After a couple of mutating virus variants, a more severe threat that could weigh on TSX stocks is inflation. The pace of rising inflation has been certainly concerning and growth stocks could feel more pressure in the near future.

Inflation and TSX stocks

US inflation reached 6.8% in November, its highest level in the last 40 years. The rate stood at 4.4% in Canada, still way higher than its 20-year average of 1.4%.

Note that not all stocks underperform in inflationary periods. Companies that are capable of passing the burden of higher costs on to their consumers are well placed during rising inflationary periods. Also, higher inflation generally makes stocks with stretched valuation unwanted.

So, value stocks outperform growth stocks. Energy stocks have outperformed, while tech stocks with rich valuations have lagged during inflationary periods in the past. However, higher inflation indeed means cash will lose its value faster.

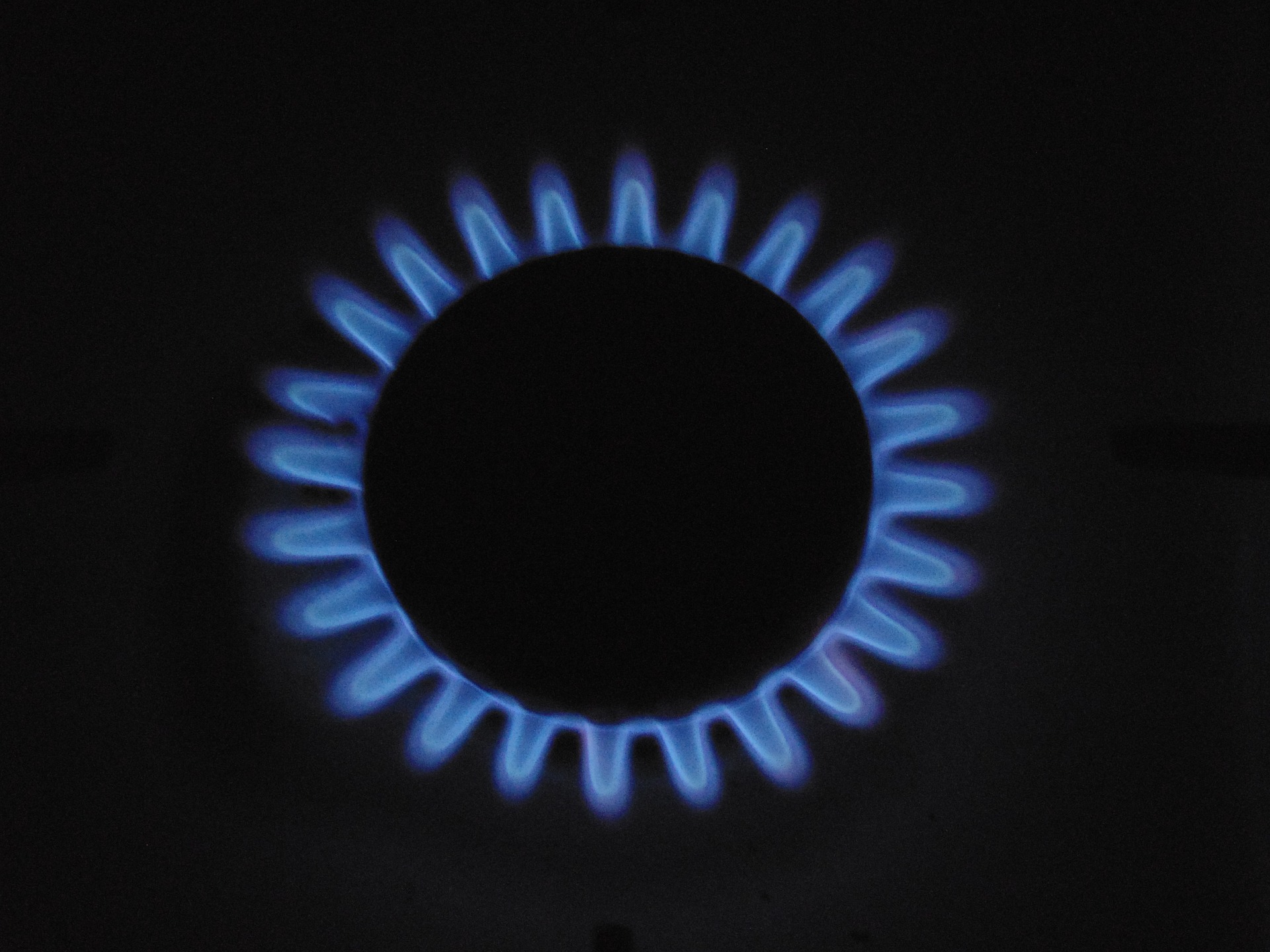

Top energy stock to buy

Energy stocks stand tall in inflationary periods because they can shift the pressure of higher costs to their customers, effectively protecting earnings. I think Canada’s top natural gas producer Tourmaline Oil (TSX:TOU) is well placed in the current scenario.

Driven by high energy prices, the company has seen remarkable earnings growth this year. In addition, it has repaid a large part of its debt this year, which has improved its balance sheet strength. Moreover, it sees higher oil and gas prices next year as well, which could unlock more value for shareholders.

While most assets have touched all-time highs lately, energy commodities have been fairly below their historical peaks. So, driven by higher demand and relatively slower supply increases, oil and gas prices might continue their upward climb next year as well.

Tourmaline Oil stock has returned 140% so far in 2021. Apart from the capital gain, Tourmaline looks poised to pay higher dividends next year as well as it has done in 2021.

Will gold stocks shine in 2022?

Gold is perceived as an effective hedge against inflation. Canadian gold miner B2Gold (TSX:BTO)(NYSE:BTG) looks appealing in the current situation. It operates three mines in Mali, Namibia and the Philippines and aims to produce a little more than one million ounces of gold in 2022.

Its all-in sustaining cost increased by 2.3% CAGR while its revenues increased by 21% CAGR in the last five years. All-in sustaining cost is an important metric for gold miners and reflects the full cost of gold production from current operations.

Thus, its consistent profitability, low leverage, and undervalued stocks make it an attractive bet for long-term investors. It has lost almost 35% in the last 12 months, in line with its peers.

If gold prices rally from here amid rising inflation, miners could repeat their stellar earnings growth like last year. Cheaply valued gold miner stocks like BTO are some of the few miner stocks that offer a huge growth potential if the yellow metal prices increase from here.