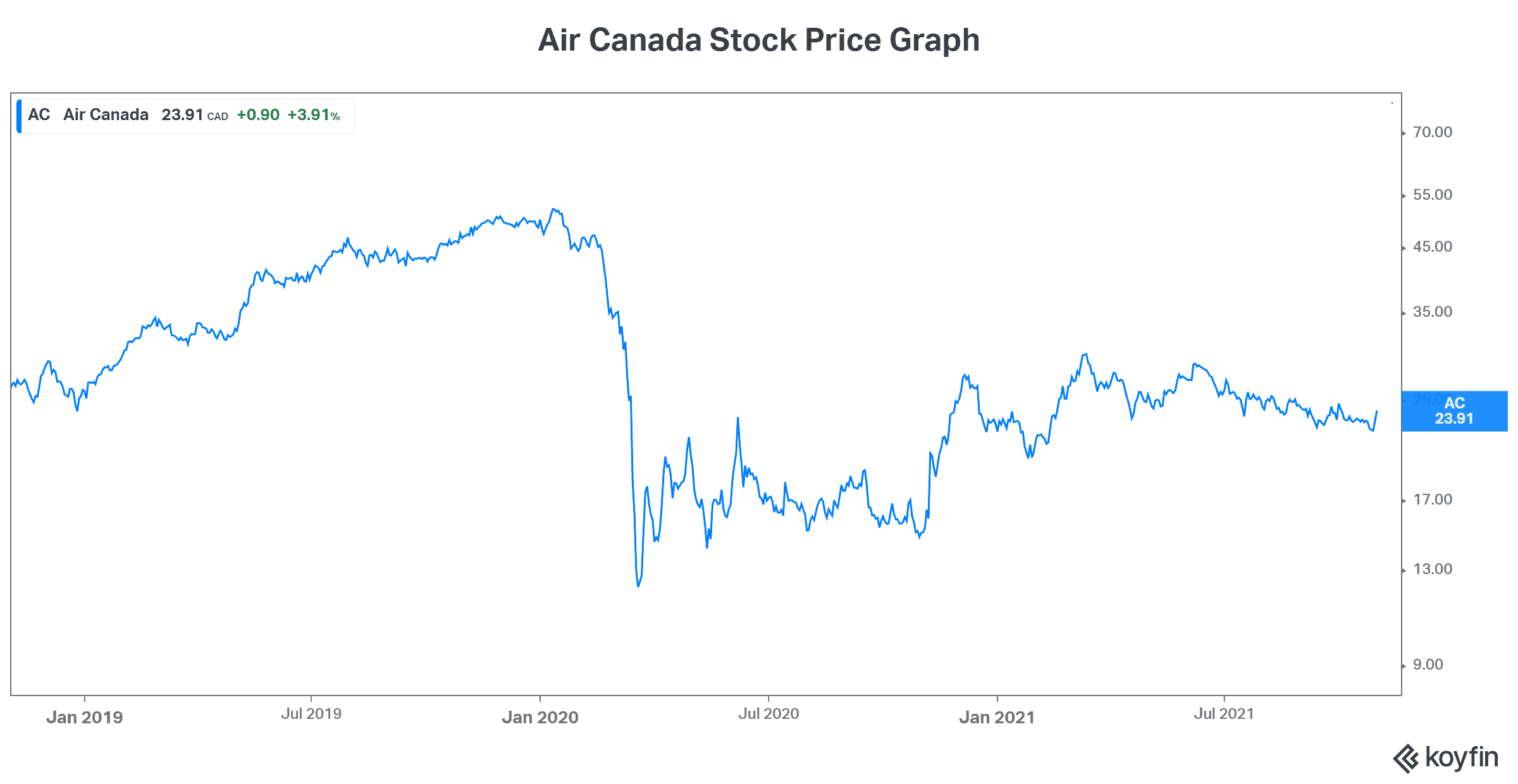

Air Canada (TSX:AC) stock has been through a whirlwind of turbulence for almost two years. But today, the airliner released its third-quarter results that are fuelling optimism. In fact, it’ll bring many investors out of hiding and back into Air Canada stock. Should you buy it today?

Let’s take a look at the third quarter to help us answer this question.

Could Air Canada’s stock price double from here?

Third-quarter results reveal many reasons for optimism. It can be summed up very nicely by looking at the demand recovery that’s happening. In fact, this recovery is so strong that it has Air Canada execs talking about returning to 2019 levels next year. Borders are re-opening, advance bookings are rising, and the pandemic is ending.

There’s no doubt that Air Canada’s financials improved significantly in the third quarter. In fact, the last two months of the quarter were particularly strong. This strength resulted in positive EBITDA in these months and cash generation of $153 million in the quarter. We only need to compare this with 2020’s massive cash burn numbers to see the improvement.

So what does this mean for Air Canada stock? Can it double from here back to 2019 levels? Well, the short answer is yes, most definitely this is possible. The long answer is more complicated. It takes into account various factors that will be headwinds for Air Canada. These factors mean that while it’s conceivable that Air Canada stock could return to 2019 levels, it’s not very likely anytime soon.

Business travel is still weak and fuel costs are on the rise

As we know, business travel used to make up a significant chunk of Air Canada’s traffic and revenue. Also, fuel costs always make up a significant chunk of costs. Any changes in these two important pieces of the pie have a big impact. Today, both of these variables are working against Air Canada. This doesn’t bode well for Air Canada stock’s upside.

First, let’s tackle business travel. During the pandemic, businesses have figured out a way to replace travelling for in-person meetings. Virtual meetings with customers and partners around the globe served to keep the business activity going. It was a necessary and acceptable alternative to the expensive practice of travelling. This, I believe, is a key factor that might hamper the return of business travel.

The cost savings of replacing travel with virtual meetings is significant. So the financial case to return to business travel is not that strong. Therefore, the corporate market has been slower to return than expected. Air Canada expects a strong return in business travel in 2022. I have my doubts.

Now let’s look at fuel costs. It’s no surprise to anyone that fuel costs have risen dramatically versus pre-pandemic days. Given that fuel is Air Canada’s biggest expense by far, this is very significant. It drastically affects the bottom line. So in the third quarter, fuel cost increased 74% for Air Canada. There’s no sugar-coating it. This will sting in the coming months and will negatively affect Air Canada stock’s upside.

The bottom line

In summary, I think investors can and should consider buying Air Canada stock today. While a doubling of Air Canada’s stock price might not be in its immediate future, things are looking good. There’s still a lot of money on the table here. The post-pandemic recovery is winding up.

Don't Miss AI's Third Wave

Don't Miss AI's Third Wave