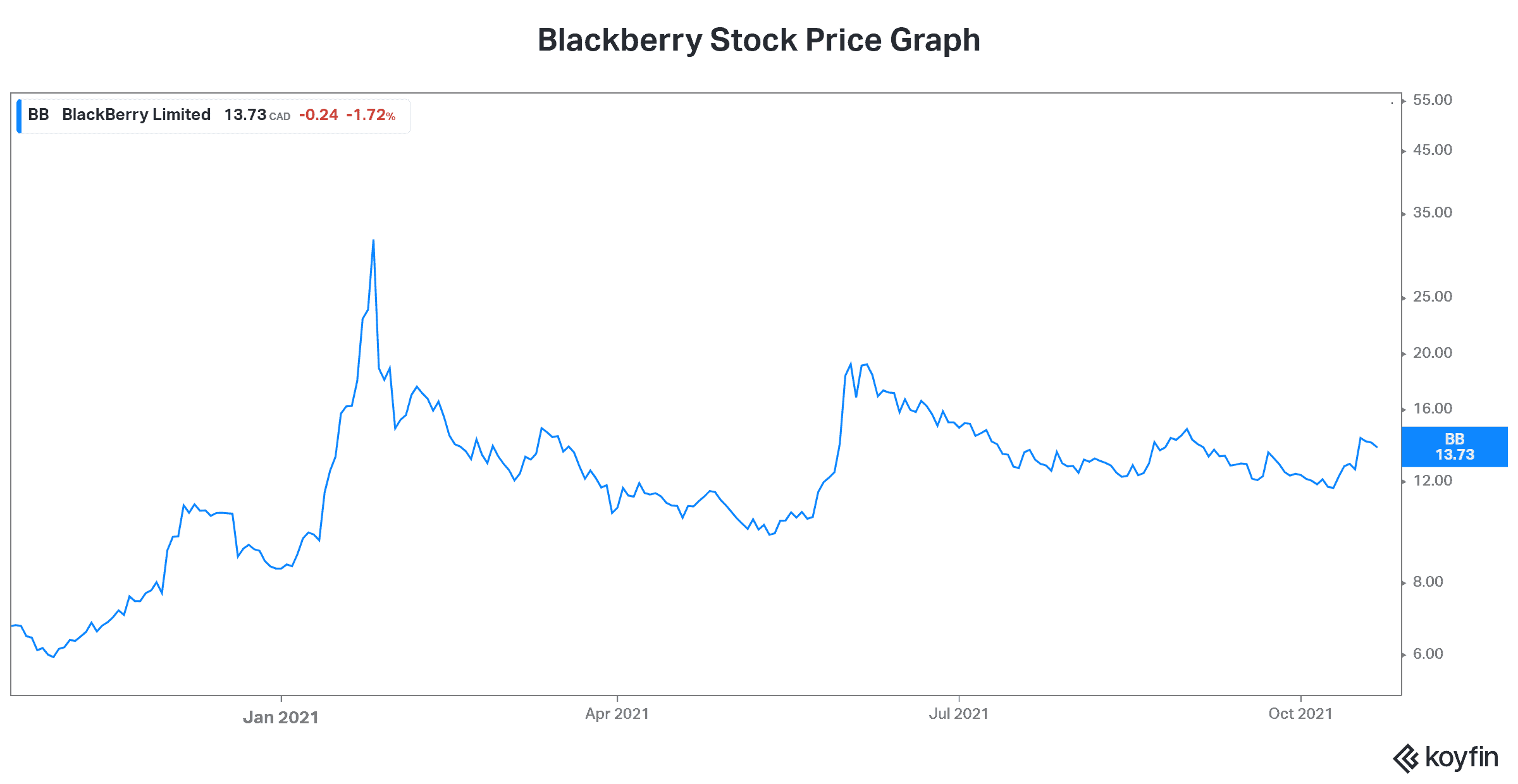

Much has been written about BlackBerry (TSX:BB)(NYSE:BB) over the last year. From doomsday scenarios to awestruck reverence, the analysis of this former powerhouse is exhausting. It leaves many investors at a loss for what to do and what to think. In this Motley Fool article, I look at BlackBerry’ stock price and why it’s up 13% in October. I also focus on the real variables that are key to analyzing a stock.

BlackBerry stock: A huge market with explosive growth

In the last week, BlackBerry’s stock price likely rallied as part of the whole Reddit trade. I mean, volumes have been higher than normal. And BlackBerry’s stock price was bid up despite a lack of “real” news. So if BlackBerry once again got caught up in the manipulation of Reddit traders, how do real investors like our Motley Fool readers assess the situation?

I’m here to try. So let’s look at the facts. First, let’s take a look at the market size and growth of BlackBerry’s businesses: the cybersecurity business and the machine-to-machine connectivity business. Demand growth for cybersecurity will grow at a healthy clip as remote working increases. It’ll also grow nicely as security risks increase. Research suggests that the global cybersecurity market is expected to grow from $149 billion in 2019 to $350 billion in 2026.

Next, we have the machine-to-machine connectivity business. This is yet another business with staying power and rapid growth. Within this segment, we have connected cars, which is the most well-known market for machine connectivity. For this segment alone, the global market size is widely expected to increase threefold in the next five years. In 2020, the market was valued at more than $60 billion. By 2025, it’s expected to be more than $180+ billion.

Competitive advantages of BlackBerry

While these industries certainty have plenty of competition, BlackBerry is positioned well. For example, the company has contracts with some of the top Fortune 500 companies as well as top government branches.

Also, BlackBerry’s technology has won numerous industry rewards. It’s in fact recognized for its excellence. Lastly, BlacBerry’s IVY platform, which is a partnership with Amazon Web Services, will standardize connected cars and cause the industry to explode higher. This standardized platform for smart cars will unleash the power of data. Because with this, data from all kinds of devices will be harnessed. In turn, an ecosystem of applications will be born. Similar to the mobile industry, an explosion of apps and services is coming.

The financials

BlackBerry’s financials are the real stumbling block. This is where investors can become discouraged, understandably so. Revenue has been stagnant at best and declining at worse. Losses keep piling up, and there seems to be no end in sight. On the bright side, however, BlackBerry has a solid balance sheet with $700 million in cash and liquid investments and reasonable debt.

But looking ahead, there’s reason to believe that all of this will change — and soon. QNX, BlackBerry’s auto software, is winning designs at a solid pace. Many of these are with top electric car manufacturers. In cybersecurity, after hiring many salespeople, the pipeline is strong. Finally, according to management, we can expect the second half of the year to be stronger than the first half.

Valuation: Given the growth ahead, BlackBerry stock is cheap

It’s difficult to talk valuation for a company like BlackBerry. But it currently trades at a price-to-sales multiple of eight times. This is not that crazy considering the growth that I believe will come to fruition. Beyond this, some believe that BlackBerry might become earnings positive in 2024. Although this is riddled with uncertainty and risk, BlackBerry will get there eventually.

While exact predictions are difficult, assessing the business and being patient usually wins the day. In my assessment, BlackBerry has a solid business with the financial capacity to ride it through until the day that revenues and earnings start pouring in.

The bottom line

Beyond all the Reddit noise, BlackBerry stock is an attractive one. Choose your entry points well and be patient. This is a long-term growth story.