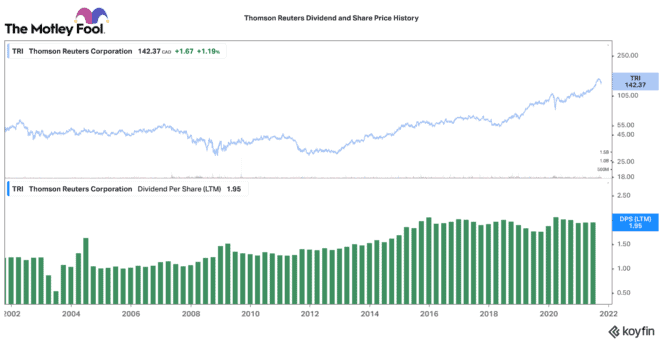

Technology stocks with growing dividends are not a combination you find often on the TSX. Yet, one TSX 60 tech stock stands out above the rest. It is Thomson Reuters (TSX:TRI)(NYSE:TRI). In fact, it is the only technology stock in Canada to have paid and raised its annual dividend for the past 28 consecutive years. Since 2012, it has returned $27 billion of capital back to its shareholders. Today, this TSX stock pays a dividend that equals to $2.06 per share annually. That is equivalent to a 1.5% dividend yield.

Is this TSX tech/dividend stock a good company?

Certainly, that is an impressive metric, but does that make this company a good TSX stock going forward? Generally, a company that consistently raises its dividend over many, many years is a good sign. It means the company produces more capital than it needs to both sustain and grow its business. Clearly, management is capable of prudently managing its balance sheet, and it capably produces more free cash flow than it needs.

To understand Thomson Reuters better, let us first ask what it does. Through the years, this TSX stock has built a leading content platform for the legal, tax, corporate, and news/media industry. You are probably familiar with its Reuters newswire service. However, that only makes up a very small piece of its business. Today, 79% of its revenues come from legal, corporate services, and accounting/tax business segments.

Dominant market position

Across these segments, it has the number one market position amongst competitors. Consequently, this TSX stock has the scale and authority to really dominate these niches. Generally, revenues are very sticky. It retains over 88% of its customers annually. Across all its business segments, 80% of revenues are recurring and 90% of revenues are delivered electronically or through Software as a Service.

Overall, its leading position gives it a competitive moat and an advantage to grow. It owns a vast array of data, information, and content that it is formulating into new organic software growth verticals. In fact, over the next two years, it is targeting annual organic growth of 4-5% and 5-6% in 2023. Not only that, but adjusted EBITDA margins in that time frame are expected to climb from 31% today to 38-40% in 2023.

Steady growth and rising profitability

While I like to see a company grow, it is even better to see them become more profitable at the same time. This year, Thomson Reuters expects to earn at least $1.1 billion in free cash flow. If it can execute its plan, management believes the business could churn out close to $2 billion (or almost twice as much) cash flow in 2023. To me, that just spells more shareholder-friendly actions like share buybacks and dividend increases.

One thing to keep in mind is that this TSX stock does have a fair amount of debt. It has $3.7 billion of debt outstanding. Fortunately, it is also sitting on a cash balance of $2.3 billion. That means net debt-to-adjusted EBITDA only sits at 0.8 times. Given its stable recurring revenue and strong free cash flow profile, management appears pretty confident in its capital position. Prudent debt could be a further tool to help accelerate growth beyond.

This TSX tech stock should grow its dividend for years to come

Sure, this TSX stock is not growing rapidly like other technology stocks. However, its industry dominance, strong profitability, organic growth, and consistent dividend growth make it pretty attractive. This stock is not exactly cheap here, and the market appears pretty optimistic about its outlook. However, for a long-term buy-and-hold investor, buy Thomson Reuters stock and let the dividend growth keep coming for another 20 years.