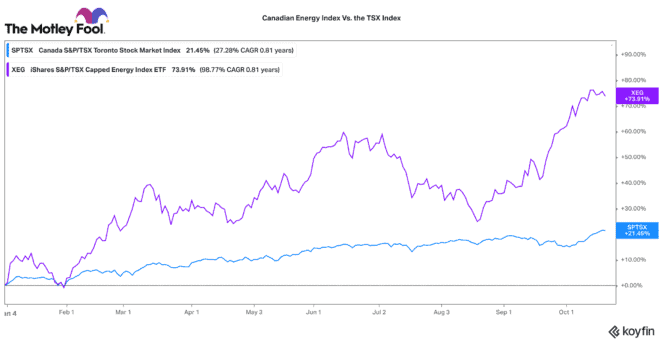

Talk about a great year for Canadian energy stocks! The S&P/TSX Capped Energy Index is up 71% year to date! Just imagine, only last year some of Canada’s best-known energy companies were essentially left for dead. Now with oil trading over US$80 per barrel, the market for energy stocks has been swiftly recovering.

Fortunately, it is still not too late. Many of Canada’s top energy companies are still reasonably cheap. With improved operations and right-sided balance sheets, many of these Canadian energy stocks are gushing excess free cash flow, which can all be directed to shareholders through dividends and share buybacks. Today, here are four of my favourite energy stocks that pay attractive dividends.

Canadian Natural Resources stock

Amongst the largest energy producers in North America, Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) was one of the only producers not to reduce its dividend in 2020. In fact, it was one of the only super players to actually raise its dividend in 2020. This Canadian stock only pays a 3.6% dividend. Yet, over the past 10 years, it has raised that dividend by a compound annual growth rate of 17%!

CNQ has some of the highest quality oil and gas production assets in North America. It has long-life reserves (+30 years) and factory-like production efficiency (its cash flow break-even is around US$30). With today’s oil prices, it has tons of optionality (and cash) on how to reward shareholders and I think there is still room for this stock to drive up.

Enbridge: A top Canadian pipeline stock

I would be remiss to talk about dividends and energy stocks and not mention Enbridge (TSX:ENB)(NYSE:ENB). Despite rising 30% this year, this Canadian stock still pays a 6.3% dividend yield. That is one of the highest dividends you can find on the TSX today.

With a market cap of $107 billion, Enbridge has a massive portfolio of pipeline, storage, and export assets across North America. It transports around 25% of North America’s crude oil. 98% of its assets are contracted or regulated. Its income streams are pretty reliable as a result.

Recently, it has added some export operations, as well as renewable power projects to its portfolio. As a result, this Canadian stock is a great way to play the transition between traditional and renewable energy over time.

Tourmaline Oil: A top natural gas play

Tourmaline Oil (TSX:TOU) does not pay a high dividend yield like the above stocks. After climbing 150% this year, it only pays a 1.6% dividend. However, it might be one of the best Canadian energy stocks for dividend growth right now.

Since November last year, Tourmaline has raised its dividend three times. In that time, it increased its quarterly payout by 42%. In addition, Tourmaline just distributed a special $0.75 per share dividend to shareholders.

Tourmaline has a low-debt balance sheet, a great management team, and very low-cost, productive natural gas assets. Gas prices have been soaring in 2021 and this Canadian stock could do very well if we have a cold winter in North America.

Topaz Energy: A top royalty stock

Another way to capture a higher yield from assets related to Tourmaline is to buy Topaz Energy (TSX:TPZ). It owns a stake in some of Tourmaline’s natural gas processing plants. It also captures a royalty stream from land that Tourmaline and other natural gas operators drill and produce on.

The company has a very efficient operating structure, so a majority of cash flows flow straight to shareholders. With a price of $17.80, it pays a 4.6% dividend. Already in 2021, it raised its quarterly dividend by 5%. In the fourth quarter, it will raise that again by 14%. As a means of playing on strong natural gas demand, Topaz is a great Canadian passive-income stock to own today.