The Suncor Energy (TSX:SU)(NYSE:SU) stock price is riding a strong wave higher. I mean, October has been a really good month for energy stocks. Actually, the whole of 2021 has been a series of good months for energy stocks. What has happened has been unexpected to many. It’s been a shift in the very supply/demand dynamics at play. This, of course, has changed everything. Oil and gas prices have been soaring. And it looks like investors may be reconsidering energy stocks.

With this in mind, I’m buying Suncor stock in October. This, along with my other energy stock holdings, will position me to participate in this wave higher. So let’s talk Suncor stock as well as two other energy stocks to buy in October. The oil and gas industry is thriving once again. Don’t miss out on this massive upward wave.

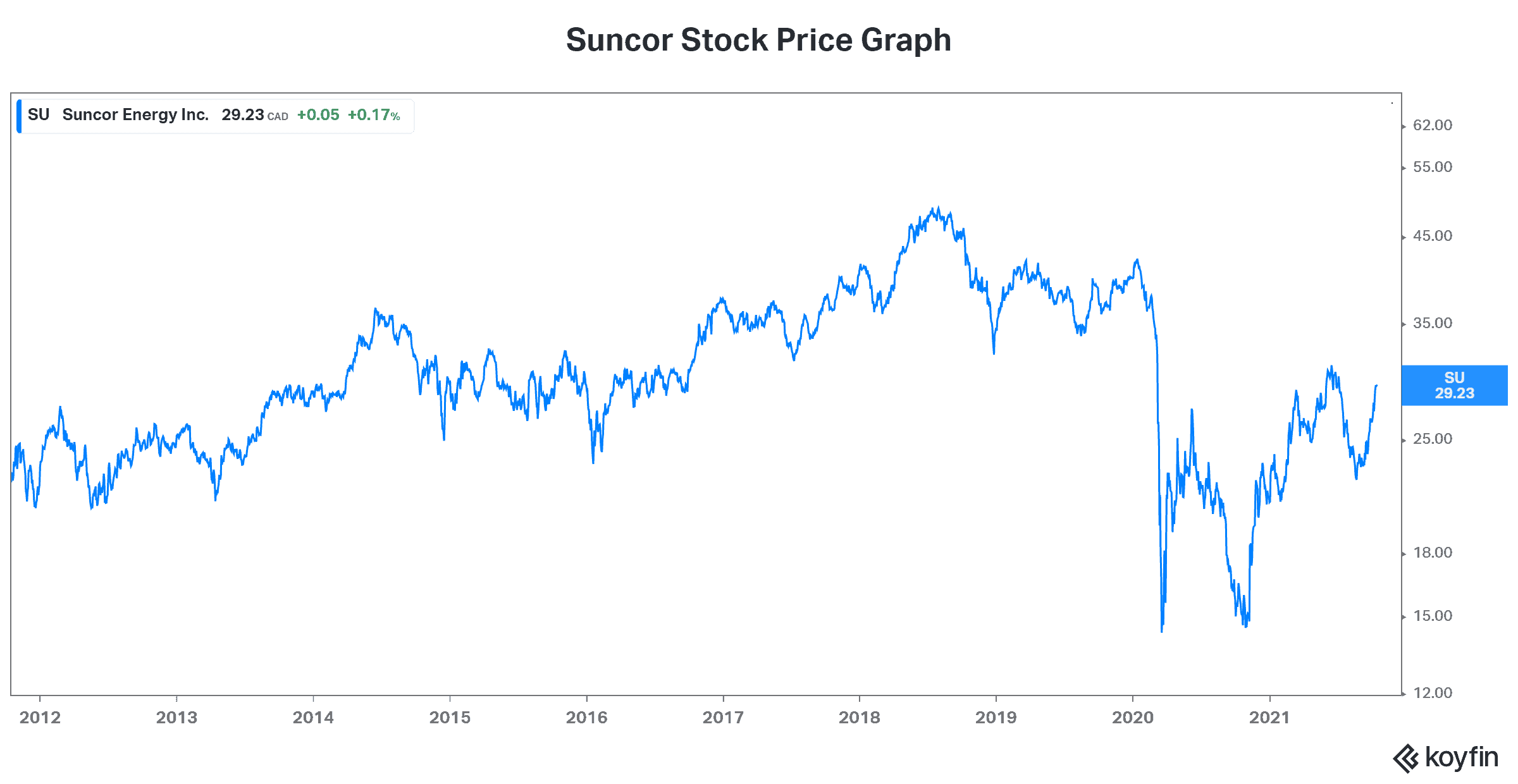

Suncor stock: A leading integrated energy stock with a strong dividend

Suncor is Canada’s leading integrated oil and gas company. But what can we say about Suncor stock? Well, we can surely say that this is a stock that has stood the test of time. Through good times and the bad, Suncor stock was resilient. In fact, Suncor’s stock price over the last decade illustrates this. This graph doesn’t show “blow the lights out” returns, but it does show resiliency. I mean, this period included really dark times for the oil and gas industry. But Suncor made it – a testament to its business.

In 2021, we have a bunch of catalysts that will finally take Suncor stock significantly higher again. For example, supply issues are taking centre stage, pushing oil and gas prices higher. Years of underinvestment in oil and gas have naturally led to higher prices. Also, on the demand side, we’re seeing a nice post-pandemic recovery.

2021 was the beginning of a new up-cycle in oil and gas. In this new environment, top energy stocks like Suncor stock can give us reasonable exposure. That’s how I’m thinking of this. Suncor is an undervalued gem that’s churning out cash flow and securing its long-term future and viability. It’s a must-own to play the upside in the energy sector today.

Keep reading if you’d like more energy stock ideas. I have a couple more companies with more upside than Suncor.

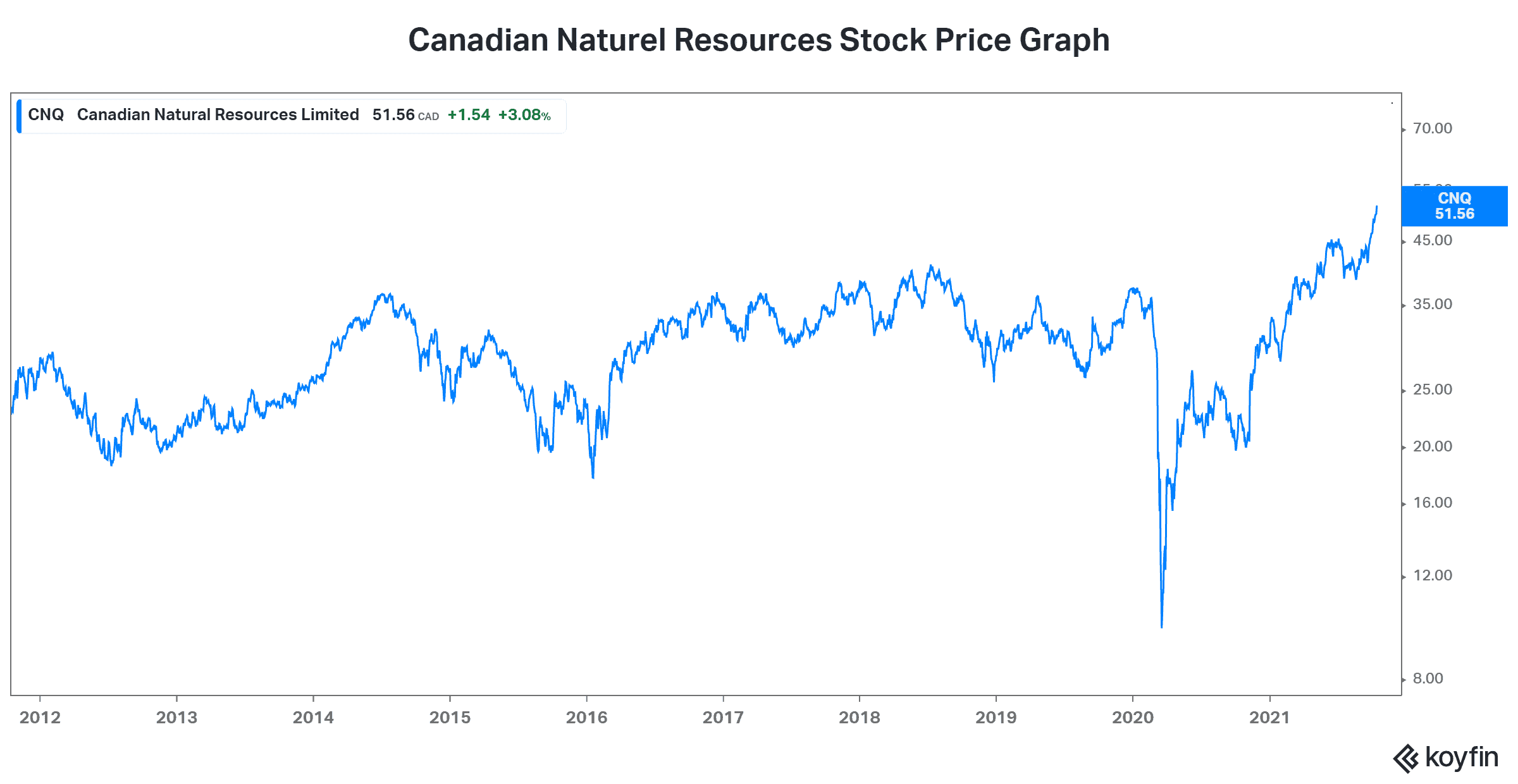

Canadian Natural Resources stock: CNQ is also a leading oil sands producer

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is another top Canadian energy stock. This company is engaged in the production, exploration, and development of oil and natural gas. It has a long history of superior operational performance. And it’s an energy giant, with a market cap of $59 billion and a 3.7% dividend yield.

This stock is another great addition to your portfolio for oil and gas exposure. In fact, the stock has soared 63% in 2021. And with oil and gas prices continuing their upward climb, the good times are just beginning. Quarterly results will show strong cash flow increases. This will translate to increased shareholder returns. In short, demand for energy stocks will rise further.

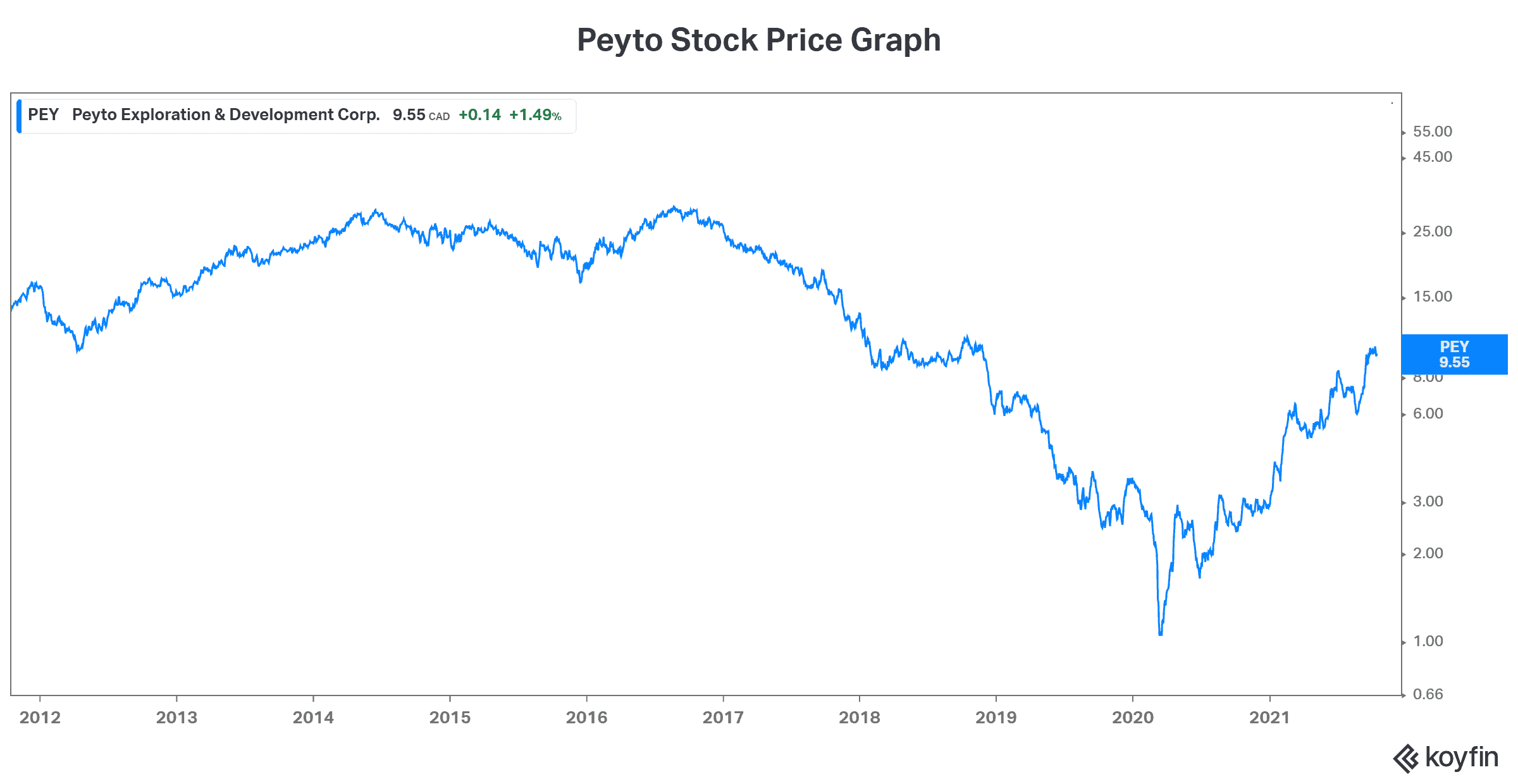

Peyto stock: A top natural gas producer up almost 200% in 2021

Peyto Exploration and Development(TSX:PEY) is one of Canada’s lowest-cost natural gas producers. The company has an exceptional asset base that’s benefitting from soaring natural gas prices. Natural gas is a relatively low-carbon, low-emitting fuel. It’s the easiest replacement for high-carbon fuels such as coal. It will certainly be a key transition fuel as we fight to reduce our carbon footprint and will continue to power our lives for the foreseeable future.

The bottom line

Energy stocks like Suncor stock are on a tear. Motley Fool investors can join this rally by buying top-quality energy stocks mentioned in this article.