Air Canada (TSX:AC) stock continues to be one of the most popular and highly searched stocks among Canadian investors. The stock, which has seen its operations impacted severely for over a year and a half, continues to trade down more than 50% below its pre-pandemic price.

Despite this underperformance by Air Canada, it continues to be highly popular as savvy investors wait for a recovery.

The last major rally the stock saw, though, was after vaccines were announced. And even that rally was relatively muted, as investors understood the reality that it could be years before Air Canada sees its capacity return to 100%.

Even through the summer, as Canada’s vaccination rate skyrocketed and the country got the pandemic under control, there was no sign of recovery even beginning to materialize.

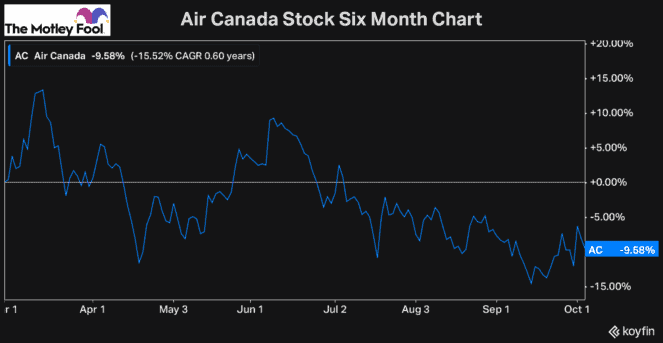

And if you look at a chart from the last six months, you can see that Air Canada has been flat at best and has even continued to lose more value for investors.

So here’s why Air Canada stock continues to trade flat and even lose investors money, and when you can expect the stock to finally recover.

Air Canada stock: An unusual situation

When most investors buy a value stock, the idea is to buy the company and hold it until it rallies back to its fair value. This is a strategy that’s been employed by millions, including most famously by Warren Buffett.

The problem is, you can’t buy any struggling stock that looks undervalued and buy it to hold. The business still needs to be of high quality, and it still needs to be earning a profit.

If you hold a business that you believe is undervalued, but it’s still earning attractive income, there’s no rush to sell it. However, if you own a stock like Air Canada, which continues to lose tonnes of value each quarter, the longer you hold it, the lower its fair value will ultimately be.

This is why an investment in Air Canada stock is so risky and has been throughout the pandemic. If you buy too early, the company will just continue to bleed value.

This is evident both by looking at Air Canada’s financials but also by the slight downtrend in its stock over the last six months.

At the same time, though, if you wait too long to buy Air Canada stock, you’ll miss out on the rally. So how can you know when the perfect time to pull the trigger is?

When to take a position

The first and most important thing is to figure out how much the company is worth today. Look at how much value it’s lost, all the debt it’s taken on, and the new shares it’s issued, and come up with a per-share figure on what you believe the stock is worth today.

In addition, you’ll want to have an idea of how much value it’s losing each quarter, which the company should offer guidance on during earnings calls.

Once you have a good idea of the stock’s value, you can decide what discount you want to buy at.

For example, if it’s only trading 10% below what you deem to be its fair value, it’s likely not worth an investment, especially for the risk you still have to take on. The stock could lose another 10% in a matter of quarters or even just a few months.

Once you decide how cheap you want to own it for, it’s time to prepare for a buy. However, I still wouldn’t pull the trigger until there is a meaningful reason why its operations will recover.

So, for the time being, I would keep up to date with the industry and Air Canada’s progression as they each recover. And each quarter, it’s crucial to figure out its new fair value.

That way, when the time finally comes, you have a good idea of what the stock’s worth. And if it still offers attractive value, you can buy for the long-term knowing you bought this high-quality Canadian stock well undervalued.