Passive income is income that you can earn without doing anything. It’s a highly sought-after source of income for obvious reasons. We can all agree that passive income is a treasure. However, we don’t always agree on how to get it. In this Motley Fool article, I introduce a top Canadian dividend stock for passive income: utility giant Fortis (TSX:FTS)(NYSE:FTS).

Here’s why Fortis stock is a top stock to buy and hold forever.

Passive income: 48 consecutive years of dividend growth

When it comes to passive income, there’s no better quality than steady growth. Fortis stock has that in spades. Indeed, 48 years is a long time – a lifetime even. For 48 years, Fortis’s dividend has given its shareholders passive income that has grown consistently. In fact, Fortis stock’s dividend income has combatted inflation. It’s also provided more than acceptable returns on investment.

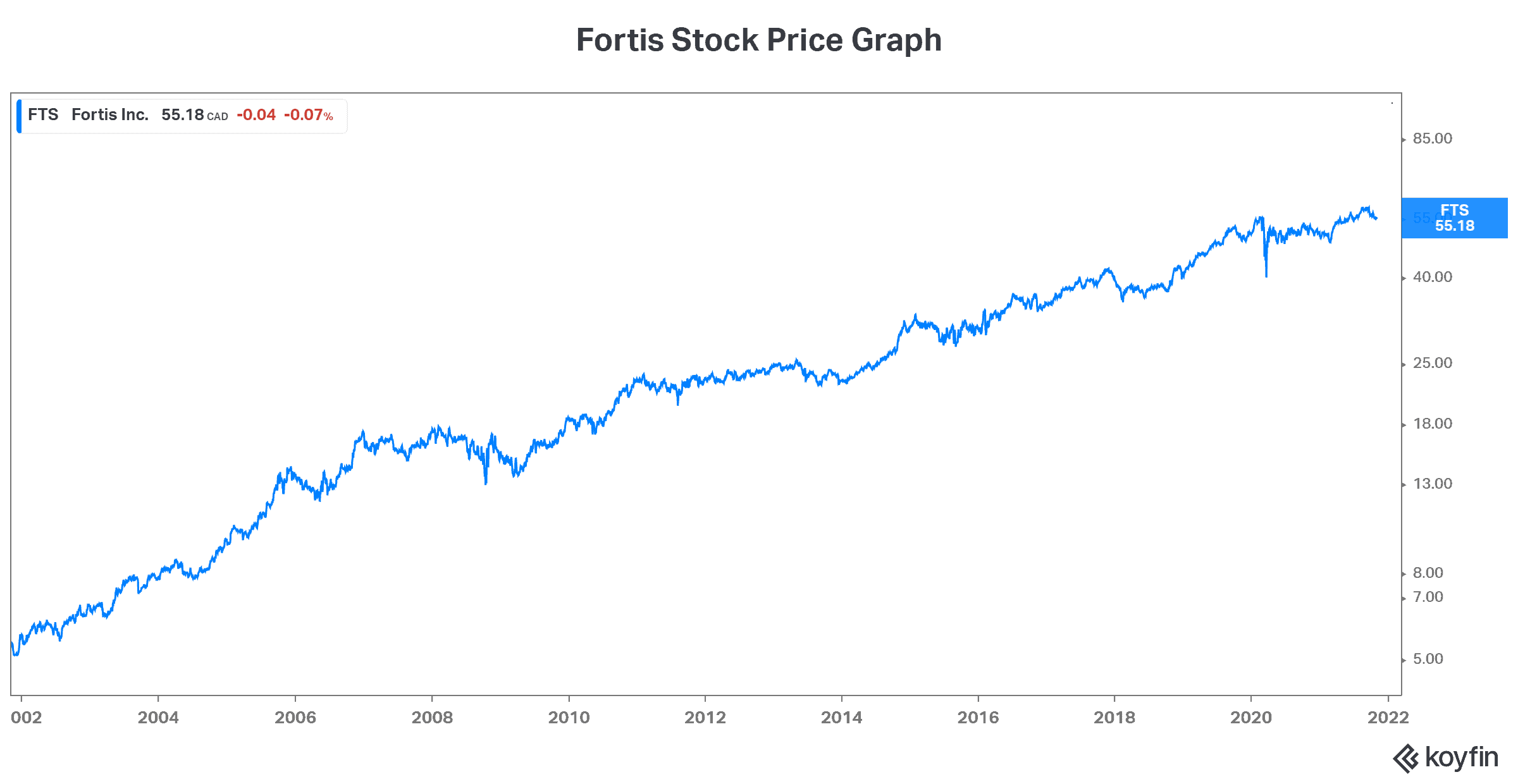

Today, Fortis is yielding an attractive 3.9%. It’s more than you can get in bonds. And it comes with dividend growth as well as potential capital appreciation. I mean, maybe Fortis is a “boring” utility company — but don’t be fooled. It can still generate lucrative capital gains. See the graph below to get a sense of the capital appreciation that Fortis stock has generated for its shareholders since 2001 (20 years). You will quickly see the long-term value proposition here.

The picture of security, consistency, and predictability

Looking at Fortis stock’s price graph, you will notice two things. The first is stability. I mean, Fortis’s stock price doesn’t trade with much volatility. This is certainly something that we should value in our passive income investments. In short, it means that we can rely on the stock. We can rely on it both for income as well as for steady, long-term capital gains.

The second is predictability. This is clear in Fortis’ results through the years. These results reflect the fact that Fortis’s business is a defensive one. As a regulated gas and electric utility company, we can see why. We need power in both good times and bad. There’s little sensitivity in our demand. Also, Fortis’s business is highly regulated. Therefore, predictability is a theme for Fortis.

Looking ahead, Fortis is fully funded. This means that the company can finance its growth internally. It doesn’t have to go to the market to issue equity. This protects current shareholders. Also, Fortis’s management expects its dividend to continue to steadily grow. In fact, the dividend is expected to increase 6% per year through to 2025.

Sustainable long-term growth plan makes Fortis a stock to buy for passive income

Beyond the next five years, there are many more opportunities that Fortis is pursuing. In fact, long-term regional transmission planning is already underway. Certainly, big investments in transmission infrastructure are essential to ensure a low carbon future. In short, Fortis will invest what is needed. Fortis’s target is to reduce emissions by 75% by 2035. There’ll be a major overhaul of energy infrastructure — and Fortis is claiming its spot.

Motley Fool: the bottom line

Fortis stock is a clear winner for passive income. Motley Fool writers are always looking for a good idea. Even in today’s market, we can find them. Consider building a position in Fortis stock over time. This will average out your entry points to maximize capital gains. Most importantly, this dividend stock will provide you with passive income for many years to come.