One of the best ways to earn passive income is by owning Canadian income stocks. However, it is crucial that passive income investors think with a long-term mindset. If you buy commercial real estate for passive income, you generally don’t think about trading it a month, a quarter, or a year later. If it is a high-quality property that is well-located, you probably don’t want to sell it for years, decades, or ever.

Owning Canadian income stocks forever is a great way to accumulate wealth

The same type of thinking should be applied to Canadian income stocks. Stocks fluctuate day-to-day. However, over long periods of time (years and decades), they can produce steady streams of cash and ample capital upside.

When it comes to income, the best Canadian stocks are serial dividend-growers. Businesses can only grow their dividend if they have a strong balance sheet, business tailwinds, and rising cash flows.

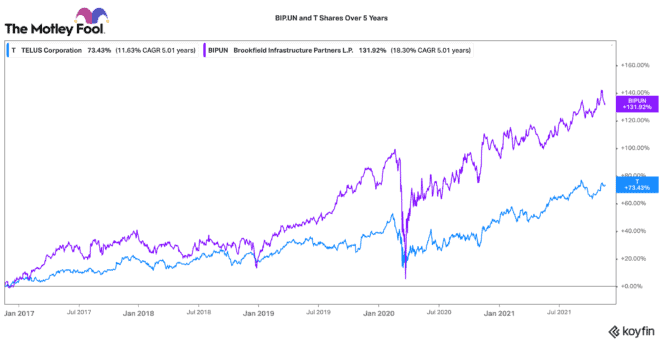

If I were to buy and hold some top Canadian income stocks forever, two of my top picks would be Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) and TELUS (TSX:T)(NYSE:TU).

Brookfield Infrastructure Partners: A serial asset acquirer

Infrastructure is a great way to play the modernization of the global economy for years and decades ahead. To enjoy this trend, Brookfield Infrastructure Partners is one of the best Canadian income stocks you can own.

It operates crucial infrastructure assets across the world. This includes ports in the United Kingdom, an American railroad, midstream assets in Alberta, pipelines in Brazil, and data centres in India (just to name a few). These assets capture very predictable streams of cash flow.

Brookfield’s assets are generally highly contracted. It collects very predictable cash flows. When inflation rises, BIP benefits because it captures higher margins from strong volumes and inflation-indexed rate increases.

BIP has a great history of growing its distribution annually by around 10%. Today, this Canadian income stock yields 3.4%. It pays a quarterly dividend worth US$0.51 per unit.

TELUS: A staple Canadian income stock

TELUS is a great income stock to play the digitization of Canadian society. Over the past few years, TELUS has been investing heavily to modernize its network to fibre optic. The strategy has been paying off. TELUS continues to have leading net new customer additions over competitors.

As its investment cycle wanes, management expects higher free cash flow accretion in 2022 and 2023. I expect that will result in market-leading dividend increases and further investments into its exciting digital growth verticals. TELUS has been fostering growth initiatives in digital services, telehealth, agriculture technology, security, and the internet of things.

As is evidenced by the recent TELUS International spin-out, each of these businesses could be substantial in the future. These growth verticals have yet to be fully factored into TELUS’s valuation. I believe there is room for a valuation re-rating.

This Canadian income stock has done a great job of growing its dividend for many years. In fact, since 2011, it has grown its dividend payout by an 8.7% compound annual growth rate. At $29 per share, it pays an attractive 4.5% dividend. Combine the dividend with inflation-beating capital growth and this is a great stock to buy and hold for the long run.

Don't Miss AI's Third Wave

Don't Miss AI's Third Wave