There are a lot of economic, political, health, and geopolitical issues that could disrupt the strong upward momentum in TSX stocks. After traversing through the COVID-19 pandemic, the stock market now has to navigate inflation, supply chain bottlenecks, and rising interest rates. While Canadian stocks are climbing near all-time highs, there are risks. If you are concerned, I have two rock-solid TSX stocks you can buy, hold, and sleep easy at night owning. They are perfect stocks to hold for decades ahead.

Image source: Getty Images

This TSX infrastructure stock is a perfect portfolio anchor

The first TSX stock is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP). There is nothing more rock-solid than infrastructure to anchor an investor’s portfolio. At $74 per share, this stock is trading at all-time highs. Year to date, this stock is up 18%.

Brookfield Infrastructure is a dividend-growth king. Since 2009, it has grown its distribution by a 10% compound annual growth rate. It has paid a nice US$0.51 (CDN$0.6475) distribution every quarter this year. That is equivalent to a 3.5% dividend yield today. There is a good chance a similar rate of growth should continue going forward.

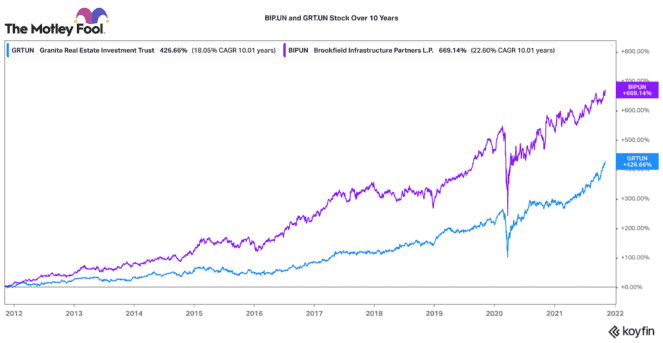

Brookfield has a strong history of delivering steady, solid returns for shareholders. Had you bought this stock in 2011 and reinvested the dividends, you would be up a total of 669%. That equals a 22% average annual total return. Nearly half of those returns would be from dividend distributions!

This TSX stock has a great balance sheet. Despite just completing the major acquisition of Inter Pipeline, it still has ample dry powder to deploy. As its recent third-quarter results showed, BIP has a very strong organic growth profile that actually benefits when inflation is on the rise.

Certainly, today this TSX stock is not cheap in the traditional sense. However, given a great combination of operational, financial, and dividend growth expected going forward, it is still a solid stock to buy and hold for years to come.

A global real estate stock with rock-solid fundamentals

Granite Real Estate Investment Trust (TSX:GRT.UN) stock is just as solid as its name. Granite owns an institutional-grade portfolio of logistics, distribution, and manufacturing properties across Canada, the United States, and Europe. These are anchored by high-quality tenants like Amazon.com and Magna International.

Its properties are infrastructure-like and essential for the flow of commerce in society. Consequently, they command very long-term leases (around six years on average). This ensures very stable streams of monthly cash flows.

Today, Granite is sitting with over 99% occupancy across its portfolio. Likewise, this REIT has one of the best balance sheets in the industry. It is not over-levered (net leverage is below 25%) and it has ample dry powder that it can continue to deploy into growth opportunities (development or acquisitions). During the pandemic stock crash, this TSX stock was very quick to rebound, which I believe is due to the quality of its portfolio and balance sheet.

Over the past 10 years, Granite has grown the value of its portfolio from $1.9 billion to $7.3 billion today. It has delivered a very nice 426% total return for shareholders over that time frame. Its stock is up 30% this year!

Like Brookfield, Granite has done a great job of growing its dividend. It has raised its distribution every year for the past 10 years. Today, this TSX stock yields a 3% dividend. However, that is set to rise by 3.3% in 2022. For a top income stock that you can rely on through most business cycles, Granite is one to just buy, forget about, and own for a lifetime.