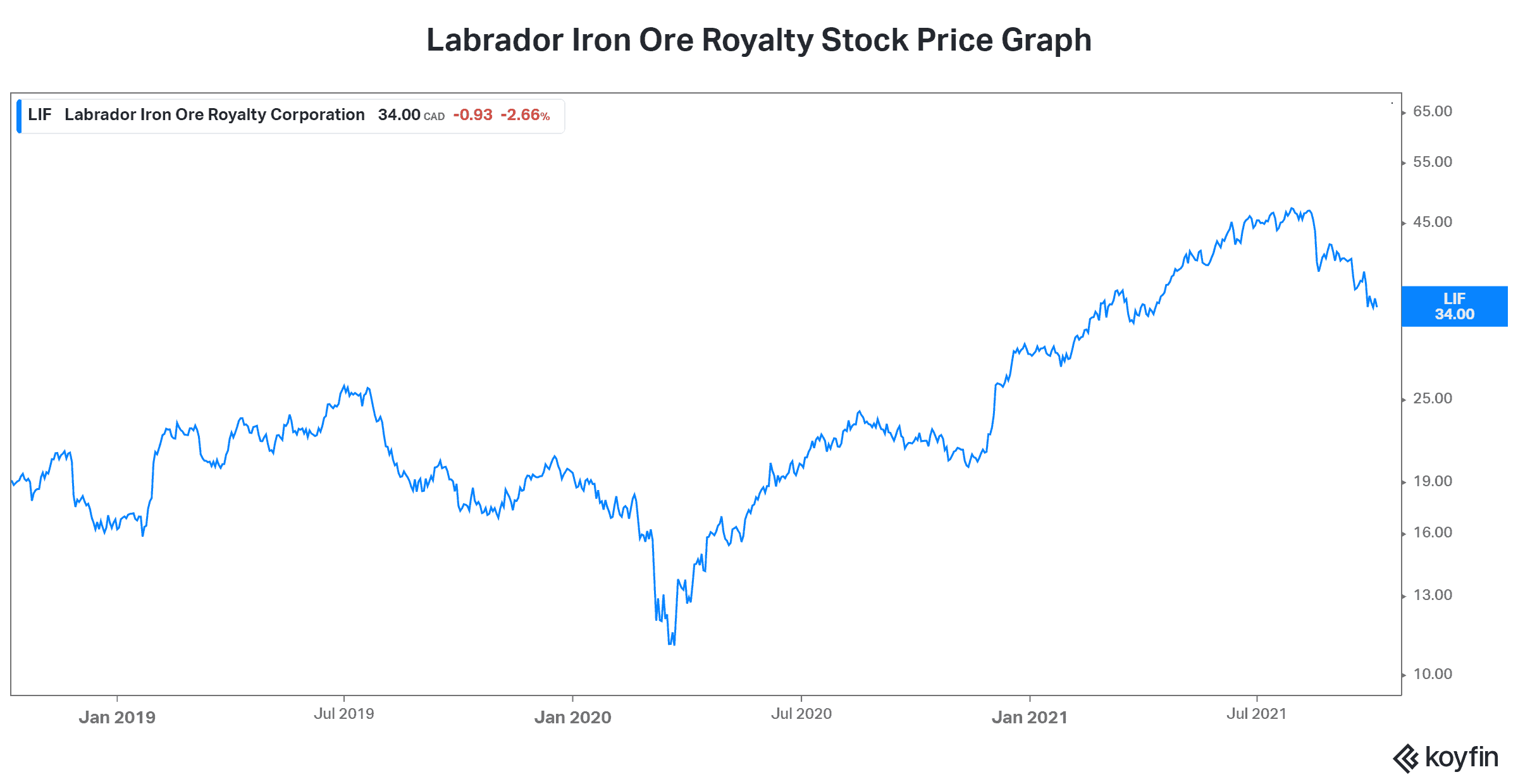

This TFSA stock is the best stock for its dividend yield

Labrador Iron Ore Royalty (TSX:LIF) is a TSX stock that’s a true Canadian gem. Labrador Iron Ore Royalty owns a 15.1% interest in the Iron Ore Company of Canada. It participates in the revenue through royalties, which it receives without bearing any of the risks and costs of running operations.

Its whole “raison d’etre” is to pass on its ample cash flow to its shareholders. This takes the form of a regular dividend. And once a year, extra cash flow is paid out in a special dividend. The result has been explosive returns for shareholders. In fact, in the last five years, $16.55 per share was paid out to shareholders.

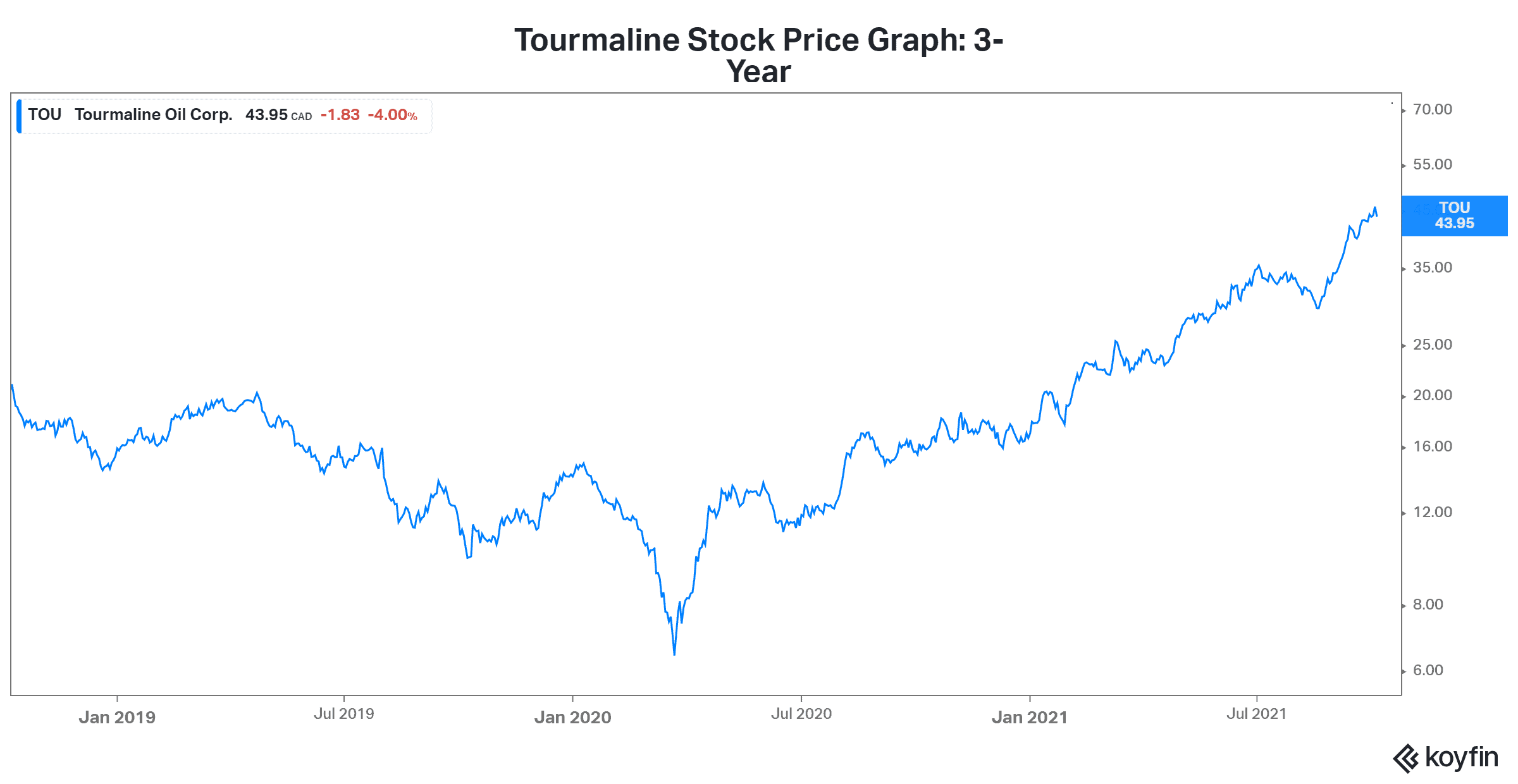

TFSA stock: Explosive dividend growth expected from this TSX stock

Natural gas stocks are the last ones that most Motley Fool investors would think of when they think of the best stocks to buy for dividend growth. However, this is actually the case today. I don’t know how long it will last, but we are in the midst of a bullish oil and gas cycle. And there’s a lot of money to be made.

Tourmaline Oil (TSX:TOU) is a mid-tier Canadian natural gas producer. It’s a high-quality company that’s heavily weighted toward natural gas production (almost 90%). This is good news in today’s environment. I mean, natural gas prices are soaring – up 23% in the last month alone. With this, comes soaring cash flows for natural gas producers like Tourmaline.

Ultimately, these soaring cash flows are translating into rapidly increasing shareholder returns. Tourmaline’s dividend growth in the last year is nothing short of spectacular. Its regular annual dividend has grown over 40% to $0.68 per share. And the company announced a special dividend of $0.75 per share just last month. Looking ahead, management intends to continue to pay out excess cash flow in the form of dividends. This is why Tourmaline stock is one of the best stocks to buy for your TFSA.

Motley Fool: The bottom line

TFSA investors today have a lot of options to get the most out of this tax-free vehicle. After all, you have $75,500 to work with. You also have some of the best stocks trading on the TSX. They offer huge dividend growth opportunities. They also offer big capital gains potential. Use your TFSA to make all of this 100% tax-free!