Altagas (TSX:ALA) is a diversified Canadian energy infrastructure company. It operates in two segments, the utilities segment and the midstream segment. Last week, Altagas released its Q3 earnings results. In short, they demonstrate the value that is Altagas and demonstrate that business is booming. Not surprisingly, so is Altagas stock. Motley Fool readers, consider putting it on your buy list.

Here’s why Investors who are looking for growth and security should pay attention to Altagas stock.

Altagas stock = stability plus growth

Altagas has had a really phenomenal year so far. Business is booming and the stock is flying. This combination almost certainly interests Motley Fool readers. For investors looking for yield, Altagas stock is yielding almost 4%. This is backed by a stable and predictable utilities segment. It’s also backed by a midstream segment that’s overwhelmingly made up of long-term contracts.

The growth comes from the midstream segment located in Western Canada. It includes processing and export facilities. These assets are located in some of the fastest-growing markets in North America, including Montney and Marcellus/Utica basins.

Propane prices up 130 % in 2021

So propane prices are soaring. But why is this important to Altagas? Well, it’s important because propane and butane are a big part of Altagas’ midstream business. It’s also important because this is a big part of Altagas’ future growth.

Propane is a by-product of domestic natural gas processing. In recent months, Altagas has really scaled up its propane and butane export facilities. This, in turn, has allowed the company to respond to the booming demand for propane from Asia. This demand from Asia is being driven by the fact that it’s considered a cleaner energy source. As such, propane is meeting Asia’s demand for cleaner energy to power its homes and its economy. In fact, Altagas is exporting record volumes of propane to Asia. And the demand shows no signs of stopping.

Altagas’ Ridley Island Propane Export Facility (RIPET) went into service in May 2019. It provides Canadian natural gas producers with the ability to export their propane to markets in Asia. This facility is located in the Montney and Marcellus/Utica basins. Therefore, it connects Canadian producers to global markets like Asia. It’s a strategic advantage for Altagas at a time when this access is lacking. In short, the Ridley facility is seeing strong interest from buyers and producers alike. Therefore, utilization is increasing and volumes are ramping up quickly. Simply put, it’s in growth mode.

Altagas stock will catch up to these booming fundamentals

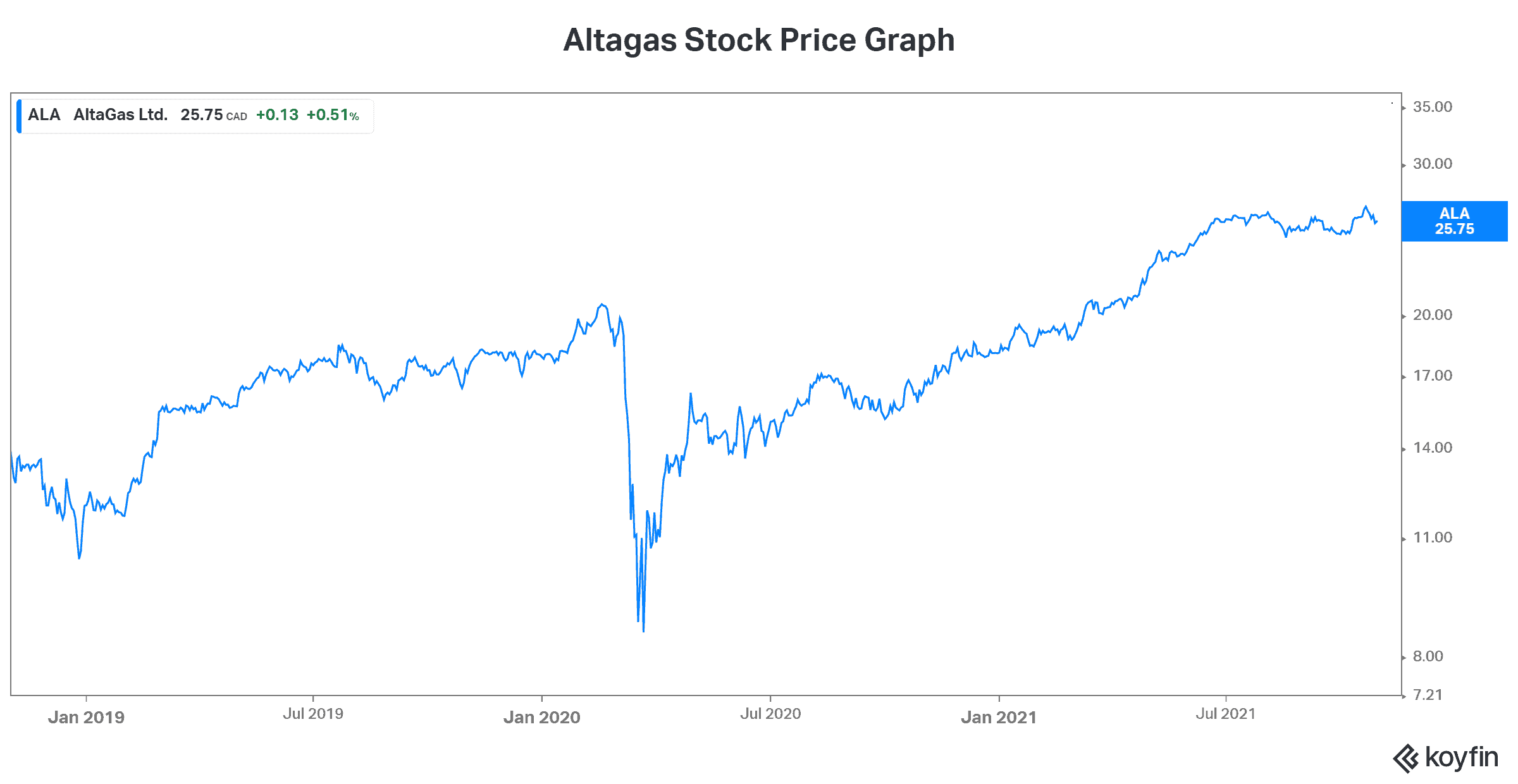

So we have gone over a bit of the qualitative thesis surrounding Altagas. So far in 2021, Altagas stock has been soaring. In fact, it’s up 37%. But what the company’s latest quarterly results have shown us is that the stock is due for a revaluation as it doesn’t seem to be fully reflecting the positive fundamentals that are in play here.

Cash flow from operations is soaring more than 50%. EBITDA is growing at a more than 15% growth rate. And the pricing environment for natural gas and its by-products are rapidly rising. In short, the demand from Asia is huge. Canadian natural gas, and Altagas, are in the perfect position to be a supplier of choice. The stock is simply undervalued based on this outlook.

The bottom line

Altagas had a misstep in 2018. As a result, the company was forced to do the unthinkable – reduce its dividend. Today, we see that this was for the benefit of the company’s long-term health. In my view, we should now expect rising dividends for Altagas stock. This is being driven by strong growth in propane exports and propane prices and a strong underlying utilities business.

Act Fast: 75 Only!

Act Fast: 75 Only!