Although you can find a high-quality dividend-growth stock in any sector, there are a few to consider that are known to be the best. And while dividend-growth stocks are some of the top businesses Canadian investors can own, you still want to diversify your portfolio with other types of companies.

There is no question, though, that dividend-growth stocks will be some of your best and most important holdings. So, it’s crucial to know where to find these stocks and which industry offers the lowest risk.

It’s important to remember, though, that every company is different. They all have various operations and are exposed to different risks. So, while they could be in the same sector or industry, some stocks will be safer than others. Conversely, others may offer higher dividends or more growth potential.

With that in mind, if you’re a Canadian investor looking to find a high-quality dividend-growth stock, here are two of the best sectors to find them.

Utilities stocks are excellent dividend-growth stocks

Utility stocks are some of the best investments to make. While they will never really provide rapid growth, they provide consistent growth. Plus, because they are so resilient that in times of economic turmoil or market pullbacks, they’ll be some of the best at protecting your hard-earned capital.

Several utility stocks in Canada offer high-quality dividend-growth potential. One of the best, though, has to be Emera (TSX:EMA). Emera is a utility company with a well-diversified portfolio of utility businesses spread across six countries in North America. This helps lower the risk of an already highly resilient portfolio.

And going forward, the dividend stock is in the midst of a three-year capital plan, which will see roughly $8 billion invested in growth. Emera expects this will lead to an increase of its rate base by between 7.5% and 8.5% through 2023, which will drive more earnings per share and cash flow growth.

It also expects to continue increasing its dividend by at least 4% annually through 2024. And that dividend today already has an attractive yield of 4.5%, especially when you consider how safe of an investment Emera is.

So, if you’re looking for a highly resilient investment that still offers consistent dividend growth, Emera is one of the best stocks Canadian investors can buy today.

Real estate offers several high-potential opportunities

Real estate is another excellent industry where you can find high-quality dividend-growth stocks. And while they may not offer as much safety, and in some cases, such as with Canadian Apartment Properties REIT (TSX:CAR.UN), they may not offer a major yield, the stocks can offer a lot more long-term growth.

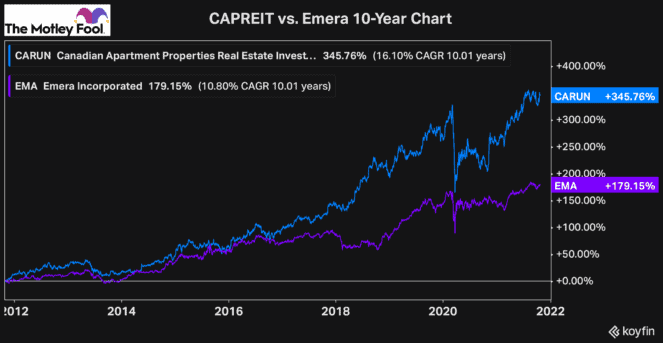

As you can see, while Emera has earned investors a compounded annual growth rate (CAGR) of more than 10% over the last decade, an impressive amount, CAPREIT has a CAGR of more than 16% over the same period.

So, while the real estate stock may not be as resilient, and its dividend yield of 2.4% may not be as attractive, CAPREIT can grow both its dividend and its share price faster, which, for many investors, is more appealing.

CAPREIT is one of the best dividend-growth stocks to buy, as it continues to expand its portfolio and acquire more properties, taking advantage of ultra-low interest rates. It’s also been investing in upgrading its existing properties, which helps to significantly increase the value of its units.

So, if you’re looking for one of the best dividend-growth stocks to buy, real estate is a top sector. These stocks may not always have significant yields. But if they are quality companies with excellent operations, they can be some of the best dividend-growth stocks to own long term.