Dividends play a key role in building wealth. They supplement our income for most of our lives until one day, in retirement, they may become one of our biggest sources of income. Planning for retirement is a long process. It includes putting money aside early on in your career. It also includes building a portfolio that’s right for your stage in life. In the younger years, a focus on growth stocks is appropriate. In the years closer to retirement, however, it’s best to focus on stable dividend stocks. Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ), Enbridge (TSX:ENB)(NYSE:ENB), and Northwest Healthcare Properties REIT (TSX:NWH.UN) are all examples.

So, let’s dive a little deeper into these top Canadian stocks that pay great dividends.

Canadian Natural Resources stock: A top oil and gas dividend stock that’s pumping out cash flow

The oil and gas sector has been booming in 2021. This means tons of cash flows and shareholder returns for energy stocks. Canadian Natural Resources is one of the companies that’s benefiting from this scenario. It’s also one of the top Canadian stocks that’s paying generous dividends right now. In addition to this, the dividends are rising fast and furiously.

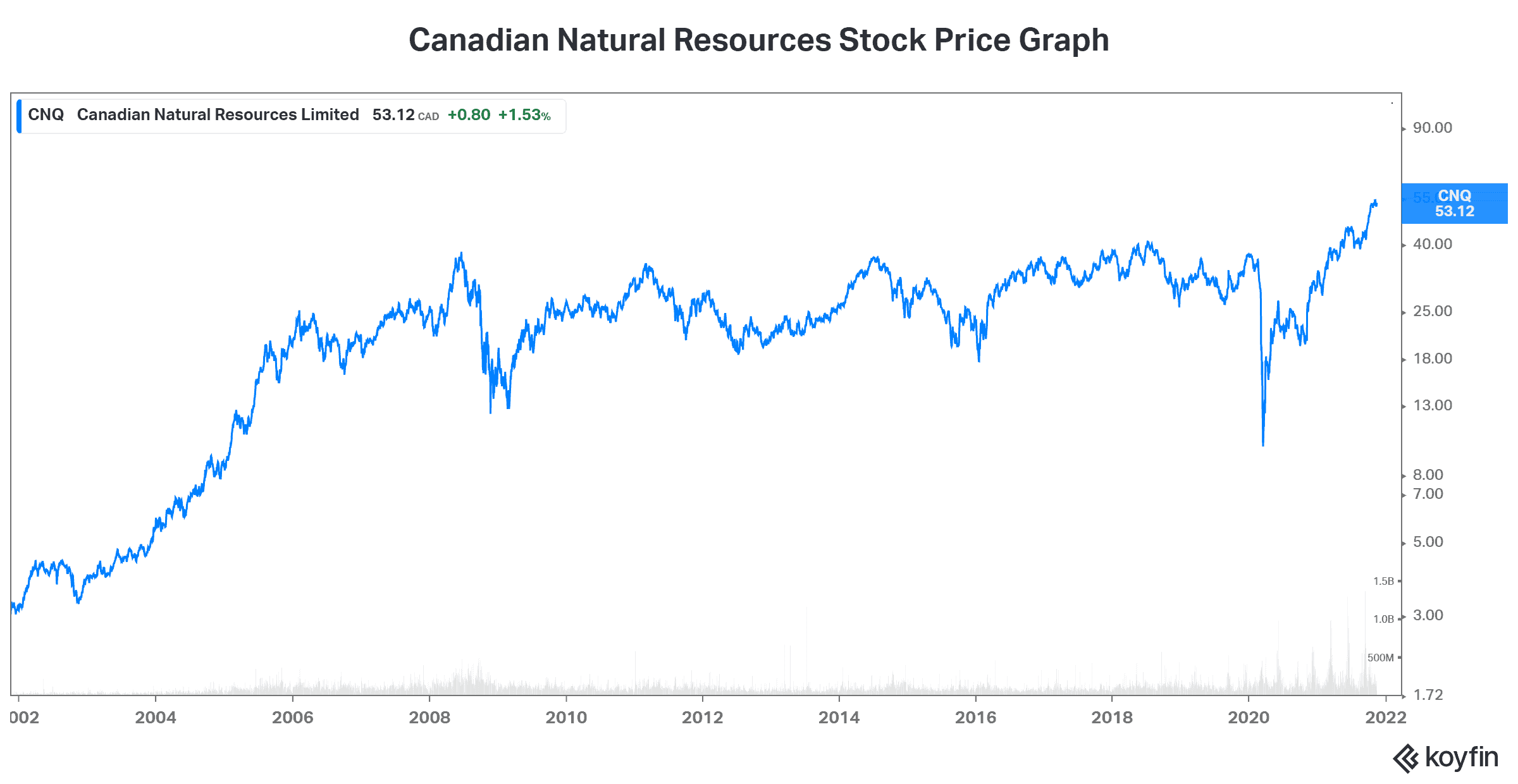

For example, CNQ just announced a 25% increase in its dividend, bringing its dividend yield to a juicy 4.5%. But it’s not like this one-time move is the only reason that Canadian Natural Resources is a top Canadian stock. CNQ also has a long history of creating shareholder value and rising dividends. This latest increase represents the 22nd year of consecutive increases. For an oil and gas company, this is pretty great. In short, the oil and gas sector is a highly volatile one. For CNQ to manage this, it speaks to its quality assets and operations. The chart below demonstrates the capital appreciation of the stock over the last 20 years.

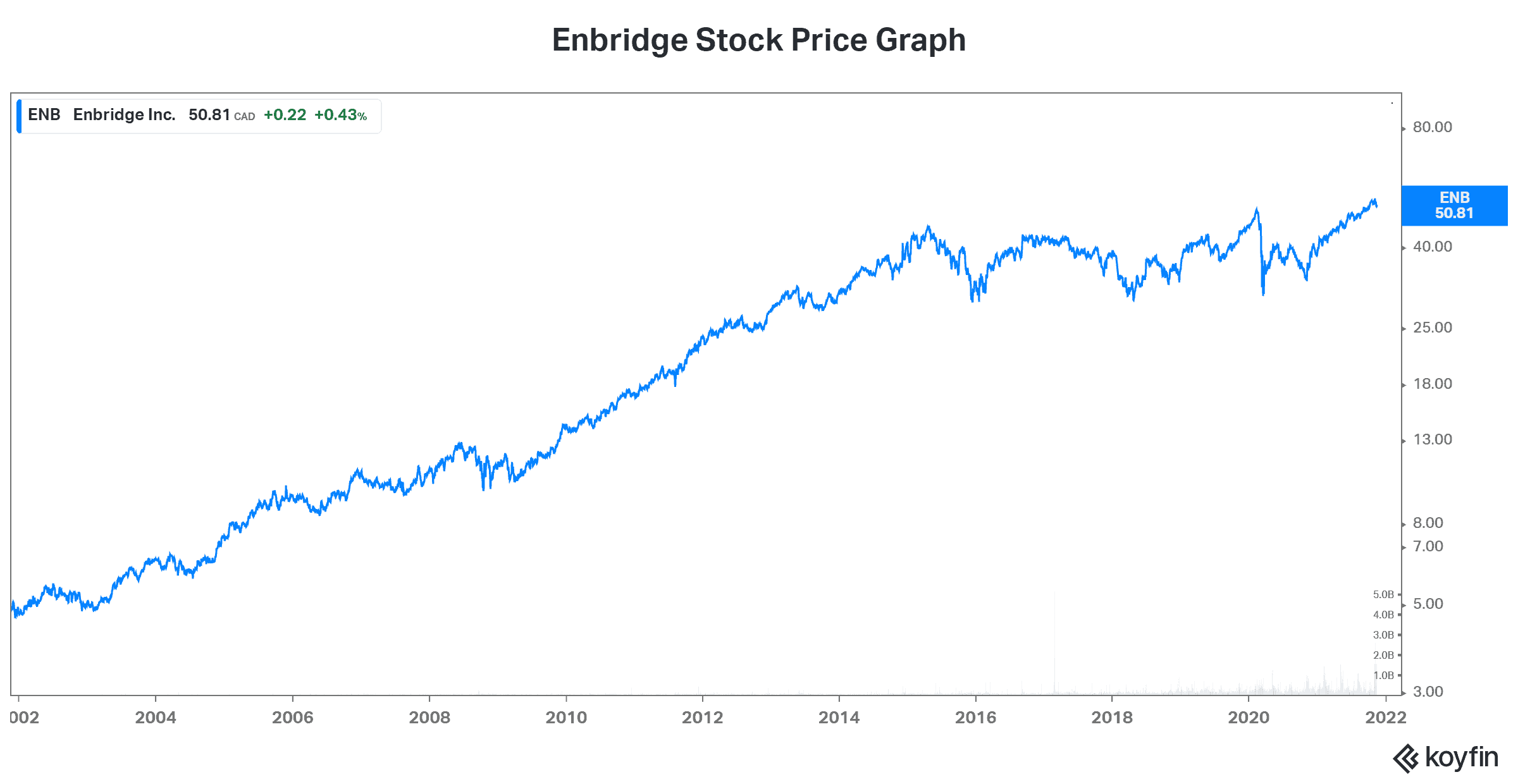

Enbridge stock: An energy stock that’s the backbone of North American energy delivery

Enbridge is a leading North American energy infrastructure company. It owns natural gas transmission assets. It also owns and operates oil pipelines. Lastly, Enbridge has a substantial stake in renewable energy. Enbridge stock is currently yielding 6.6%. That’s a rare thing for a company of this calibre.

This stock is a top Canadian stock for two reasons. The first is its dividend yield. The second is for its well-diversified and cash flow-rich business. Not only does Enbridge have key oil and gas infrastructure that generates big returns, but it’s also positioning itself to be a key player in the energy transition.

Northwest Healthcare Properties: A real estate giant that’s focused on the healthcare sector

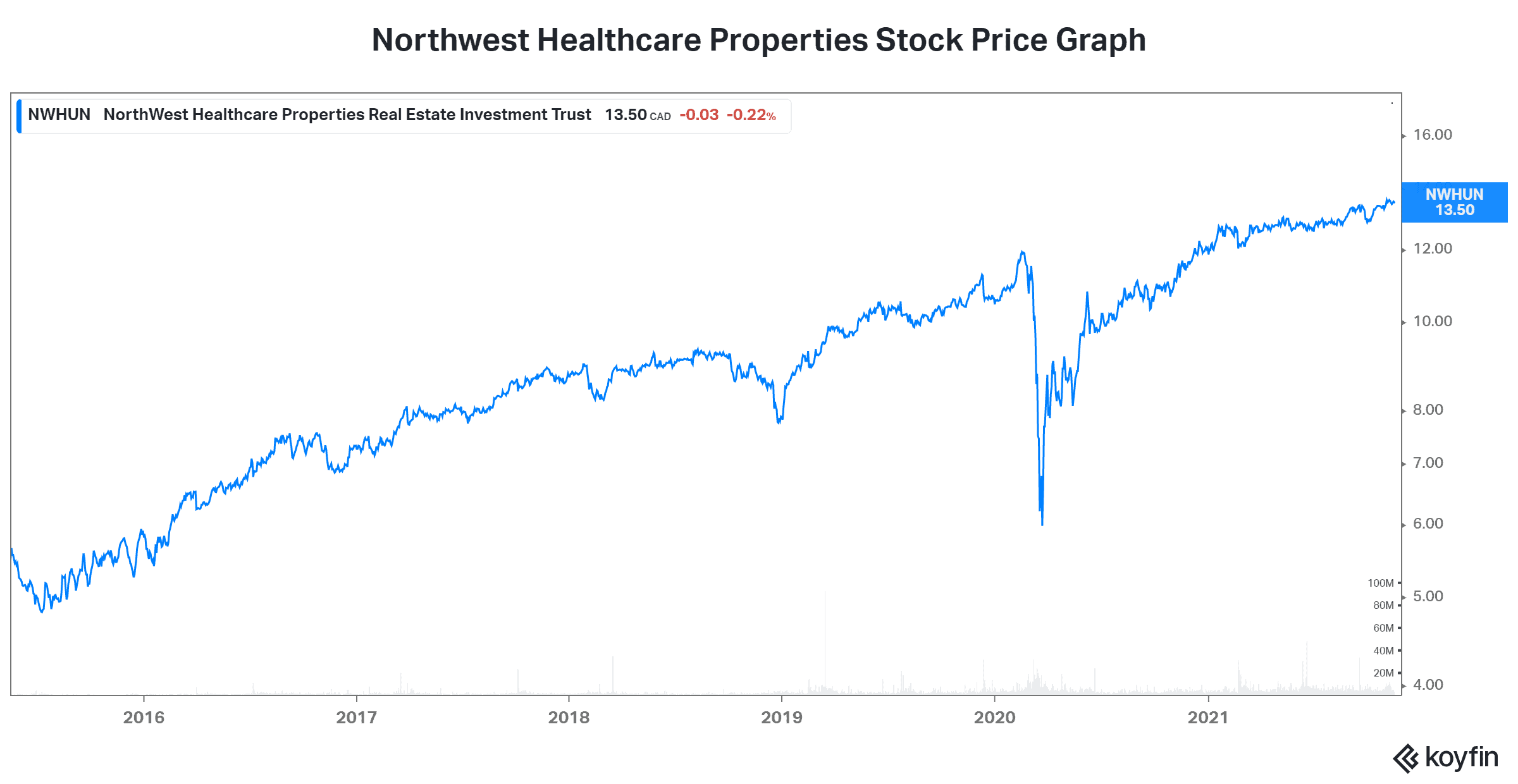

The healthcare sector is an area that has strong growth drivers and strong defensive attributes. Hence, Northwest Healthcare Properties also has both of these characteristics. In short, the population is aging. This is a strong long-term driver for everything healthcare. Also, healthcare is a basic need no matter the economic situation we’re in — it’s defensive.

Northwest Healthcare is benefiting from all of this. It’s currently yielding a very attractive 5.9%, so it can contribute immensely to your income both before and in retirement. The stock has been steady and reliable — things we like to see with our retirement investments. In fact, in the last three years, Northwest Healthcare Properties stock has risen 26%. Also, and more importantly, Northwest has paid out a fortune in dividends. It’s currently yielding 6%, but this yield has been well above 8% in prior years when the stock price was lower.

Motley Fool: The bottom line

Retirement planning is made easier by sticking to the basics — top Canadian stocks that pay generous dividends. Good, old, reliable stocks, such as the ones listed in this article, always help investors reach their goals. These top Canadian stocks are characterized by stable and growing dividends over the long term.