Over the last decade, we have seen what rapid growth in stocks can do for investors. When you find a high-quality Canadian stock that can grow rapidly and for years, it can drive a major portion of your portfolio growth.

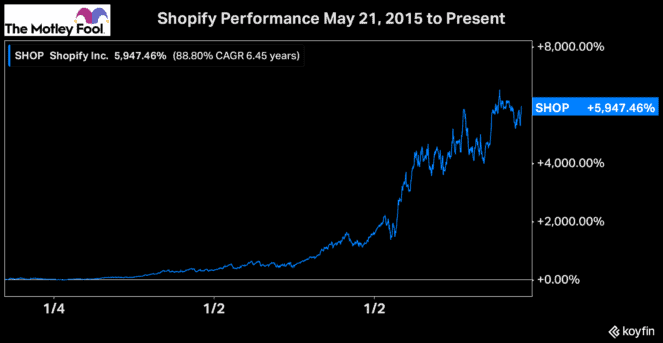

Just look at how much investors made in the roughly six-and-a-half years since Shopify’s IPO in 2015.

An investor who put just $2,500 into Shopify would have over $150,000 today, just from Shopify stock. So, it’s safe to say it would easily have been your best performer and by far the largest contributor to growth.

Shopify’s incredible performance goes to show that when you find a stock you’re bullish on and you believe it has years of potential, it makes sense to buy for the long run. And even if it gains significantly soon after you buy it, if you continue to believe it has potential, it’s worth holding for the long term.

With that in mind, if you’re looking for a high-potential growth stock to buy today, here are three Canadian stocks that I think will be some of the biggest businesses in Canada by 2030.

A rapidly growing Canadian healthcare tech stock

There’s no doubt WELL Health Technologies (TSX:WELL) has been one of the fastest-growing and most impressive Canadian stocks over the last few years. What’s most impressive about WELL, in my opinion, is the fact that it’s been able to grow the many facets of its healthcare portfolio together.

There is a significant opportunity to modernize many parts of the healthcare industry, and WELL Health has been seizing that opportunity. This leads me to believe that WELL could easily be one of the largest Canadian stocks, or at least one of the leaders in the healthcare sector, by 2030.

The company already owns and operates Canada’s largest network of outpatient medical clinics in addition to the digital health apps and telehealth businesses it’s consistently acquiring.

So, with the company worth just $1.4 billion and continuing to grow rapidly, it offers investors a huge opportunity. That’s why I think it’s one of the best Canadian growth stocks to buy today and could possibly be one of the largest stocks in Canada by 2030.

A massive renewable energy stock

Another stock with the potential to be one of the largest companies in Canada is Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP).

There are a few reasons why Brookfield has the potential to be one of the largest Canadian stocks by 2030. First, it’s already a massive company with a market cap of more than $23 billion. It’s easily the largest renewable energy stock in Canada. And considering that green energy is one of the top long-term growth industries, Brookfield already has a natural path to continue growing larger.

In addition, because it’s a Brookfield company, it has some of the best management in the industry. So, you can continue to expect that the company will take advantage of high-potential opportunities all over the world.

Brookfield Renewables has over 20,000 megawatts of generating capacity with assets located in North and South America, Europe, India, and China.

So, if you’re looking for one of the best Canadian stocks to buy and hold, Brookfield has a tonne of potential to expand its operations for years.

A high-quality crypto stock with an enormous runway for growth

Lastly, and maybe not surprisingly for some, is a cryptocurrency investment: Galaxy Digital Holdings (TSX:GLXY). Cryptocurrency and the blockchain industry have a tonne of potential, and now, with the popularity and momentum the space has, we’re seeing a snowball effect when it comes to growth.

There is a tonne of opportunity for investors to find long-term growth stocks in the cryptocurrency industry. Galaxy Digital, though, in my opinion, offers the best potential. Galaxy is building a well-diversified financial services company in the cryptocurrency space that serves retail and institutional clients.

The company has built an incredible portfolio of segments that look to take advantage of the significant growth potential of the industry. Therefore, I wouldn’t be surprised if Galaxy Digital is one of the largest Canadian stocks by the time we reach 2030.