Growth stocks have a history of creating massive wealth for those who invested in them early. The problem is, finding stocks that will not only survive but also thrive is a real challenge. It’s not an easy road, but well worth the effort. In this Motley Fool article, I discuss two growth stocks that I think hit on all the top stock prerequisites – Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP) and BlackBerry (TSX:BB)(NYSE:BB).

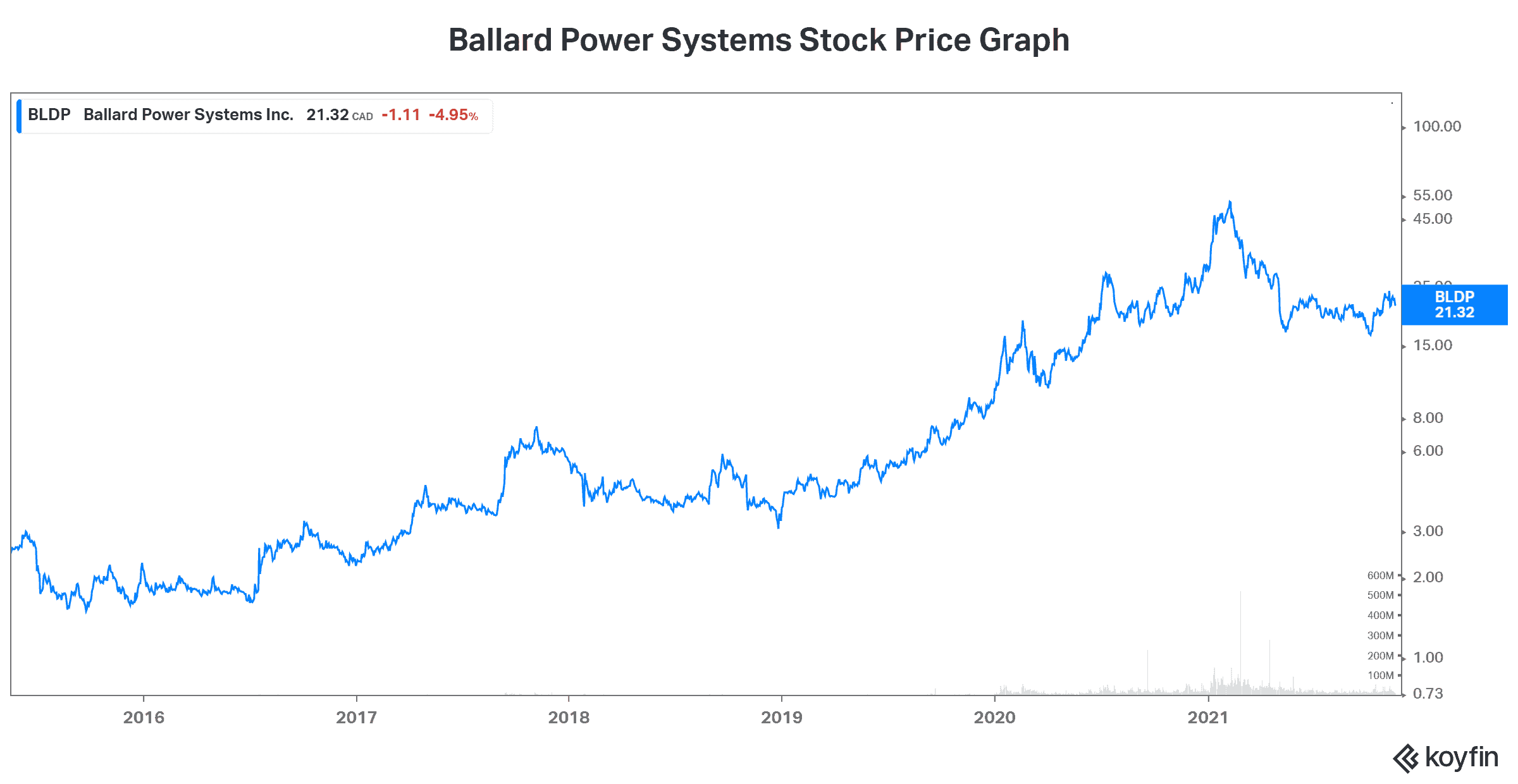

Ballard Power Systems stock: Clean energy at its best

Fuel cells are rising as the clean energy of choice for heavy-duty vehicles. This means vehicles such as trucks, buses, trains, and ships. The reason for this is pretty simple. Fuel cells provide the power that batteries simply can’t. While this may not be necessary for passenger cars, it’s certainly necessary to get the large mass vehicles moving efficiently.

So Ballard addresses this, and so far, the results are extremely compelling. For example, there’s a large amount of buses running on Ballard’s fuel cells across the world. In short, their performance is impressive. From reliability, to power, to charging times, fuel cells have outperformed. China, Europe, and California are leaders with large deployments, but interest is growing exponentially.

Ballard Power Systems in on a massive growth trajectory. Although the build-up has taken a long time, 2022 and beyond will be game-changing. To highlight the kind of growth that we can expect, I refer to comments by Ballard’s CEO, Randy MacEwen, namely, “The number of fuel cell-powered buses in Europe grew 80% since October. They’ll grow another 100% in the next few months”. This is clearly big stuff. In addition to this, MacEwen said, “We have the other markets that are seeing huge interest – rail, trucks, ships, etc… In short, 2022 will see a hockey stick growth trajectory.”

Ballard Power Systems stock is a growth stock that has performed exceptionally well over the last few years. This is backed up by the strong case for fuel cells. Interest has been strong, deployments are rising quickly, and its market is opening up rapidly. In September 2020, Ballard estimated its addressable market size to be $130 billion. According to the CEO, this number is outdated. On the next quarterly call, we will be given the new estimate, which will be much higher.

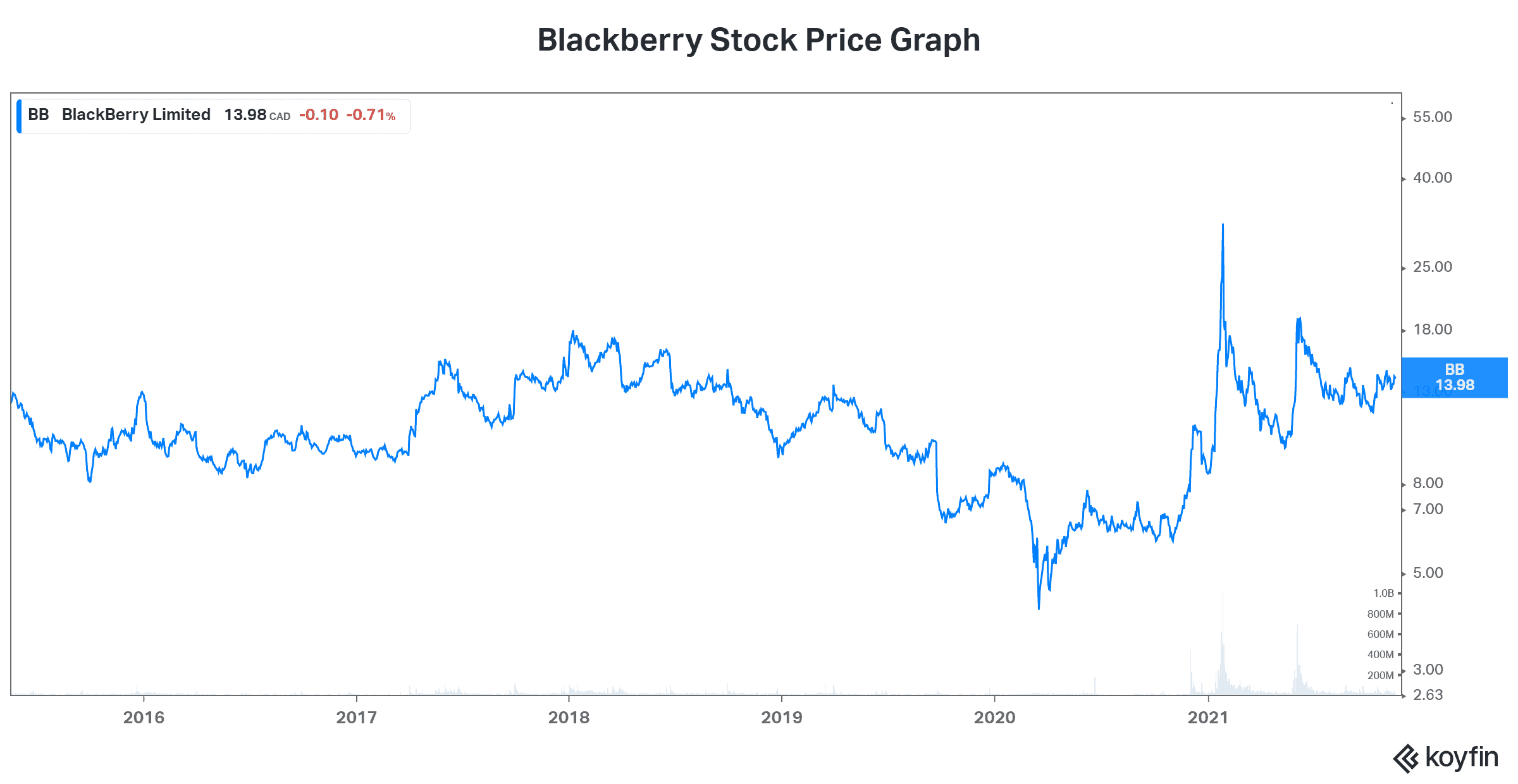

BlackBerry stock: A growth stock targeting the Internet of Things

BlackBerry is another high-growth story. This company is involved in two rapidly growing industries. The first is the Internet of Things or machine connectivity. The second is cybersecurity. In short, these are strong secular, lasting trends. BlackBerry stock has broken out in the last year or so but seems to be stuck at roughly $13.00. But not for long.

Machine connectivity is important in a variety of industries. The most well-known is the automotive industry. While autonomous cars are at least a decade away, cars are quickly becoming equipped with BlacBerry’s technology. BlackBerry QNX is at the forefront of transforming automobiles into connected systems today and autonomous vehicles tomorrow. But this business doesn’t stop there. Medical devices and robotics are just two of the other areas that BlackBerry’s machine-to-machine connectivity software is taking to the next level.

In addition to this, through the use of artificial intelligence and machine learning, BlackBerry is creating state-of-the-art security systems. Research suggests that the global cybersecurity market is expected to grow from $149 billion in 2019 to $350 billion in 2026.

So BlackBerry stock is another growth stock that’s worth holding onto. While the road has not been easy, we should not expect it to be. It takes time to do things right; growing a company and developing its place in its industry is expensive and time-consuming. That doesn’t mean it’s not a top growth stock, however.

The bottom line

Ballard Power Systems stock and BlackBerry stock are two top growth stocks that I’m holding on to as their growth accelerates. They’re simply worthy of holding on to for the long term. I mean, this is how we can make real returns. These companies are changing the world. These growth stocks are top buy-and-hold growth stocks.