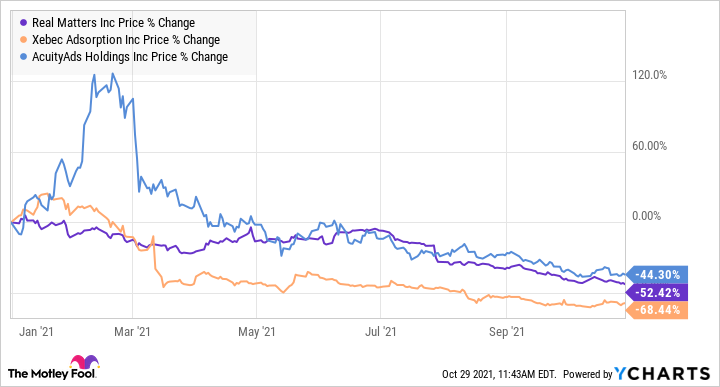

First of all, I would like to wish you a Happy Halloween! You might be going around your neighbourhood to trick or treat with your kids or handing out candy at home with your awesome costume. For me, I’ll be thinking about why I still own these spooky stocks on Halloween. Even witches won’t touch them because they spell trouble! Here’s a stock chart illustrating their year-to-date, scary price action.

Data by YCharts

Xebec Adsorption

First off the list is Xebec Adsorption (TSX:XBC). Out of the three TSX stocks, it is the worst performer. Boo! It declined 68% year to date. The big culprit is that the stock was run up to very expensive valuations at the start of the period based on high hopes of its future, namely, expectations for its revenue growth. When that did not materialize, the stock came tumbling down. Most notably, the industrial stock isn’t profitable yet. So, at best, it should be considered a speculative investment.

Xebec provides clean energy solutions for renewable and low carbon gases used in energy, mobility, and industrial applications. Being more environmentally friendly is a trend. So, there’s hope that the stock could make a comeback if the company turns a profit in a year or two. Right now, analysts think the stock could trade more than 60% higher in the near term. So, it’s not a good time to give up the stock.

Real Matters

The runner-up is Real Matters (TSX:REAL). The stock lost about half of its market cap year to date and certainly looks like a lost cause. But actually, the growth run-up for the company during the pandemic in 2020 tapered off this year, and dragged the stock down with it.

Real Matters provides network management services for mortgage lending and insurance industries. Additionally, in the United States, it provides residential real estate appraisals to the mortgage market as well as title and mortgage closing services.

The company is at least profitable, as it posted a net income of almost US$36.5 million in the trailing 12 months. The investing community is likely concerned with where its growth will come from, especially when the real estate sector slows, or worse, enters a bear market. Currently, analysts think the tech stock could climb close to 90% over the next 12 months. I wouldn’t be as optimistic, though, as it takes time for execution and requires the operating environment to cooperate.

AcuityAds

Last on the list is AcuityAds (TSX:AT)(NASDAQ:ATY). The stock ran up a lot from the pandemic trough to peak set in February this year — a 29-bagger. Naturally, that kind of crazy appreciation could not continue forever. So, the stock turned the other way instead. Year to date, it fell 44% and its valuation is attractive for its growth potential.

The tech company provides solutions for digital advertising, which is projected to experience continued above-average growth going forward. Its balance sheet is robust. Therefore, I have the best feeling in AcuityAds of the three stocks. Analysts think the stock could soar about 142% over the next 12 months.