This week will be a busy one for TSX 60 components. This is because earnings season is ramping up and the expectations are high. So, with this earnings season, there are three things that investors need to pay attention to. The first is simply the financial performance of companies. Next is their outlook. And finally, we must gauge how much good news is already priced into the stocks.

Without further ado, here are three TSX 60 components that are reporting this week. Although they’re from different sectors, they all have one very important thing in common. That is, they’re all examples of operational and financial excellence.

Image source: Getty Images

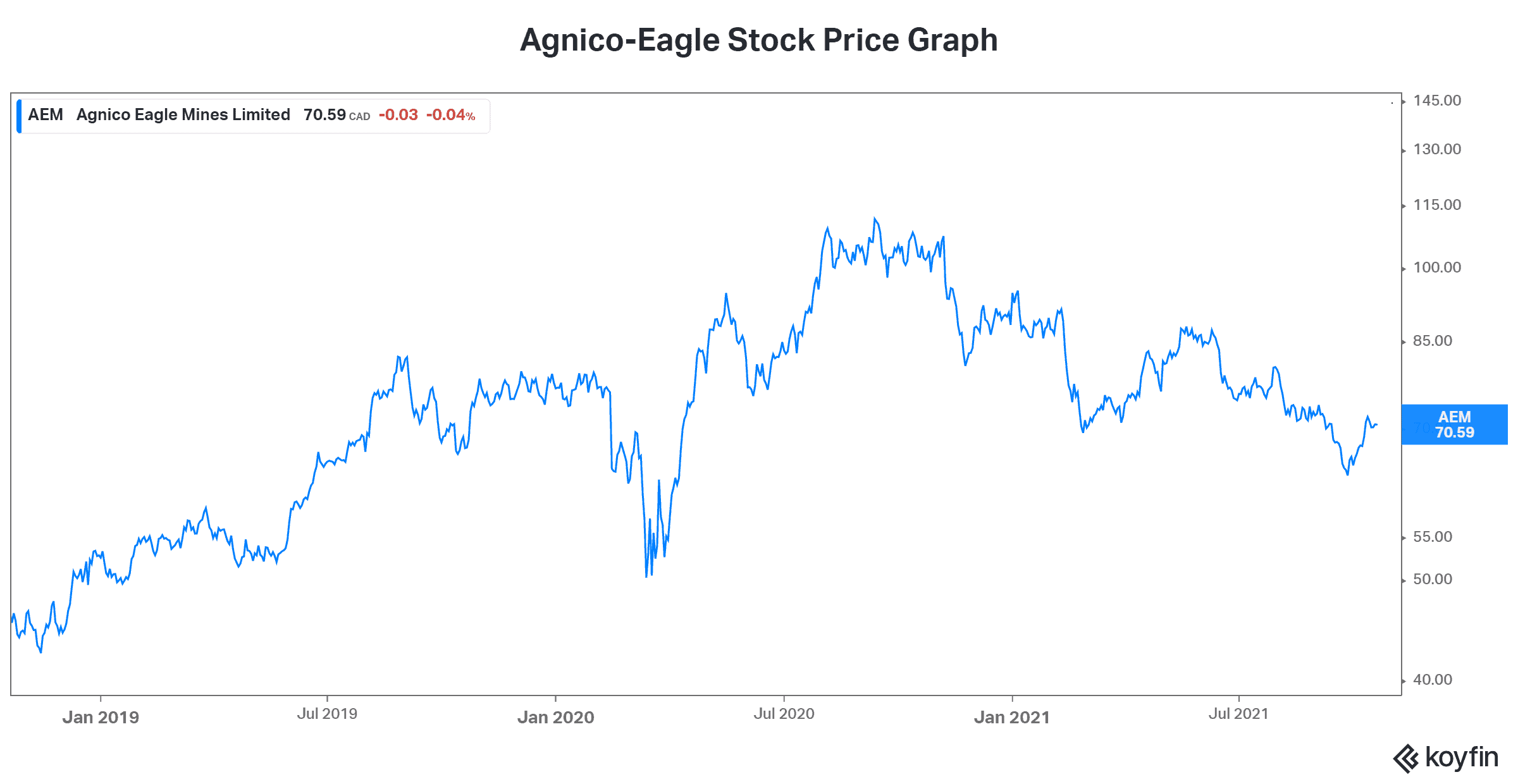

Agnico-Eagle stock: A TSX 60 component that gives us gold exposure

Agnico-Eagle Mines (TSX:AEM)(NYSE:AEM) is a $17 billion global gold producer. Its operations are in safe areas of the world, with an industry-leading cost structure. These attributes are highly attractive for investors. They ensure a lower risk profile and, ultimately, greater returns.

Inflation is on the rise globally. For example, in Canada, the latest inflation number was big. Coming in at 4.4%, it represented the highest level since 2003. Among the biggest causes of inflation was gasoline, which increased over 30%. This backdrop is ideal for gold stocks such as Agnico-Eagle, because gold is a hedge against inflation and a store of value. Consequently, we can expect gold prices to strengthen from here. Currently trading near all-time highs, it’s very fitting that gold has already rallied so much since 2019. Rising inflation and increasing risks all play into the investment thesis for gold.

So, Agnico-Eagle will be reporting its third-quarter results this week, on October 27. We can pretty much expect more of the same from Agnico. That is, strong cash flows, low costs, and rising dividends. During the quarter, gold prices were pretty much flat sequentially. This means that they were strong once again.

During the quarter, Agnico-Eagle acquired Kirkland Lake Gold. This transaction is expected to bring more than $2 billion in synergies and cost savings. It’s a move that combines two top-class gold companies into a bigger TSX 60 component. The consensus EPS estimate for the quarter is $0.64. Given that Agnico has consistently beat expectations, we might expect the same this time around.

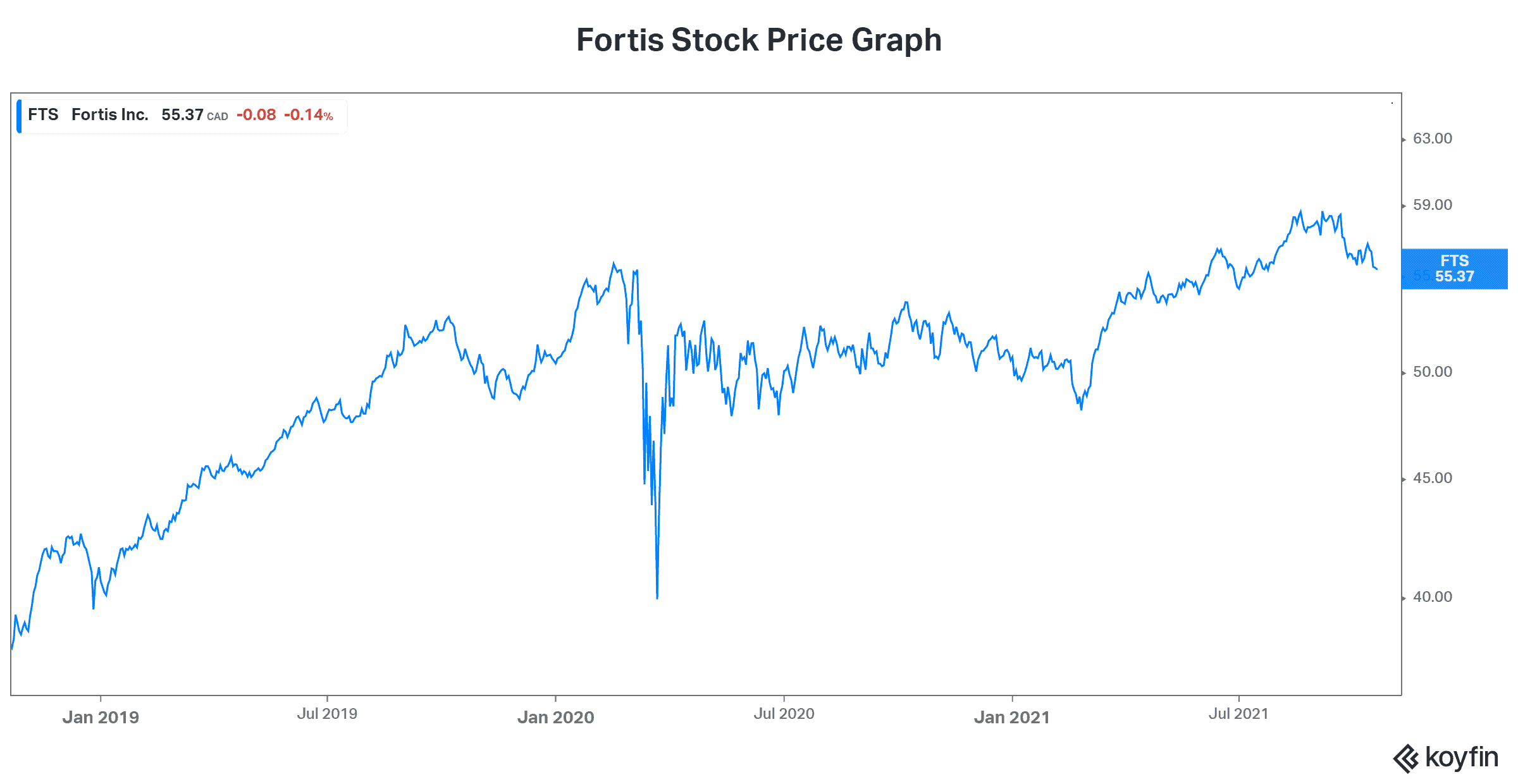

Fortis stock: A premium TSX 60 stock component that never disappoints

Another TSX 60 stock reporting this week is Fortis (TSX:FTS)(NYSE:FTS). Fortis stock is a leader in the regulated gas and electric utility industry in North America. And it’s reporting on October 29. For the quarter, we can expect that higher sales last quarter probably continued. Analysts are expecting EPS of $0.65, which is significantly higher than last quarter and flat versus last year.

Importantly, the quarterly release and conference call will also include details about Fortis’s five-year capital outlook. So far, we know that the next five years will busy, with Fortis spending $20 billion on energy delivery and clean energy infrastructure.

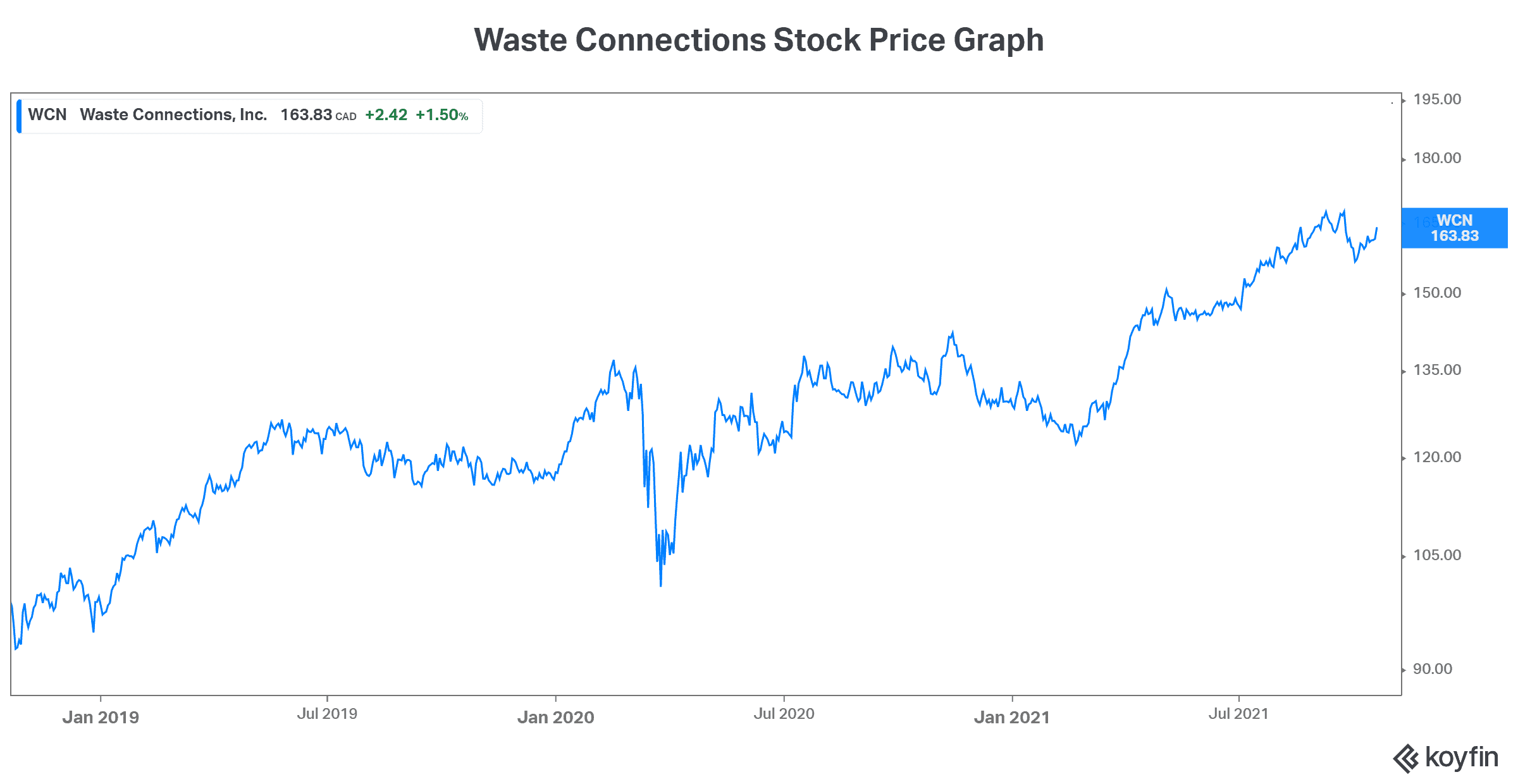

Another TSX 60 stock that continues to impress: The third quarter will be no different

Waste Connections (TSX:WCN)(NYSE:WCN) also has a history of beating expectations, which, of course, bodes well for Waste Connections stock. The third-quarter earnings report will be released on October 28. It’s expected that EPS rose by 15% versus last year. This is being driven by rising waste pricing and volumes. It’s also being driven by recovering commodity values as oil and gas prices soar. The third-quarter result will reflect the momentum that Waste Connections has been experiencing. For example, the company increased its outlook last quarter. Also, many analysts have upgraded the stock last quarter.

Waste Connections expects to generate free cash flow of $1 billion in 2021. This represents 20% of revenue and is a remarkable result. Although the company is still a consolidator in its industry, I wouldn’t rule out a dividend hike in the near future.

Motley Fool: The bottom line

In summary, three of the best TSX 60 stocks will be in the news this week. They’ll be reporting their third-quarter results, which will be a reflection of the continued recovery we’re experiencing after the pandemic as well as of their collective proven track records of excellence.