Well, this is it. The big reopening is finally happening. After almost two years of the pandemic, the stock market is trading at all-time highs. It almost seems like there was no economic crisis. Many companies have taken off during the pandemic. And others have steadily shaken it off. But, of course, this depends on where you look. There are some stocks that have been hit hard as the pandemic struck. Some are now attractive reopening stocks to buy.

So, how should we position ourselves? Which stocks should we buy? The answer is to look for those stocks that were hit hard during the pandemic. In short, look for the stocks that have not recovered and that are trading well below their pre-pandemic highs. Please read on, as I take you through three reopening stocks to buy in October.

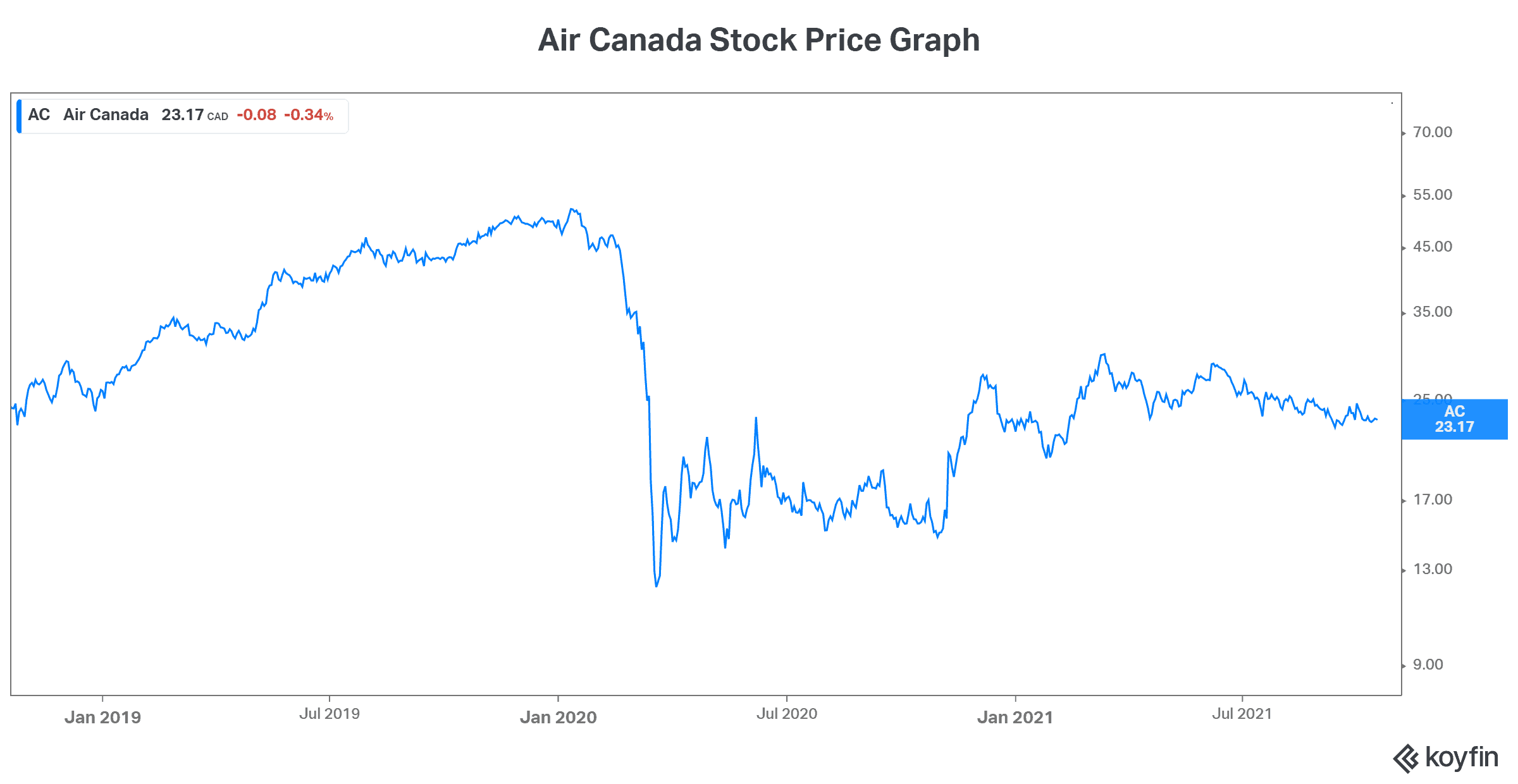

Air Canada stock is a reopening stock that’s ready to take off

Many things are happening that signal an end to the pandemic. For example, vaccinations are making their way through populations. Also, pharmaceutical giant Merck has found an antiviral pill that treats COVID-19. In fact, it cuts the risk of death in half in unvaccinated people. This is truly a game changer.

So, with this new backdrop, it becomes clear that air travel will likely be returning — if not to pre-pandemic levels, at least to levels significantly higher than now. Because as we accumulate more tools to combat the virus, it will fade into the background. The focus on other things will return.

Air Canada (TSX:AC) stock has pretty much done nothing this year. Investors are still nervous. I mean, a comeback will not be easy. Air Canada management itself has said that a recovery from the pandemic hit would take years. In addition to this, the new world that Air Canada will return to will be a different one. A bigger cargo business will impact the bottom line. Also, business travel might not return to what it once was. And ambitious ESG targets will be a big focus.

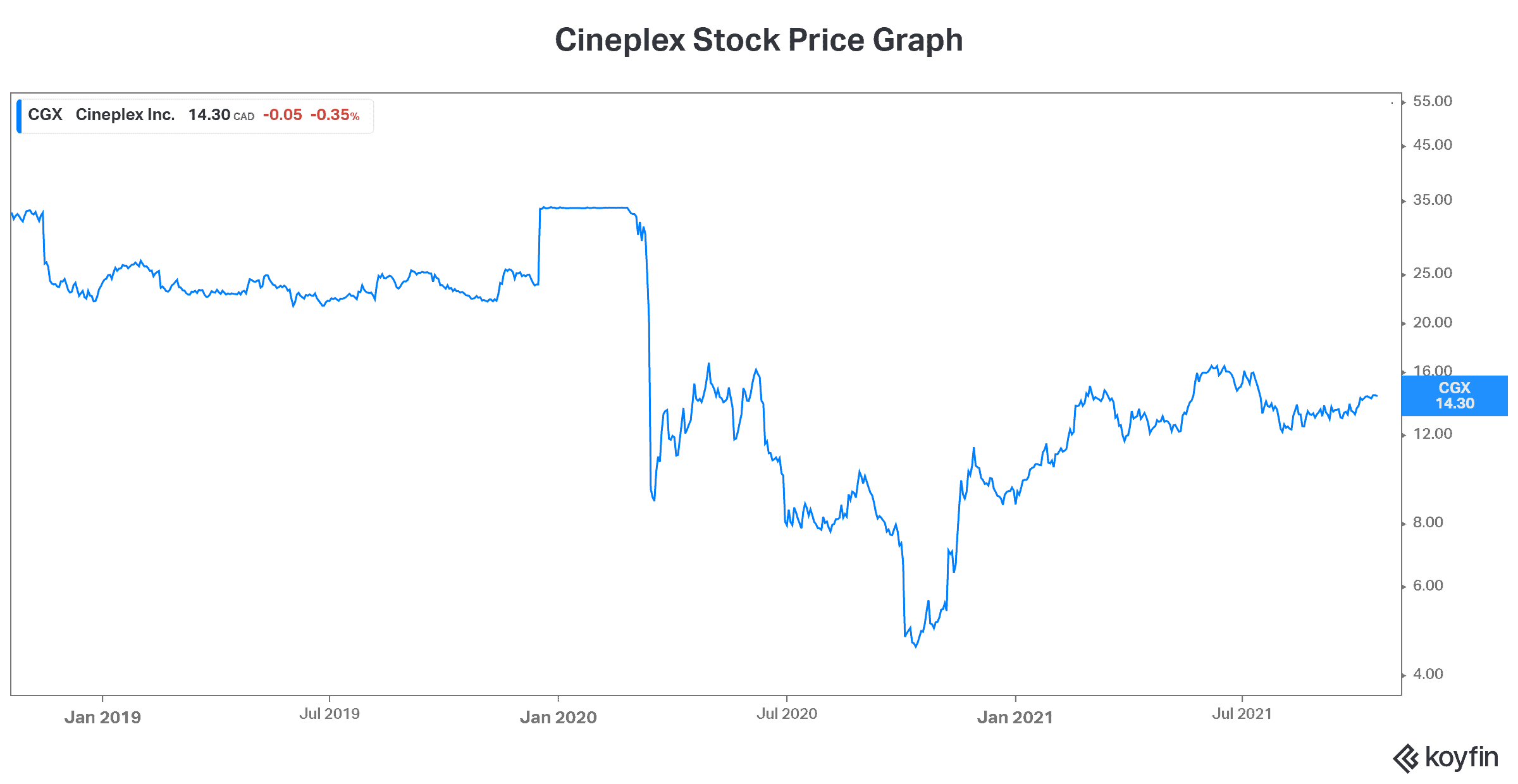

Cineplex stock rallies as reopening plan lifts attendance limits

The reopening plan has been the most impactful on theatres, restaurants, and other public gatherings. As capacity limits are lifted, this falls right down to the bottom line for companies. And as people are vaccinated, that also falls right to the bottom line. In short, no more capacity restrictions plus less fear of COVID-19 equal big dollars for Cineplex (TSX:CGX).

In fact, Cineplex’s latest results and conference call speak volumes. Movie watchers are returning in droves. The first fully open weekend in July was the busiest since March 2020. As of this summer, Cineplex was running at over 50% versus 2019 attendance. In the second quarter of 2021, Cineplex continued to reopen its theatres and entertainment venues. As of July 13, all venues were open from coast to coast. The strong attendance already seen will be built upon as more people are vaccinated. This will provide increasing comfort for a return to theatres and gaming venues. As we approach the end of the year, Cineplex management expects attendance to rise to 80% of 2019 levels.

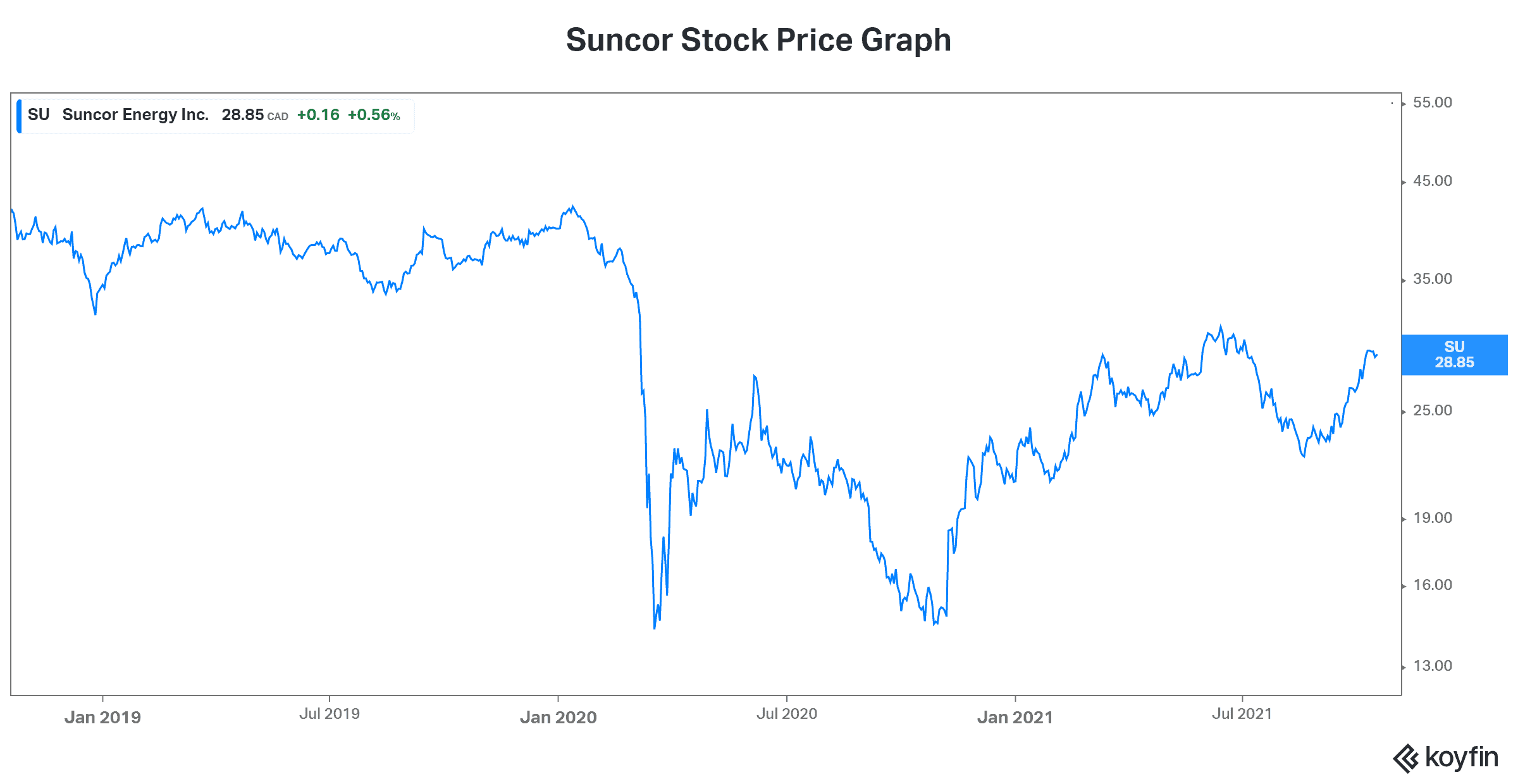

Suncor stock rallies as oil and gas demand return

Suncor Energy (TSX:SU)(NYSE:SU) is a diversified and integrated energy giant. Suncor stock has been soaring in 2021, as oil and gas demand has risen sharply. In turn, this rise in demand has put pressure on a supply that’s suffered from underinvestment. The result is soaring oil and gas prices.

As a reopening stock, Suncor is a clear winner. This oil and gas giant will continue to benefit from demand increases as the world opens up. It will also continue to benefit from its extremely well-managed business that pumps out strong cash flows.

Motley Fool: The bottom line

The country is finally reopening. Reopening stocks like Air Canada, Cineplex, and Suncor stock will benefit greatly from this. They’re all undervalued and primed for a pick-up in demand.