Facedrive (TSXV:FD) stock, a technology company that’s building a sustainable and equitable ride-sharing platform and one of the most popular growth stocks among investors in 2021, had another rough couple of days of trading last week.

This came after multiple weeks of high volatility that followed a massive months-long selloff, where Facedrive stock lost over 95% of its value. And while the volatility wasn’t as prominent as it has been in the past, the stock still saw its share of choppy trading last week.

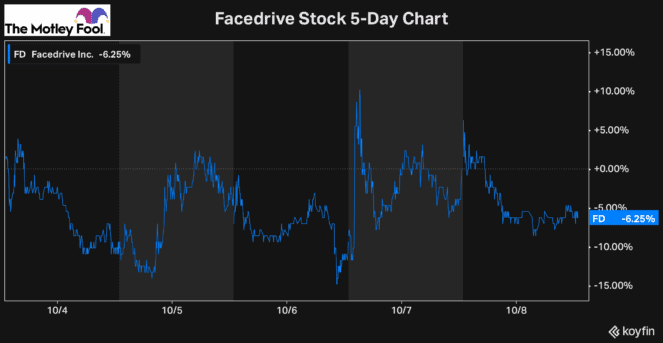

As you can see, Facedrive stock fell as low as 15% on Tuesday and Wednesday and reached a more than 10% gain for the week on Thursday. However, ultimately, the stock finished the week down another 6%. And today, it has a market cap of just over $110 million.

Facedrive is a particularly speculative and therefore volatile stock. However, while there was still quite a bit of volatility last week, relatively speaking, it was a quiet week for Facedrive.

One of the reasons Facedrive stock wasn’t as volatile is that there was much less volume this week. Because Facedrive is a highly speculative stock, as volumes increase, so do the massive price swings in Facedrive stock.

Last week, there was a little over nine million shares of volume. That was roughly in line with the same as the week before. However, two weeks ago, almost 15 million shares were traded, and the week before that, which is the week Facedrive saw a tonne of volatility, the stock saw over 13 million shares exchange hands just on the Thursday and Friday alone.

This shows just how much volatility can move the stock. And because Facedrive is already a company with a low market cap, major volume increases can significantly move the price. So, it’s crucial that if you’re going to invest in Facedrive stock, you pick your entry point wisely and plan to hold for the long term. But is the stock even worth a long-term investment today?

Is Facedrive stock worth a buy?

While Facedrive started out to build an equitable and sustainable ride-sharing platform, the timing was unfortunate. The pandemic has undoubtedly changed the way we live, and for now, one of the services that is seeing a lot less demand is ride sharing.

Plus, Facedrive stock was already facing heavy competition from the two giants in the space: Uber and Lyft. So, the company has tried to shift its focus and grow other segments of its business. In addition to adding food delivery services, Facedrive also offers health technology services and it’s built its own e-commerce platform.

For now, though, sales remain muted. Over the last 12 months, Facedrive’s total revenue is just $13 million. So, even at a valuation of $110 million, the stock still looks slightly overvalued. Therefore, an investment today would still be quite speculative.

There is a tonne of uncertainty with Facedrive stock’s future at the moment. And in addition, it and many other tech stocks face increasing headwinds as bond yields have been rising in recent weeks.

So, for now, I would hold off on an investment in Facedrive and watch the stock for some developments over the coming months. However, if you are inclined to take a position, I’d make sure to invest money that you’re comfortable with losing. In addition, it’s crucial to invest for the long run to avoid short-term speculation and volatility.