It’s no secret the stock market has been choppy lately. With fears of inflation, rising interest rates, and a new COVID-19 variant afoot, investors are on the edge of their seats, ready to dump risky assets at a moment’s notice.

Fortunately for Canadians, there is a slew of stocks out there that not only offer low volatility, but also stable, sizable, and ever-increasing dividend payments to keep your portfolio safe during a crisis. With that in mind, let’s take a look at my top pick: Fortis (TSX:FTS)(NYSE:FTS), a Canadian-based international diversified electric utility holding company.

Low volatility and market risk

What makes Fortis especially appealing to defensive investors is its low beta — a measure of how volatile a stock is compared to the broad market. A beta of one is considered to be as volatile as the market, while is two is twice as volatile.

Fortis has an incredibly low beta of 0.07 as of right now. This gives it great stability and downside protection from market movements, allowing it to anchor the rest of your portfolio if you build up a substantial holding. I even know some investors who replace the fixed-income portion of their portfolio with Fortis due to its low volatility, although I would caution against this in a rising interest rate environment.

Solid fundamentals and dividends

What’s even better is that Fortis has some solid fundamentals and very profitable financial metrics to back this low volatility with. Fortis currently runs with a 69.70% gross margin, a 26.80% operating margin, and a 13.40% profit margin, which is very respectable for a utilities company. It currently has an ROA of 2.20%, an ROE of 7.10%, and a ROI of 5.40%.

Fortis has a healthy balance sheet, with ample cash reserves and relatively low long-term debt. Moreover, the company pays a solid dividend yield of 3.67% and has a 48-year streak of quarterly dividend increases. These characteristics make it an excellent choice for income-oriented portfolios with a low risk tolerance.

Fortis outperforms the index

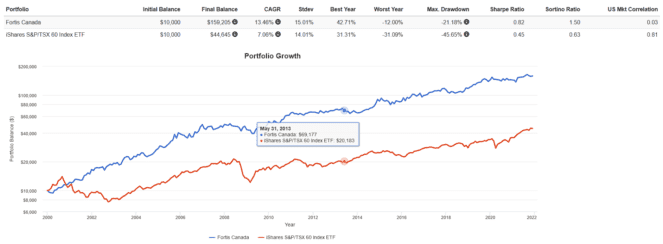

The chart below shows the backtested performance of $10,000 invested in Fortis against iShares S&P/TSX 60 Index ETF (TSX:XIU) from 1999 to 2021 YTD with dividends reinvested on Portfolio Visualizer:

We see that Fortis has significantly lower drawdowns (-21.18 vs. -45.65%), lower correlation with the U.S. market (0.03 vs. 0.81), and lower worst-year performance (-12.00% vs. -31.09) compared to the index, which helped mitigate losses. Thanks to its low volatility and ever-increasing dividend yields, Fortis also significantly outperformed the index on both an absolute return (CAGR of 13.46% vs 7.06%) and risk-adjusted basis (Sharpe of 0.82 vs. 0.45).

The Foolish takeaway

Investors looking for a safe, long-term pick to anchor the Canadian equity allocation of their portfolio should consider Fortis. Its low volatility and correlation to the U.S. market helps with diversification and minimizing drawdowns. Maintaining a sizable position and reinvesting those ever-increasing dividends can compound significantly over time to boost your total return.

Nevertheless, if you chose to actively invest in Fortis or any other single stock versus an index fund, ensure you stay up to date on the company’s latest financial filings, press releases, and corporate actions. Doing so allows you to keep your risk appetite updated and appraised to any material changes.