We begin another week with energy stocks taking front and centre spot. The emerging energy crisis is real. It’s been caused by falling supply due to underinvestment. It’s been exacerbated by rapidly rising demand. In short, this has shifted the conversation about the oil and gas sector. This is why my list of the best stocks to buy right now consists exclusively of energy stocks. But not just any energy stocks. I’m talking top energy stocks that rank highly on financial matters as well as on operational matters. This means Cenovus Energy stock, Peyto stock, and Tourmaline stock.

Widely held beliefs of recent years are being challenged. In short, oil and gas are more crucial to our daily lives than the market recognizes. And perhaps the future can and will include these energy sources for years to come.

Let’s uncover the three best stocks to buy right now.

Cenovus Energy stock: The right balance

As an integrated oil and gas company, Cenovus Energy (TSX:CVE)(NYSE:CVE) is looking good. Cenovus Energy is the third-largest Canadian oil and gas producer and the second-largest Canadian-based refiner and upgrader. This company has a history of operational excellence. It also has a history of strong and relatively stable cash flows.

So what specifically makes it an attractive energy stock? Well, two things. The first is that Cenovus Energy has the kind of diversification that shelters it from the bad times. The company’s refining assets might do well while its production assets struggle – and vice versa. Also, Cenovus has oil sands assets as well as natural gas assets, and everything in between. This commodity diversification adds another buffer.

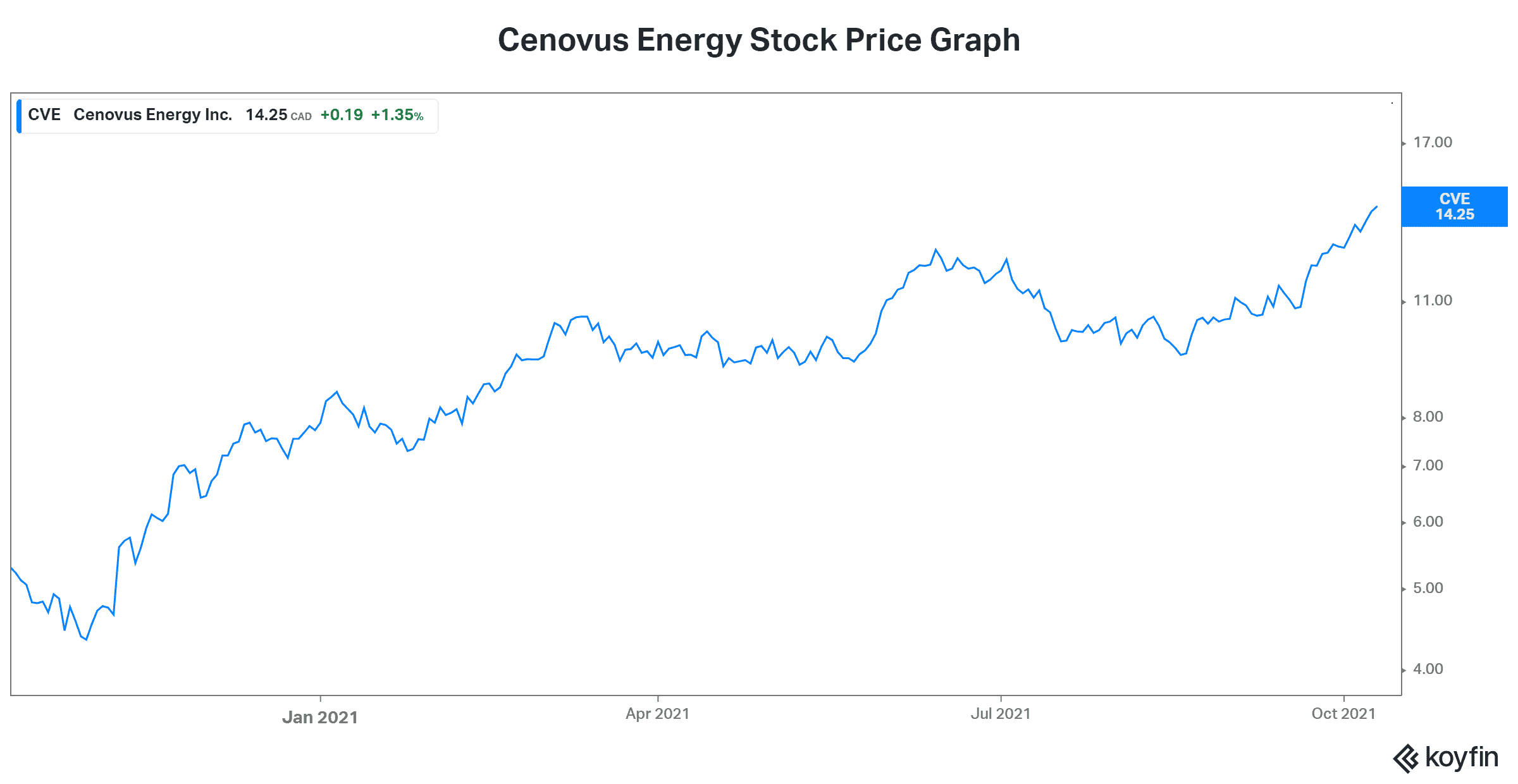

Second, Cenovus Energy stock has been benefiting from rapidly rising oil and gas prices. The stock has performed exceptionally well in 2021, as we can see in the graph below.

But the good times have just begun. The company will be reporting Q3 results in November. In my view, this report will be positive for the stock. I mean, oil prices rose 13% in the third quarter. And natural gas prices rose almost 100%. This will translate into soaring cash flows for Cenovus.

Peyto stock: A natural gas leader and the best stock to buy right now

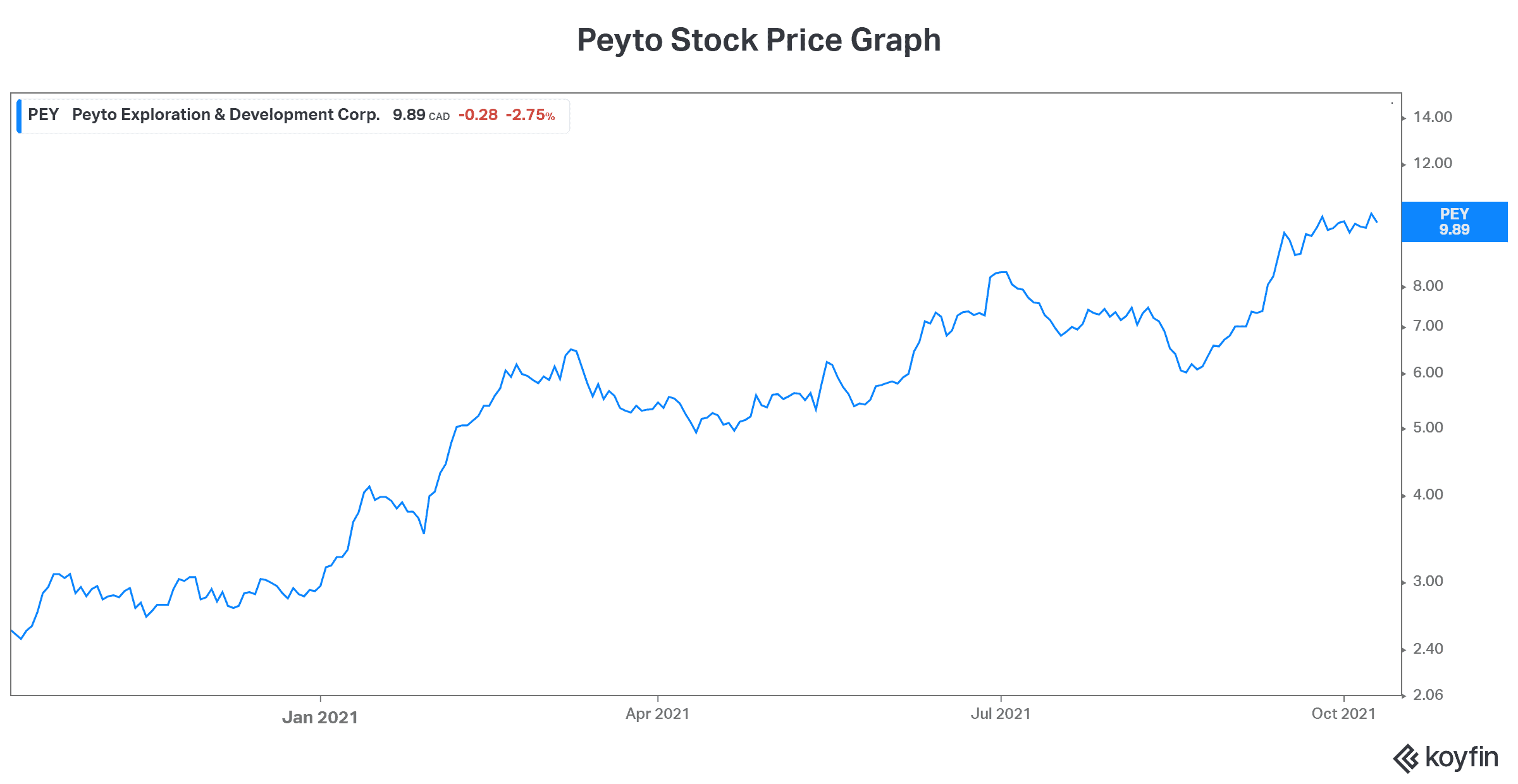

As I’ve just mentioned, natural gas prices soared almost 100% in the third quarter alone. While some of this rise is certainly reflected in stock prices, I believe there’s more to come. When investors see how this rise in commodity prices translates to cash flow growth, there will be another leg up. And this is what makes Peyto Exploration and Development (TSX:PEY) one of the best stocks to buy right now.

Peyto is one of Canada’s lowest-cost natural gas producers. It operates in a very prolific resource basin that’s characterized by predictable production, low-risk exploration, and long reserve life. And it’s heavily weighted toward natural gas production, which is a great thing these days. Peyto’s stock price and its financial results are partly reflecting this reality.

Tourmaline stock: The best stock to buy right now as it returns cash to shareholders

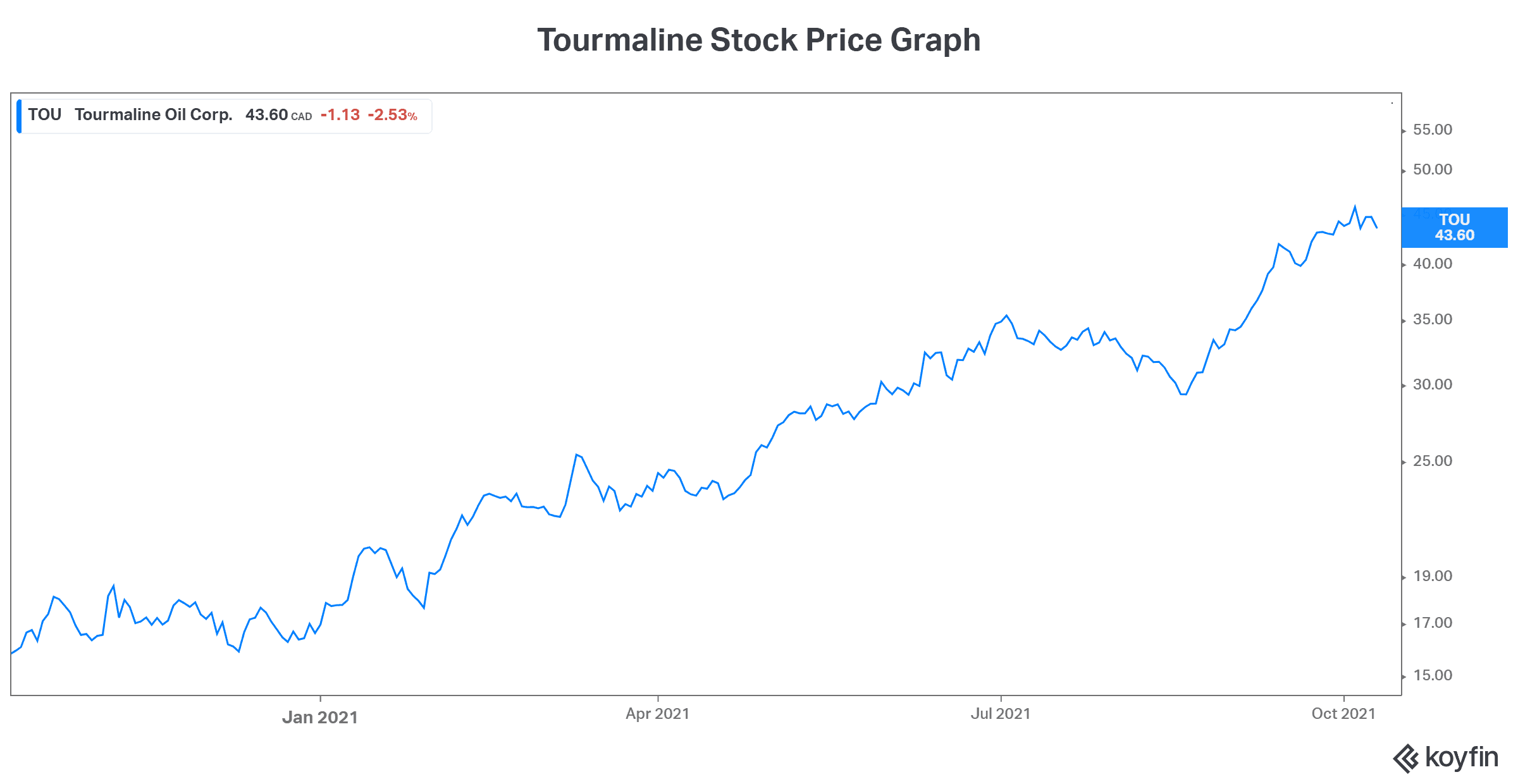

Tourmaline Oil (TSX:TOU) is another oil and gas stock that’s heavily weighted towards natural gas. It’s a top-quality mid-tier Canadian natural gas producer whose cash flows are also soaring along with natural gas prices. And this is rapidly translating into rising shareholder value creation.

In fact, Tourmaline’s dividend growth in the last year has been nothing short of spectacular. Its regular annual dividend has grown over 40% to $0.68 per share. And the company announced a special dividend of $0.75 per share just last month. Looking ahead, management intends to continue to pay out excess cash flow in the form of dividends. This is why Tourmaline stock is one of the best stocks to buy right now.

The bottom line

Energy stocks have certainly been in the doghouse for quite some time. But in 2021, this is coming to an end. Today, oil and gas stocks represent some of the top-performing stocks. Their businesses are booming. Just take a look at Cenovus Energy stock, Peyto stock, and Tourmaline stock. They’re three of the best stocks to buy right now.