Utility stocks are safe, defensive stocks. They benefit from businesses that provide basic services. Therefore, they are prime holdings that investors can rely on for dividend income and stability. If this sounds interesting to you, keep reading. In this Motley Fool article, I’ll introduce two of the best utility stocks: Enbridge (TSX:ENB)(NYSE:ENB) and TC Energy (TSX:TRP)(NYSE:TRP). These stocks are yielding over 5% and are trading near all-time highs today.

Let’s explore.

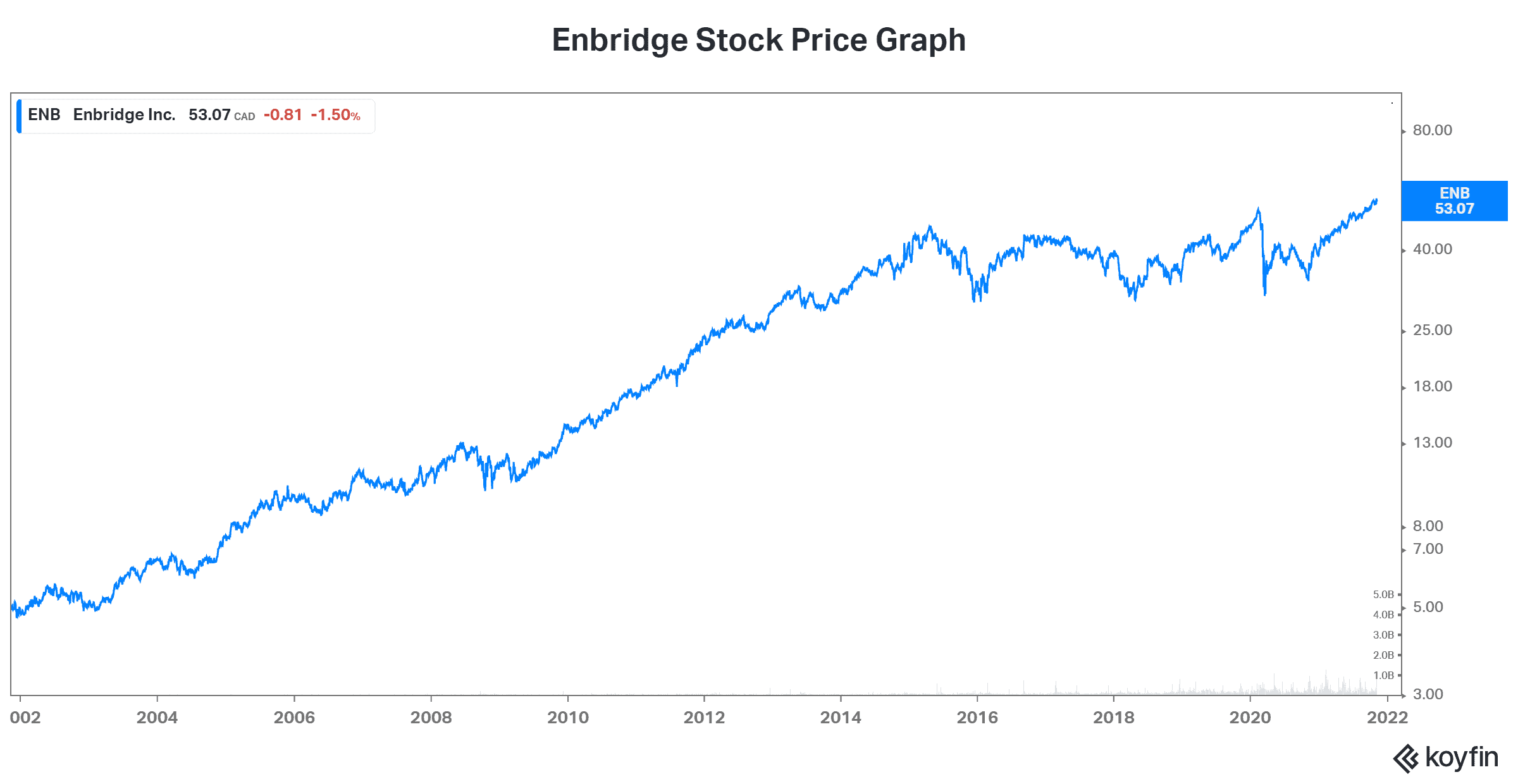

Enbridge stock: The utility stock with the big dividend yield

Enbridge’s assets are a critical piece of North America’s energy infrastructure. In fact, Enbridge is one of North America’s leading energy infrastructure companies. It transports about 25% of the crude oil produced in North America. It also transports nearly 20% of the natural gas consumed in the United States. And to top this off, Enbridge Gas is North America’s third-largest natural gas utility.

Enbridge stock is a Dividend Aristocrat that’s yielding a disproportionately high rate. I mean, the company has a highly predictable and defensive cash flow stream. Therefore, its generous 6.2% dividend yield is an anomaly that certainly won’t last much longer. This high yield is partly a function of the fact that Enbridge’s stock price is grossly undervalued. This has been due to the market’s shunning of anything oil and gas in recent years. But this is changing.

In short, global energy shortages and rising oil and gas prices are speaking volumes. Persistent underinvestment in all forms of energy in recent years has created an energy crisis today. And it’s creating big problems globally. For example, rolling blackouts and rationing in Asia and India have been the norm. Also, Germany has surprisingly increased its coal consumption to combat its energy shortage. Lastly, fuel shortages in the U.K. have highlighted the extent of this crisis.

Thankfully, Enbridge is ready for this opportunity and challenge. As a result, Enbridge stock is one of the best utility stocks to buy today. Investors can also take comfort in Enbridge’s 26 years of dividend growth at a 10% compound annual growth rate (CAGR). We can also take comfort in Enbridge’s continued growth prospects.

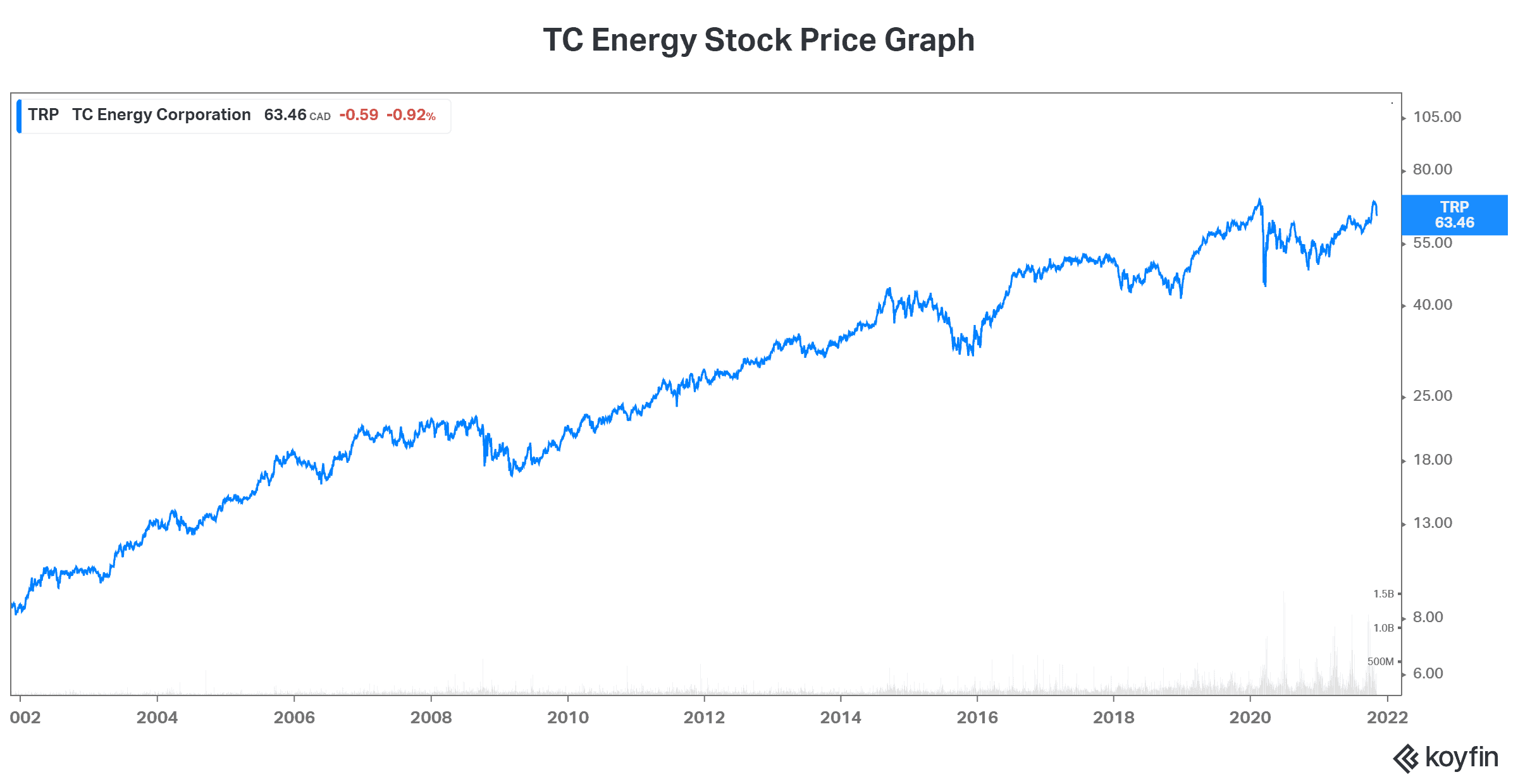

TC Energy stock: Another generous dividend yield from a defensive giant

TC Energy stock is a $63 billion stock that’s yielding a very generous 5.5%. As with Enbridge, TC Energy’s dividend yield is extremely high — especially considering its low corresponding risk. This is because this company is also characterized by a steady, predictable, and defensive stream of cash flows. In fact, the company’s cash flows and earnings are booming. And TC Energy is exceeding expectations. So, what we have here is another top utility stock that we can rely on for dividend income.

Since 2000, TC Energy stock has appreciated more than 400%. Also, its dividend has grown at a CAGR of 7.25%. Take a look at TC Energy’s stock price history below. You can see that its return is very strong. It’s also steady and reliable — something that may not get as much attention as it probably should.

Looking ahead, TC Energy stock has a bright future. This future will be ensured due to a growing population, rising energy prices, and continued investments in growth.

Motley Fool: The bottom line

Utility stocks like Enbridge stock and TC Energy stock are sure winners among investors. Many Motley Fool investors have surely already seen this firsthand. I’m here to say that this past performance will likely repeat. This makes these two utility stocks worth considering. They’re dividend stocks that can provide the passive income you may be looking for.