Cryptocurrencies, as well as crypto stocks, saw a massive gain in 2020. This wasn’t the first time that it’s happened. However, it was the first time that the rally was sustained. A massive revolution began specifically with the rise of decentralized finance (DeFi), and the popularity of the industry has only continued to grow since then.

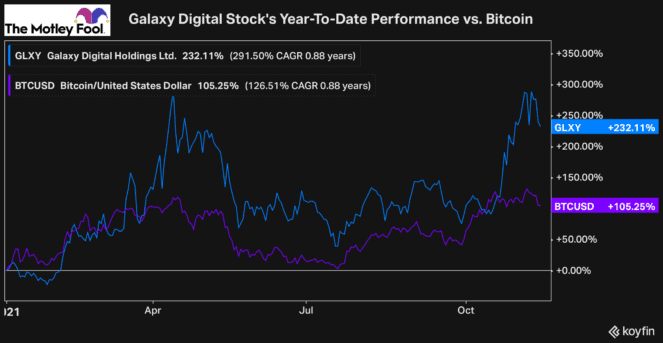

And now, in 2021, we are again seeing major gains. For example, Galaxy Digital Holdings (TSX:GLXY), a top financial services stock serving the crypto industry, has already gained roughly 232% so far year to date.

The stock tends to mimic the popularity of the cryptocurrency industry and the price of major coins such as Bitcoin, as you can see above.

So as the industry rallied to start 2021, Galaxy Digital investors saw a significant return on their investment. And while these stocks did sell off into the summer, you can see how well Galaxy has performed this year. At the low of the summer, the stock was still up 39% year-to-date compared to Bitcoin which was flat at that point.

And ever since the summer, especially over the last month, these stocks and the industry as a whole have once again gained a tonne of popularity.

So you may be wondering, with Galaxy Digital already more than tripling investors’ capital this year, how could it still be worth a buy?

The crypto stock is positioning itself for the future

Although Galaxy Digital stock does mimic the performance of other key cryptocurrencies such as Bitcoin, it’s actually building one of the most robust and diversified businesses in the space.

The company has several segments that will certainly benefit from an increase in the major cryptocurrencies. However, it doesn’t entirely rely on those prices to increase, as a cryptocurrency miner would, for example.

Instead, with the crypto stock earning revenue from providing investment banking services such as advising on mergers and acquisitions, as well as a trading division that serves institutions and high net worth individuals, it can continue to grow regardless of what’s going on with the price of Bitcoin or Ether.

Galaxy’s recent earnings report

Galaxy’s recent earnings report showed what an impressive company it’s building. During the third quarter, the industry didn’t see that much growth in popularity, and Galaxy’s stock was essentially flat.

However, that didn’t stop its operations from expanding considerably. The headline number was a significant $517 million in comprehensive income that it reported, up over 1,100% year over year.

However, the company saw its assets under management rise by 57% quarter over quarter and 175% year to date. Furthermore, it announced more investments in early-stage blockchain companies and NFT companies, as well as the purchase of two highly prominent NFTs. And the crypto stock also reported that it was currently advising on multiple mergers and acquisitions that have yet to be publicly announced.

Bottom line

Galaxy Digital seems to be firing on all cylinders at the moment. And despite the incredible rally the stock and the rest of the industry have had over the last month, the runway for growth is still massive, and it’s still extremely early in the cryptocurrency industry.

Therefore, despite a massive 230% gain already this year, Galaxy still offers incredible opportunities, especially for investors willing to make a long-term commitment.

So if you’re bullish on crypto stocks, Galaxy is an excellent choice. But whatever stock you choose, I’d do so soon. Otherwise, you risk missing out on even more high-potential growth.