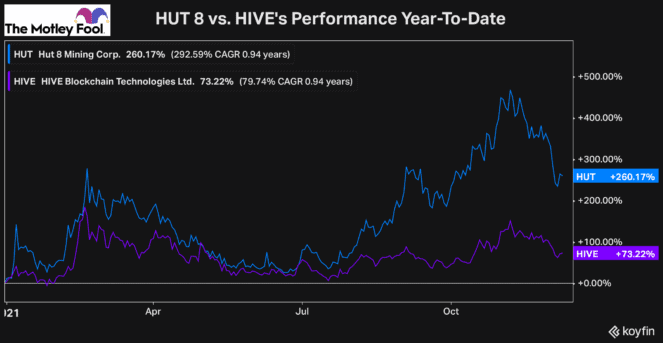

With the significant rally in cryptocurrencies lately, mining stocks such as Hut 8 Mining (TSX:HUT)(NASDAQ:HUT) and HIVE Blockchain Technologies (TSXV:HIVE)(NASDAQ:HVBT) are some of the highest-potential stocks you can own.

In general, in any industry, buying a mining stock rather than the actual underlying commodity or cryptocurrency that they mine will be a more volatile investment. This is due to the leverage the miners have.

Consider a Bitcoin mining stock like HIVE or HUT 8 that can hypothetically mine Bitcoin for $20,000 per coin. When the price of Bitcoin is $75,000, for example, the company could make $55,000 profit on each coin.

Should the price rise to $100,000, that would be a 33% increase in the price of Bitcoin. However, the miner would see its profit per coin increase from $55,000 to $80,000 — a 45% increase, which is why the stock would move more.

This, of course, is just a simple hypothetical example, but it shows why investors of mining stocks can expect a more volatile investment, which means more upside over the long run should the price of the cryptocurrencies they mine, such as Bitcoin, continue to increase.

But unlike every other industry, cryptocurrency mining is much more competitive, and the industry requires consistent investment in upgrading computing power. This is one of the main reasons why we have seen HIVE underperform Hut 8 stock so far this year.

How to find a top crypto mining stock to buy

As I mentioned above, cryptocurrency mining is unlike mining for any other commodity, because it’s much more competitive. In the gold industry, for example, two companies may compete against each other, but they each own their own land, and much of the success of their mining operations relies on how much gold is underground.

With cryptocurrencies, it’s all about having the most computing power. Bitcoin mining stocks like Hut 8 and HIVE all compete against each other to solve the mathematical equations and verify the transactions on Bitcoin’s blockchain.

If you’re going to invest in a cryptocurrency mining stock, it’s crucial to understand one of the most important metrics: the hash rate. You can learn more about what a hash rate is here, but the simple explanation is that it’s the number of guesses that a company’s computer can make in a second to try and solve the mathematical equation and verify the block.

So, you can see how competitive and efficient a miner’s operations are by looking at its hash rate. In addition, you can also look at the total hash rate for the whole Bitcoin network (all the miner’s hash rates totalled) to see if a particular mining stock’s computing power is keeping up with the rest of the market.

Here’s where Hut 8 stock has outperformed HIVE

According to both companies’ most recent investor presentations, HIVE has seen its share of the total network fall, as the difficulty of mining and the total hash rate of all miners has increased.

As of November 11, HIVE had reported its hash rate was 1.25 Exahash, which at the time was roughly 0.8% of the total market. Hut 8, however, expects its Bitcoin mining hash rate to be three Exahash by the end of 2021, up from 1.1 Exahash in 2020.

So, over the year, as Hut 8 has continued to improve its computing power, its stock has started to pull away from HIVE. During the summer months, this wasn’t as big of a deal, as the crackdown in China led the total network hash rate to fall by roughly 50%.

However, Bitcoin’s hash rate has now fully recovered, and mining is now the most difficult it’s ever been. So, if you’re going to buy a high-potential mining stock like Hut 8 or HIVE, it’s crucial to understand how their operations work.