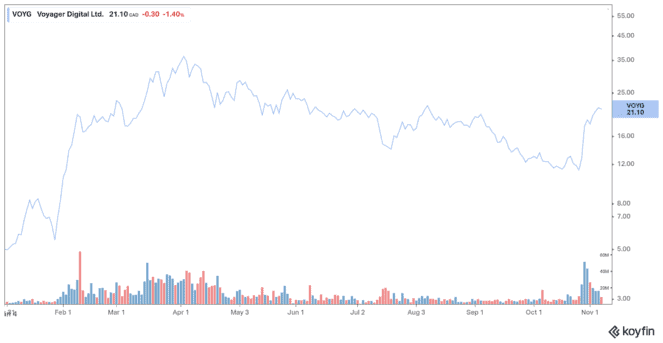

Voyager Digital (TSX:VYGR) stock posted a big 48% gain in October after the crypto company reported good news towards the end of the month. Higher trading volume and rising cryptocurrency prices also helped to boost shares. Voyager Digital provides a platform to trade crypto assets to retail and institutional investors.

Partnership with Dallas Mavericks

On October 27, Voyager Digital announced a partnership with Dallas Mavericks. With this deal, Voyager becomes the team’s first crypto broker and international partner.

Together, cryptocurrency broker and billionaire investor Mark Cuban’s Mavericks will promote accessibility to cryptocurrency through educational and community programs, global activations, and fan engagement promotions.

On the same day, Alameda Research, a pioneer in the crypto space, made a strategic US$75 million equity investment in Voyager Digital, which further helped push the stock up.

While the two companies refrained from disclosing other financial details related to the transaction, Voyager hinted that it would later work with Alameda for crypto derivatives and NFT offerings on its platform.

Strong earnings report

Voyager’s shares were further boosted after the company reported its fiscal 2021 results on October 29, which showed impressive growth.

Total revenue in fiscal 2021 came in at US$175 million, up from US$1 million in fiscal 2020.

The crypto-asset provider posted an operating income of US$56 million compared to an operating loss of US$11 million a year ago.

Total funded accounts grew to 665,000 from 23,000, while total verified users grew to 1.75 million, up from 86,000 as of June 30, 2020.

Voyager’s CEO and co-founder Steve Ehrlich said, “Fiscal 2021 was a breakout year for Voyager, positioning our platform to be a leading player in the digital asset arena as crypto and related blockchain technologies are increasingly embraced by the mainstream. Voyager continues to deliver noteworthy performance through verified user and funded account growth punctuated by providing users with a transparent, safe, secure and trusted personal cryptocurrency platform. We continued to see significant net new funded accounts and net new asset inflows on the platform and as we add more product extensions, we believe the ability to leverage our growing user base will accelerate our revenue growth and provide diversification to our revenue mix.”

Ehrlich added that as the company diversifies its revenue streams to improve the long-term value of each customer and expands its international market opportunity, he believes the best is yet to come for the Voyager platform.

In April, Voyager invested and developed a strategic partnership with Blockdaemon to offer enhanced staking capabilities.

Crypto growth

The growth in Voyager stock goes hand in hand with the performance of cryptocurrencies. When Bitcoin and Ethereum hit all-time highs, Voyager stock also did the same. And as these and other cryptocurrencies bounce back, it’s likely that Voyager stock will continue to climb.

On top of that, Voyager is benefiting greatly from the recent meme phenomenon, particularly related to Dogecoin and Shiba Inu, which maintains transaction volumes high in the crypto space.

Its crypto trading application has already regained its place in the “top 15” of Android and iOS, another factor rewarded by shareholders.