Good news has arrived for Tax-Free Savings Account (TFSA) investors. The Canada Revenue Agency (CRA) officially announced that the 2022 TFSA contribution limit will be increased by $6,000. That is in line with contribution limit increases from 2019, 2020, and 2021.

Given strong inflation in 2021, some investors were perhaps hoping for a $500 contribution boost. Since the contribution limit is inflation-indexed, that may be possible for 2023’s limit increase.

The TFSA contribution increase is only $6,000 for 2022

Until then, investors still get a decent increase of $6,000 to invest completely tax-free. In fact, if you were 18 years or older in 2009, you can now contribute a grand combined total of $81,500 to your TFSA account. This is a pretty substantial amount of money that can be invested, re-invested, and compounded completely tax-free over years and years.

If you want to boost your annual realized investment returns by 10-20%, just start investing through your TFSA. By paying no tax on interest, dividends, or capital gains, you automatically save a ton of money by not paying investment tax to the CRA.

Don’t waste your TFSA with deceptive “high-interest” accounts

Unfortunately, many investors use the TFSA as a place to store cash. Some banks advertise supposedly “high-interest” TFSA accounts. What they generally mean is between 1% and 2% interest. This is a really poor use of the TFSA. With inflation climbing over 4% in the past few months, those accounts are losing buying power quickly.

In my opinion, the best use of the TFSA is to invest in stocks of high-quality businesses for the long run. Buy these stocks in your TFSA and your wealth has the best chance to multiply over long periods of time. Given the recent increase in the contribution limit, it is never too late to plan your next investments for 2022. Here are two high-quality stocks I would certainly consider looking at today.

Royal Bank of Canada

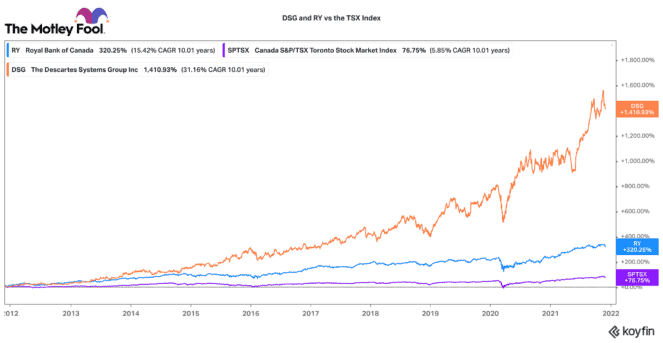

Royal Bank of Canada (TSX:RY)(NYSE:RY) is Canada’s largest bank and one of its largest stocks. It has a market capitalization of $181 billion. Over the past 10 years, its stock has delivered a compounded annual growth rate (CAGR) of over 15%. That has beaten the TSX Index by almost 10% annually.

I like Royal for its diversified business mix of retail, capital markets, wealth management, and insurance. Despite the pandemic, the company performed admirably. Today, it has a ton of excess capital. Now that it has been released from regulatory capital restrictions, investors can likely expect a nice dividend increase and probably share buybacks as well.

The stock has fallen off recently and it offers an attractive dividend yield of 3.4%. For a good all-around dividend-paying stock, long-term investors can’t go too wrong with this TFSA stock.

Descartes Systems

If you are looking for more growth, Descartes Systems (TSX:DSG)(NASDAQ:DSGX) has been an attractive compounder for years. Over the past 10 years, it is up over 1,400%! That is a compound annual growth rate (CAGR) of 31% over that time.

Descartes provides cloud-based software solutions for the logistics and supply chain sectors. Given global supply chain challenges, Descartes’ solutions are in higher demand than ever. The company only has a market capitalization of $8.8 billion, so it still has a long way to go up from here.

This TFSA stock has a great cash-rich balance sheet, high recurring revenues, very sticky customer solutions, and tons of optionality on how it grows. Its stock may fluctuate in the day-to-day trading, but over time it should compound very strong returns. Over 10 years, this is one compounding stock you don’t want to pay tax on.