The S&P/TSX Composite Index just breached 21,000 points, and TSX stocks are on fire! While that is great for Canadians that are already invested, it can be a bit of challenge for those looking to deploy new capital. That is even more true for those looking for passive dividend income.

With valuations rising, it is harder to find TSX stocks with attractive dividend yields. However, there are a few bargains out there. You will have to be patient and keep a long-term investment mindset. Here are three top stocks from different sectors that could supply growing streams of income and modest capital upside.

A top TSX income stock with a high yield

With oil prices charging higher, a risk-averse way to play this commodity cycle is by owning Pembina Pipeline (TSX:PPL)(NYSE:PBA). For weeks, this TSX stock traded in a range between $38 and $40 per share. However, last week, it leapt up to $42.50 — a new 52-week high.

Pembina makes it bread and butter by providing infrastructure, pipelines, and processing facilities for natural gas and oil producers. While it has limited direct commodity exposure, it does make higher margins from more oil/gas volumes transported, processed, or upgraded through its assets.

Today, this TSX stock pays a generous 6% dividend yield that is well covered by contracted cash flows. Given the strength across almost all parts of its business, investors can probably expect dividend increases next year and some decent capital upside as well.

A passive-income stock with decent growth ahead

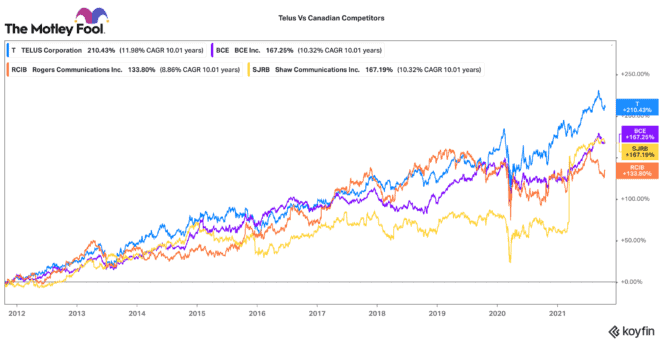

With a market cap of $37 billion, TELUS (TSX:T)(NYSE:TU) is one of Canada’s largest providers of cellular and broadband services. Over the past month, this TSX stock is down nearly 4% to around $27.50 per share. However, today, it is trading with a very attractive dividend yield of 4.5%.

TELUS has a great history of growing its dividend. Over the past 10 years, it has raised its dividend every year on average by 8.8%. Considering the company has elevated its infrastructure spend this year, investors could enjoy elevated cash flow growth in following years.

Of its peers, TELUS has consistently outperformed, both by customer growth and by total investment return. As a result, it is my top pick for a great combination of defence, income, and even growth.

A top TSX defensive stock

When it comes to defensive stocks on the TSX, it is hard to find better than Fortis (TSX:FTS)(NYSE:FTS). Not many companies can claim that they have raised their dividend for 47 consecutive years. Fortis can. Trading for $55.50 per share, this stock is paying a well-covered 3.8% dividend yield.

The company operates regulated power and natural gas transmission utilities across North America. These are essential services society relies on. Demand is generally quite consistent and predictable. Over the next five years, Fortis is investing heavily to expand its infrastructure portfolio. With decarbonization and electrification trends unfolding, it should have no shortage of organic development opportunities.

Going forward, it is hoping to expand its rate base by 6% annually. That should translate into cash flow and dividend per share growth at a similar annual rate. While this TSX stock isn’t perhaps the most exciting, it is prudently managed and will likely provide predictable, growing streams of passive income for many years ahead.