2020 was a significant year for Bitcoin and the entire cryptocurrency industry. The industry saw a major boom in large part due to the pandemic and all the fiat money that was injected into the global economy. Because this popularity of the industry grew, naturally, a tonne of innovation began, and we have seen a significant revolution take place. In total last year, Bitcoin gained just over 300% in price.

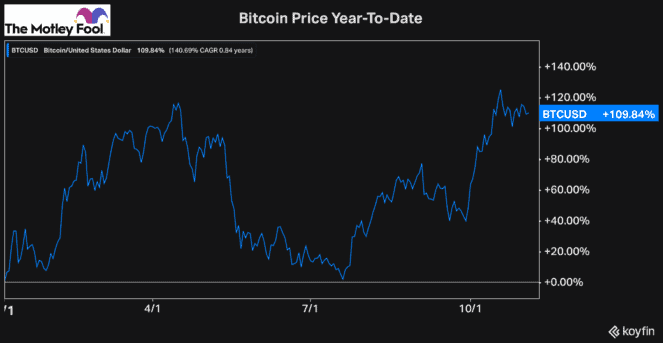

This significant rally carried into 2021, and by April, the price of the most popular cryptocurrency had gained another 100%, sparking tonnes of analysts and investors to throw out optimistic price targets. At this point, though, Bitcoin started to lose momentum.

What followed was a period of underperformance, and from April to July, Bitcoin lost the entire 100% it had gained in 2021. What’s important to note, though, is regardless of where Bitcoin’s price has gone in the last year, the innovation in the space has continued to pick up.

Each time it starts to rally, and investors jump back in, I expect it to continue to grow in popularity and ultimately continue to reach new highs.

In the past, owning Bitcoin had a lot of drawbacks, and it still does. However, the ability to wrap your Bitcoin and use it on other blockchains has completely changed the game and has allowed this major currency to continue being the bellwether for the entire industry.

As you can see, since July, Bitcoin has rebounded significantly and just recently set another new all-time high. This shouldn’t be surprising, there are several factors contributing to this rally today, so it’s certainly not out of the question for Bitcoin to hit $100,000 by year’s end.

Image source: Getty Images

Could Bitcoin hit $100,000 this year?

Currently, Bitcoin is worth a little over US$61,000. So, it would need to gain another roughly 64% to hit $100,000. That might sound like a lot for Bitcoin to gain in less than two months. However, we’ve seen much faster rallies from these cryptocurrencies in the past.

Plus, with so much going on in the industry, there is a tonne of momentum, as I mentioned before. DeFi, for example, continues to grow rapidly in popularity, and innovation in the space is faster than ever before.

It’s more than just the growth potential of the blockchain industry that’s driving Bitcoin as well as several other cryptos higher. There are significant macroeconomic factors contributing to Bitcoin’s rally as well.

With inflation growing significantly these days, it’s no surprise to see Bitcoin as well as other alternative assets gaining in price. Not only are investors buying Bitcoin as a hedge, but the dollar is losing value as well, so, naturally, other assets would be gaining in price, as we’ve been seeing.

Inflation is a major contributor to Bitcoin’s price. What investors need to understand is that it isn’t just inflation in North America, or Europe, for example. Underdeveloped countries can see even more economic devastation from massive inflation. So, it’s not unusual to see people all over the world using Bitcoin and other cryptocurrencies to protect their wealth.

With all these factors combined, I wouldn’t be surprised to see Bitcoin hit $100,000 by year-end, or at least continue with this incredible rally it’s been on the last few months.

So, if you’ve yet to gain exposure to the cryptocurrency industry and are worried you missed out on all the growth, I wouldn’t be. There is a tonne of potential for Bitcoin and the rest of the cryptocurrency industry to continue growing significantly for years.