Tech stocks have been some of the best performers over the last decade. And it’s no surprise. These are companies that are changing our lives. They are, in fact, increasing efficiencies and advancing our lives through constant progress. CGI (TSX:GIB.A)(NYSE:GIB) is a Canadian tech giant that’s been at the heart of the digital revolution. And it’s been rapidly expanding. Today, CGI is a $12 billion company. It’s taking the IT and business consulting services industry by storm. Please read on as I walk through the reasons that I believe this tech stock is heading to $200.

A tech stock with steady, consistent growth

CGI stock has a long history of consistency. I mean, this company has stayed true to its philosophy of value creation. It’s also stayed true to its values of quality, expertise, and efficiency. Let’s rewind for a second here. Since 1976, CGI has grown into one of the largest IT and business consulting services firms in the world. And its growth shows no signs of stopping.

This company is on a quest to consolidate the end-to-end IT services industry. It continues to acquire and grow. Today, CGI generates over $12 billion in annual revenue. And its market cap stands at $24 billion. It is, in fact, one of Canada’s top tech stocks.

As we know, the pandemic has accelerated all things digital. The trend toward digitization was already happening for many years. But the pandemic lit a fire beneath this trend, sending it soaring forward. And the result has been hyper growth for many tech companies. CGI is one of them. Consequently, to CGI stock’s shareholders’ delight, CGI’s stock price has also accelerated its ascent.

CGI stock: Beating expectations

Over the last year, CGI has been beating analyst expectations by a wide margin. This reflects the fact that the company’s growth profile is accelerating and that CGI continues to execute as it always has – impeccably. Clearly, this tech stock has been a shining Canadian stock.

As evidence of this, let’s take a look at CGI’s most recent quarterly result. Essentially, strong cash flow and earnings growth once again highlighted the strength in CGI’s business. In fact, all regions and business verticals showed strong revenue growth. For example, Western Europe reported a 13% rise in revenue. Also, the healthcare vertical reported a 10% rise in revenue. Finally, CGI’s backlog is also growing rapidly.

How can this tech stock can hit $200?

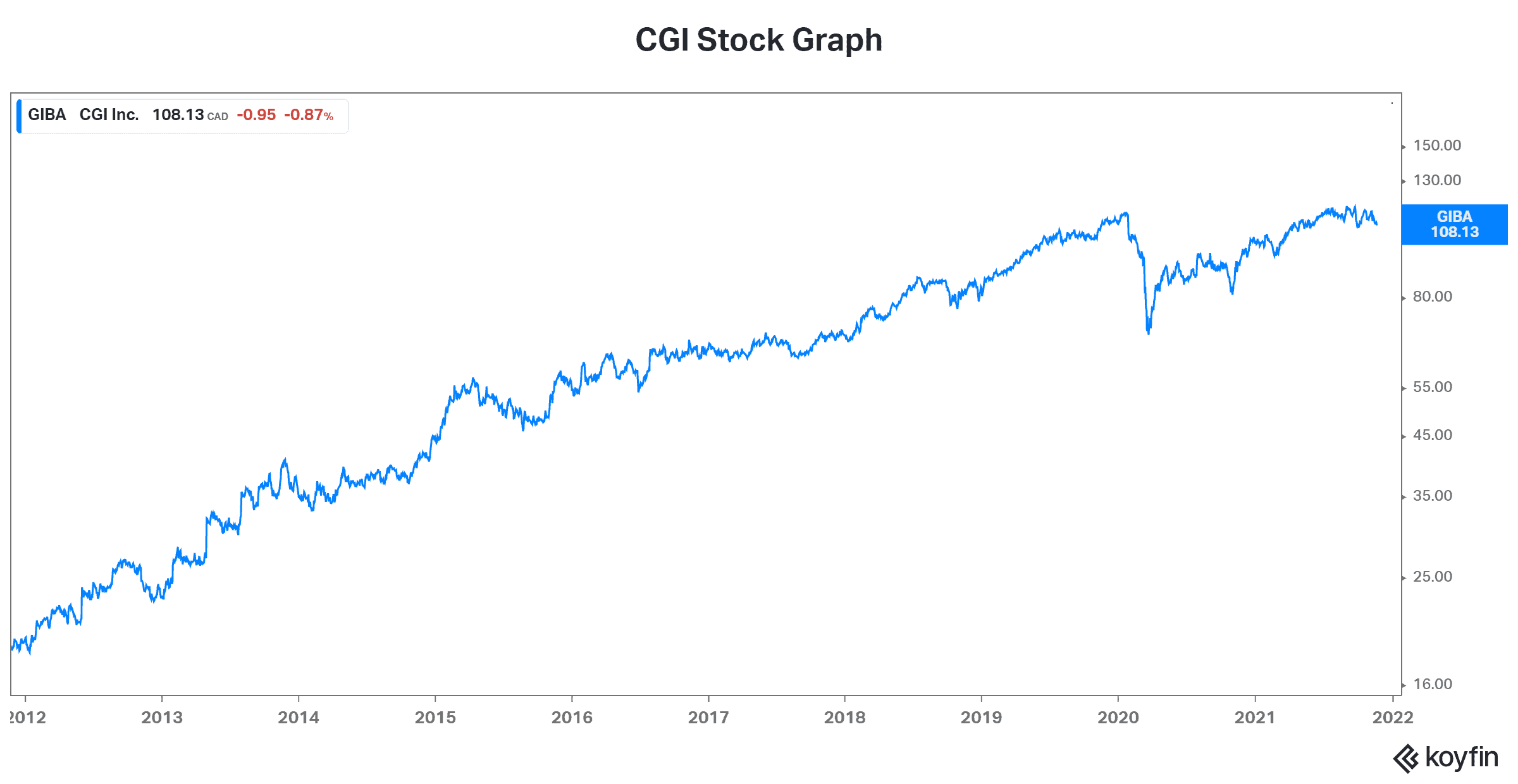

CGI stock is currently trading at $109. It’s had a spectacular ride over the last decade. As we can see from the graph below, it’s been a steady climb higher.

But what makes me think that CGI’s stock price can essentially double again?

Well, a digital transformation is happening across the globe. CGI is making this transformation possible, in different countries as well as in different industries. Also, the company is the most profitable it’s ever been. And finally, CGI’s plans to double in size in five to seven years remain achievable. With an exceptional track record, CGI will continue to consolidate this fragmented industry. And CGI stock will continue to generate shareholder value.

The bottom line

CGI is the Canadian tech stock with the best and longest track record of success. As digitization trends accelerate, I’m a buyer, as I believe that CGI stock is headed to $200.

Act Fast: 75 Only!

Act Fast: 75 Only!